The Saga begins

Cryptic ball: ether is leading.

This was a rather stable Friday, with markets continuing the recovery experienced over the week. This makes me feel the weekend will be smooth and that we won't experience the kind of black swan volatility seen last week. Why and what's next?

- Stocks pumped hard today, even if crypto barely moved. Such a move came after inflation expectations in the US eased - thus implying the Fed wouldn't need to tighten the economy as hard as the markets are pricing in.

- More interestingly, tech stonks led this rally - strengthening the confidence that it's difficult to disturb global risk assets like bitcoin and alts over the weekend. At least if nothing else surfaces in the Three Arrows Capital drama.

- Meanwhile, bitcoin is trying to conquer the $21.7k level described yesterday, while ether has already printed a higher high than that achieved Monday, June 21st. In other words, it's very likely BTC will follow and pump more soon.

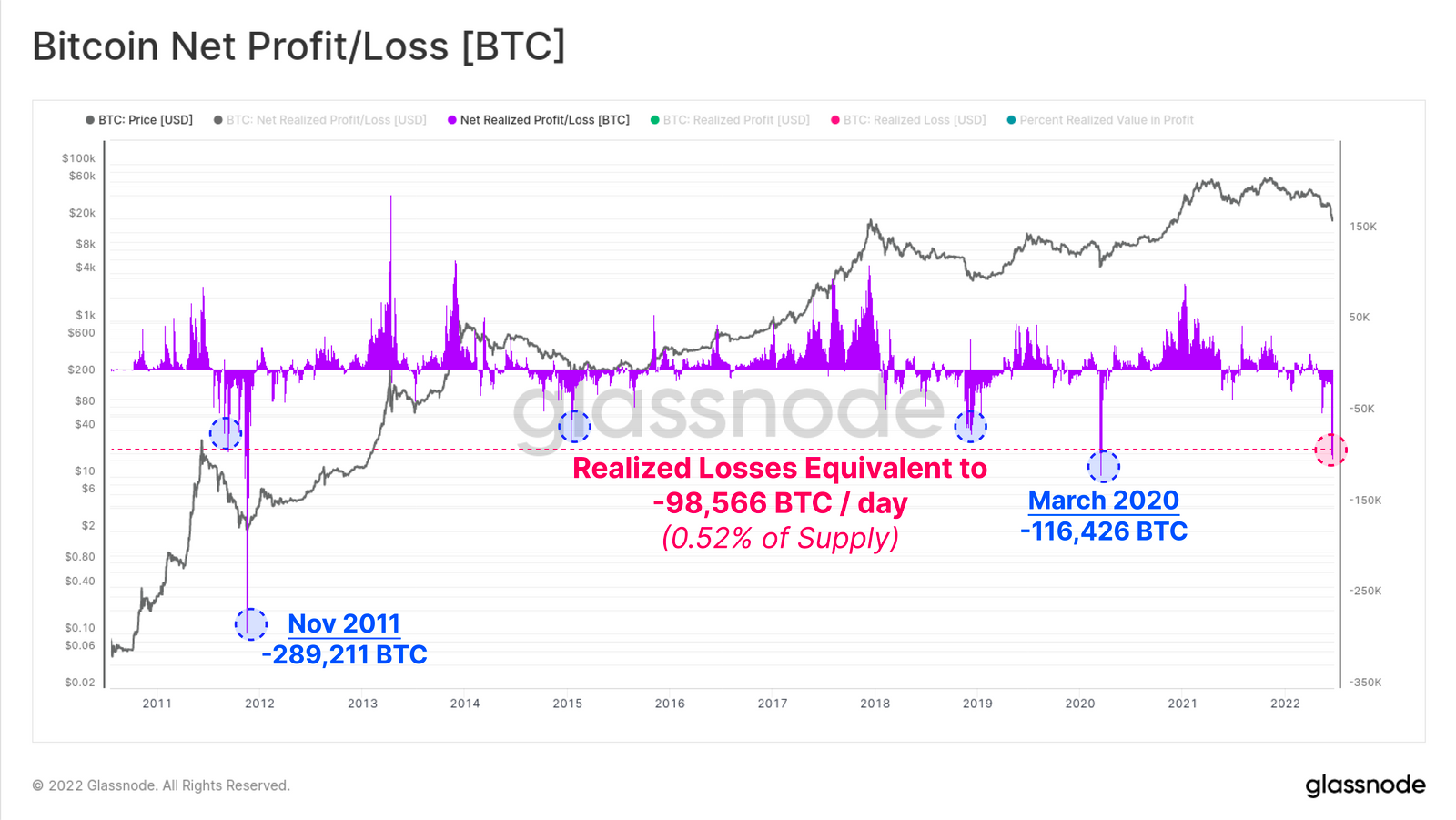

- Zooming out, the latest Glassnode insights show us that we're also potentially experiencing a market bottom. After all, bitcoin wallets have only faced worse relative drawdowns in March 2020 and in November 2011, moving up since.

Lastly, the strength alts are showing can be an additional source of inspiration if bitcoin continues to recover. Let's just hope there's no more FUD to fuel bearish attacks because things will get ugly if $17.5k wasn't the bottom after all!

Chart art: onchain is informing.

Three things: rumours are illuding.

- CPT N3mo suggests rethinking the next cycle of airdrops.

- Packy McCormick muses about present and future web3 use cases.

- Arthur Hayes urges caution regarding the Goldman Sachs news below.

Tweet tip: goldman is buying.

Meme moment: context isn't forgiving.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!