Taking a leak

Cryptic ball: $20k is $20k.

What did I tell you Monday? $20k was the next level bulls needed to hold to avoid a total eclipse of the heart and that's what we got, right before the Fed confirmed the market's worse expectations with an aggressive rate hike. What's next?

- Firstly, I explained the market was starting to anticipate a 0.75% hike before September. But, Monday, few expected it would be this June already! However, by Tuesday the consensus was that the Fed would be this aggressive now.

- The pricing of such an expectation further harmed global markets. Yesterday, the S&P 500 dropped 5%, falling into new yearly lows, and bitcoin crashed another 14%, testing $20,100 - nearly the previous all-time high!

- That level was last broken back in December 2020, when global markets roared in the aftermath of the stimulus programs to fight COVID. In previous market cycles, bitcoin had never got so close from the previous cycle's ATH.

- Why did we crash? Rumour has it that the world's most powerful central bank leaked such intentions to avoid an even worse meltdown today, when it indeed confirmed it was raising interest rates at a pace unseen since 1994!

- Fortunately, Jerome Powell, the Fed's chair, also said in the press conference that they are committed to fight inflation without causing a recession - the fear of which is fueling part of the demise in most asset classes.

- Both stocks and crypto rallied on these remarks, with BTC approaching $22k. However, we're not out of the woods. Persistently high inflation will hurt profits, which hurts equities and then diminishes the appetite for crypto.

- All-in-all, total cryptoasset market cap is still below the symbolic $1 trillion market but I'm expecting the bounce to continue over the next few days. I'm not sure the bottom is in yet, but it seems some relief is on the cards.

- On the one hand, the panic with Celsius is fading and the record level of liquidations seen over the past two days, with rumours that Three Arrows Capital went bankrupt going wild, seem to have calmed down.

- On the other hand, the ECB has kind of conceded it can't avoid a recession while fighting inflation. The Fed will be forced to do the same. I reckon they will first try to save the markets, but if things go bad it's armageddon!

I'll be back tomorrow (and Saturday too!) to reflect on this historical week. Stocks can go further down, which means that even though BTC is near $20k, at least most alts have plenty of downside that is yet to be explored. Remain cautious!

Chart art: the beginning is the end.

Three things: the boat is the ride.

- Arthur Hayes explains why most of the liquidations are behind us.

- Jack Niewold explains the potential insolvency of Celsius.

- 0xRusowsky explains "how to mentally survive the bear market".

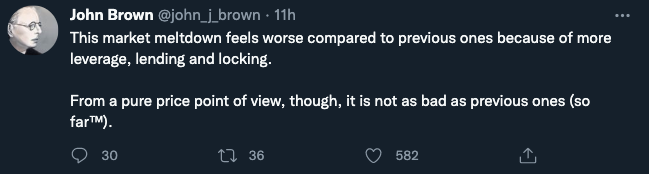

Tweet tip: the price is the god.

Meme moment: the lords are the flies.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!