Three arrows in the knee

Cryptic ball: $1 billion hurts.

As anticipated, stocks continued to go down into new yearly lows, even if bitcoin's $20k support and ether's $1k meme level are still holding. However, contagion from the 3AC's downfall could spread more fear in the next days. Is the end near?

- It's still unclear as there's not enough information regarding the exposure various crypto players had to one of the largest cryptoasset funds out there (3AC, aka Three Arrows Capital), which seemingly is also insolvent.

- What was known today is that the fund, managed by crypto OGs Su Zhu and Kyle Davies, had its account with BlockFi - a crypto lender - liquidated as it failed to meet a margin call. In other words, they aren't very liquid right now.

- The big question is how much more they can still be forced to unwind to meet their obligations, after losing at least $600M in Terra's LUNA blow-up and at least $400M more in various other margin calls!

- Personally, and as said yesterday, I'm inclined to believe that what was there to liquidate has already been liquidated and the current sentiment indeed feels like capitulation, as Joe McCann philosophically explains here.

- However, as Jason Yanowitz aptly reminds us, after this forced capitulation we still must go through the last stage of a bear market: aka "bottomless exhaustion". This means prices will remain depressed for a long time.

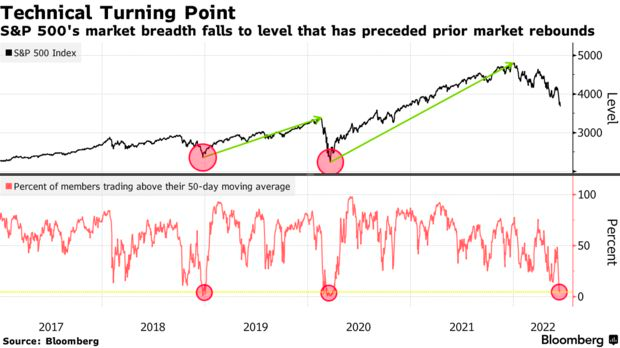

Lastly, there's another silver lining. As you can see in the second chart below, stocks are approaching a historical turning point - as the tide tends to turn once all members of the S&P 500 trade below their 50-day MA, which just happened!

Oh, and today is the first time in history bitcoin fell for 10 consecutive days in a row. Will we make it to eleven or is it time for some relief?

Chart art: the only thing that's real.

Three things: everyone I know goes away.

- Jason Yanowitz on why you shouldn't walk away from a bear market.

- Joe McCann on why the crypto market may have formed a bottom.

- Meltem Demirors on "asset-liability mismatch and why crypto firms are especially susceptible to this phenomenon due to issues around duration matching and risk management". Short must-read!

Tweet tip: and you could have it all.

Meme moment: the old familiar sting.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!