Acutely focused

Cryptic ball: all about that 2%.

The cryptoasset rollercoaster continues, as bitcoin remains close to $20k for the third day in a row. The S&P 500 also briefly printed a new yearly low, and even if it has recovered on the daily, it concluded the week in the red. What's next?

- I'm expecting the weekend to be smooth. We experienced plenty of capitulation this week and I don't expect bears to have the strength for a renewed attack so soon. Moreover, there's not enough fuel for another liquidation cascade.

- However, I'll be back tomorrow to reassess the situation in case $20k proves to be flimsy support - which is not very likely now, even if over summer we can lose that key level in case the world stops caring about crypto again.

- For example, I fondly remember 2018, when bitcoin roughly held the key $6k support until November 14th. By then, the designated scapegoat was Bitcoin Cash, a fork of Bitcoin which created a civil war between crypto supporters.

- It eventually faded into oblivion, but before that it was responsible for pushing bitcoin's price below thaat critical $6k level. At the time, after months of crypto winter, the market was extremely boring. But, remember, boring isn't safe.

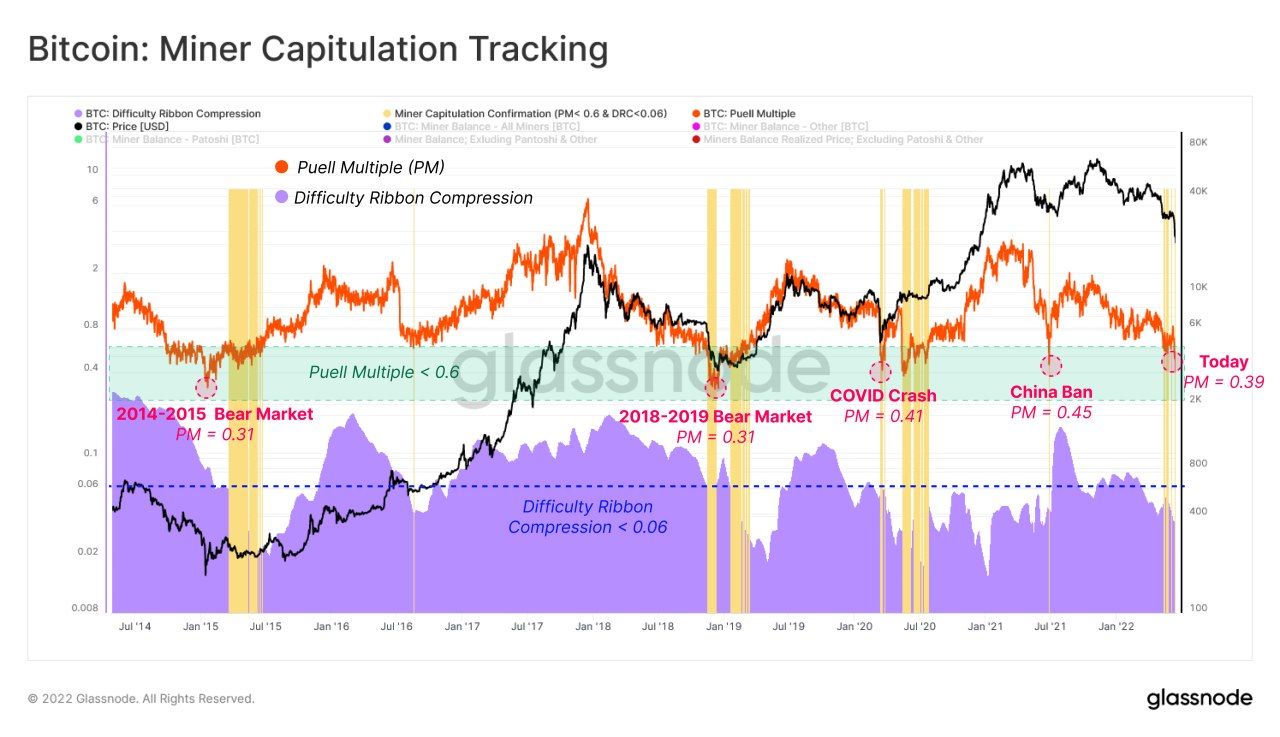

- As some groups of miners felt the need to get rid of their holdings to fuel the Bitcoin civil war, the generalised lack of interest in the market wasn't enough to absorb such selling pressure, and BTC crashed from $6k to $3.2k.

- While I'm not saying bitcoin can now crash to $10k or $11k - there's still plenty of support aaround $13k to 14$k - I'm indeed reminding you we're not out of the woods yet and things can still get worse before they get better.

Still, and most importantly, the extent of this week's crash already pushed fear to nearly record levels, unseen since August 2019. So I'm pretty sure the rest of the weekend is going to be smooth. Take some rest and let's get ready to rumble!

Chart art: all about that miner capitulatioon.

Three things: all about those floaters.

- Arthur Hayes is back and thinks he is Johnny Cash. A must-read.

- Sami Kassab explains what Ethereum miners can do after the merge.

- Ari David Paul explains what crypto needs to do to overcome this crash.

Tweet tip: all about that redemption.

Meme moment: all about that dot.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!