Holy Christiano

Cryptic ball: sweet victor!

Both stonks and crypto recovered slightly this Thursday, with bitcoin bulls seemingly defending $20k. However, the bounce was small and doesn't inspire confidence unless we can see BTC above $21.7k before the weekend. Why?

- That was this Tuesday's high, when the solstice inspired traders across the board to get long like the days. If BTC conquers it, then that will show bulls are back in charge - at least for a while, until the next resistance is met.

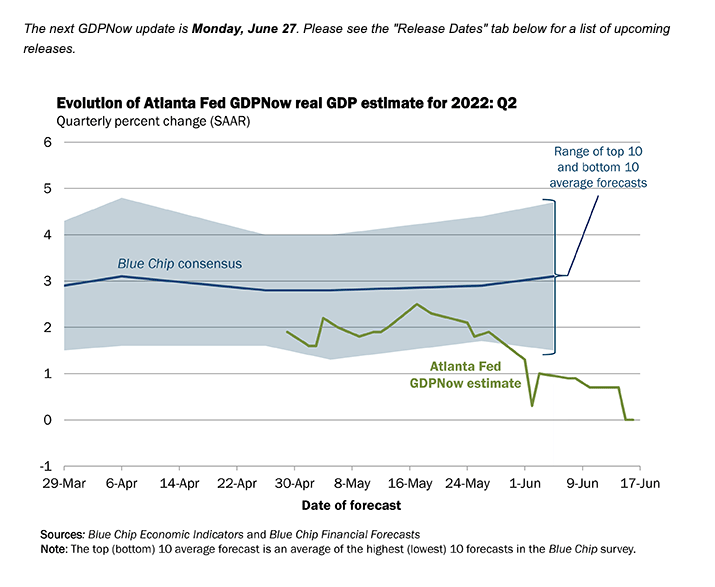

- Moreover, the S&P 500 doesn't look that good. And, next Monday, the Atlanta Fed will release the latest Q2 economic data. It seems the US is bracing to enter an official recession, with two consecutive quarters of negative growth!

- Those anticipating such negative news will likely sell into the weekend. As the stock market closes tomorrow, that leaves crypto - being a 24/7 global market - as the next best alternative to express one's financial bets!

- So, even though many alts provided 10% to 20% pumps today, especially the major L1s trying to eat into Ethereum's pie, remember that this is not the time to sleep at night with open positions. Let your winners run, but protect profits.

All-in-all, scroll down to today's "Visual Block" revival, showing Messari's Ryan Selkis perspective on crypto's future. And don't forget that "despite the setbacks, crypto is inevitable". What do they say about the ideas "whose time has come"?

Chart art: good grief!

Visual block: ay caramba!

Three things: earnings above.

- Binance's CZ was featured on Bloomberg's cover. Let's see if he survives!

- DeFi Education explains why P/E ratios are broken. Let's see its limits.

- Evan Conrad asks "where are all the crypto use cases". Let's build them!

Tweet tip: bloody yields.

Meme moment: pump almighty.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!