Can you spare a quarter?

Cryptic ball: Q3 is near.

As anticipated in the last post, the weekend was fairly smooth. Only this Monday, as the US market opened, did the situation change. And it's changing quite fast, with bitcoin finding new lows unseen since Thursday. Reasons to worry?

- As usual, the move came after the S&P 500 opened in the red, even if weekend futures were anticipating a positive week ahead. This makes me think we're just experiencing some beginning of the week volatility, but $20k needs to hold.

- Especially because this Thursday is the end of the month! And volatility also tends to increase as derivative contracts expire and traders roll-over their futures positions, something that is heightned at the end of a quarter!

- While mainstream financial media is spreading the news that the "end of the second quarter brings hopes that the stock market rally will continue", I must urge you to be careful, as the bear market in equities can resume anytime.

- For crypto, I still believe Q3 will bring proper relief if the Republicans win the midterms - but that outcome isn't certain and things can become so depressed until then that this forecast may need to be updated over the summer.

For now, let's keep following the correlation between stocks and bitcoin and see how the next test of $20k (or $19.7k, to be more specific) fares. Bulls need to wake up if they want to avoid the misery of going through summer below that level!

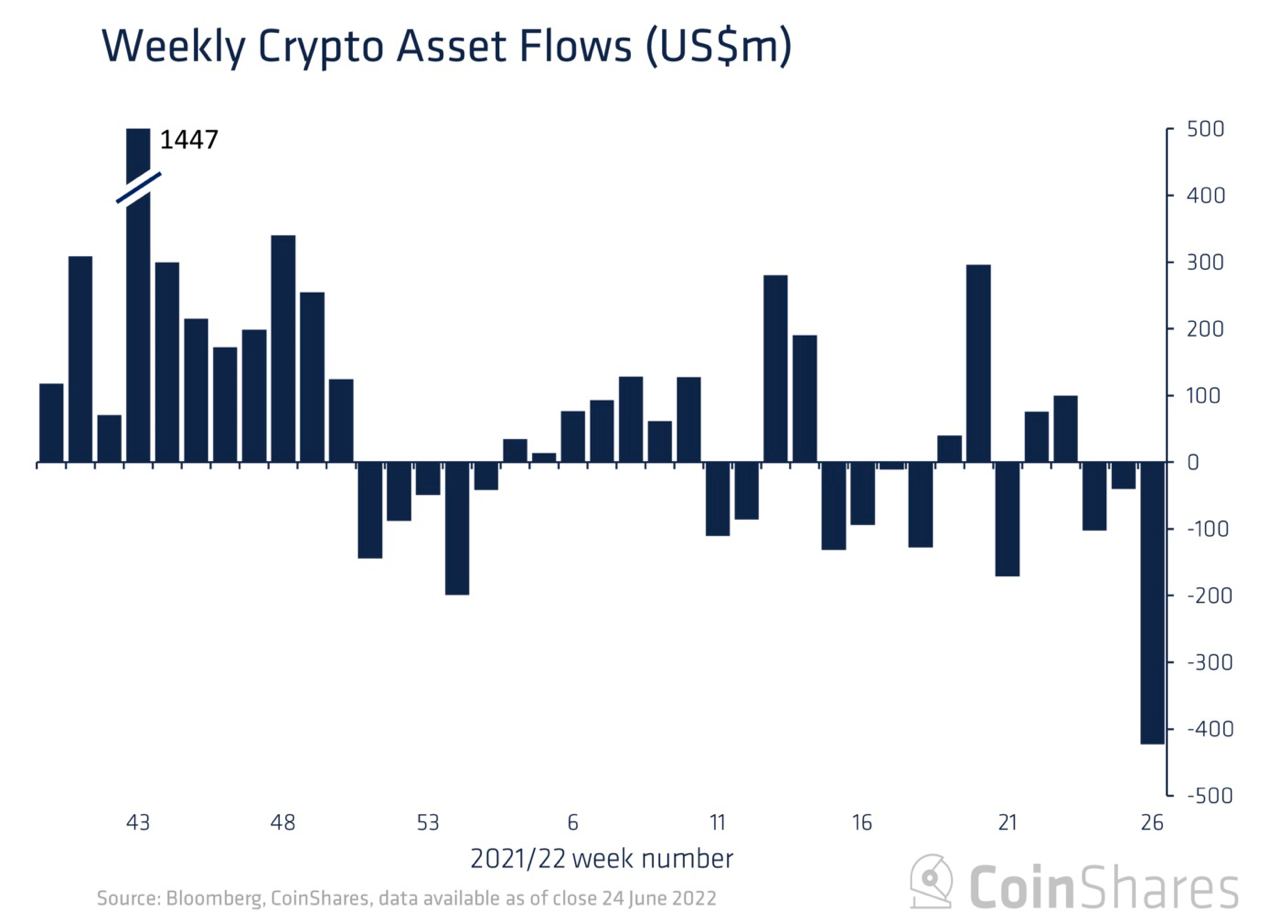

Chart art: institutions are dumping.

Three things: mass adoption is near.

- Nathan explains why Solana is still a "growing threat to Ethereum".

- Nat Eliason shares his "crypto investment mistakes and lessons".

- Jeff Dorman shares his "thoughts on the digital assets bear market".

Tweet tip: developers are muddled.

Meme moment: more pain is here.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!