It's $20k degrees Celsius out there

Cryptic ball: all about Wednesday.

We're back to our regular schedule this week, and hopefully won't need to send a well-timed Saturday newsletter again. I told you fear was spreading like wildfire and bitcoin could lose its key $30k range while Celsius could implode. Now what?

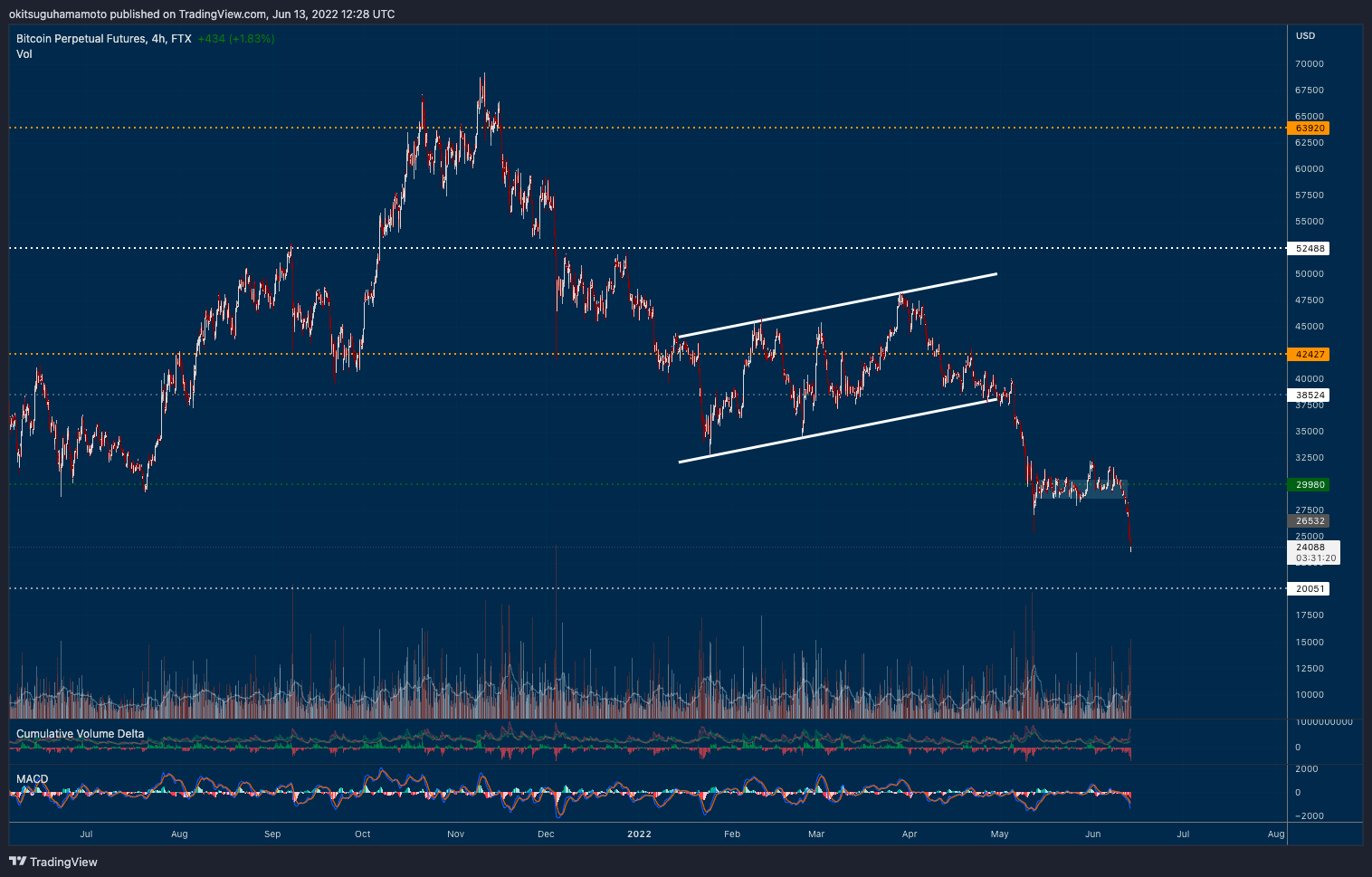

- As you can see in the chart below, while on May 11th the range was broken on a liquidation cascade, but then was promptly defended, now things were different. As soon as it bitcoin fell below it, all hell broke loose.

- The original cryptoasset is down nearly 18% from that level, while ether dropped nearly 30% since then, when it also lost the key $1.7k support from last summer's mini-bear market. Most alts are naturally in a worse position.

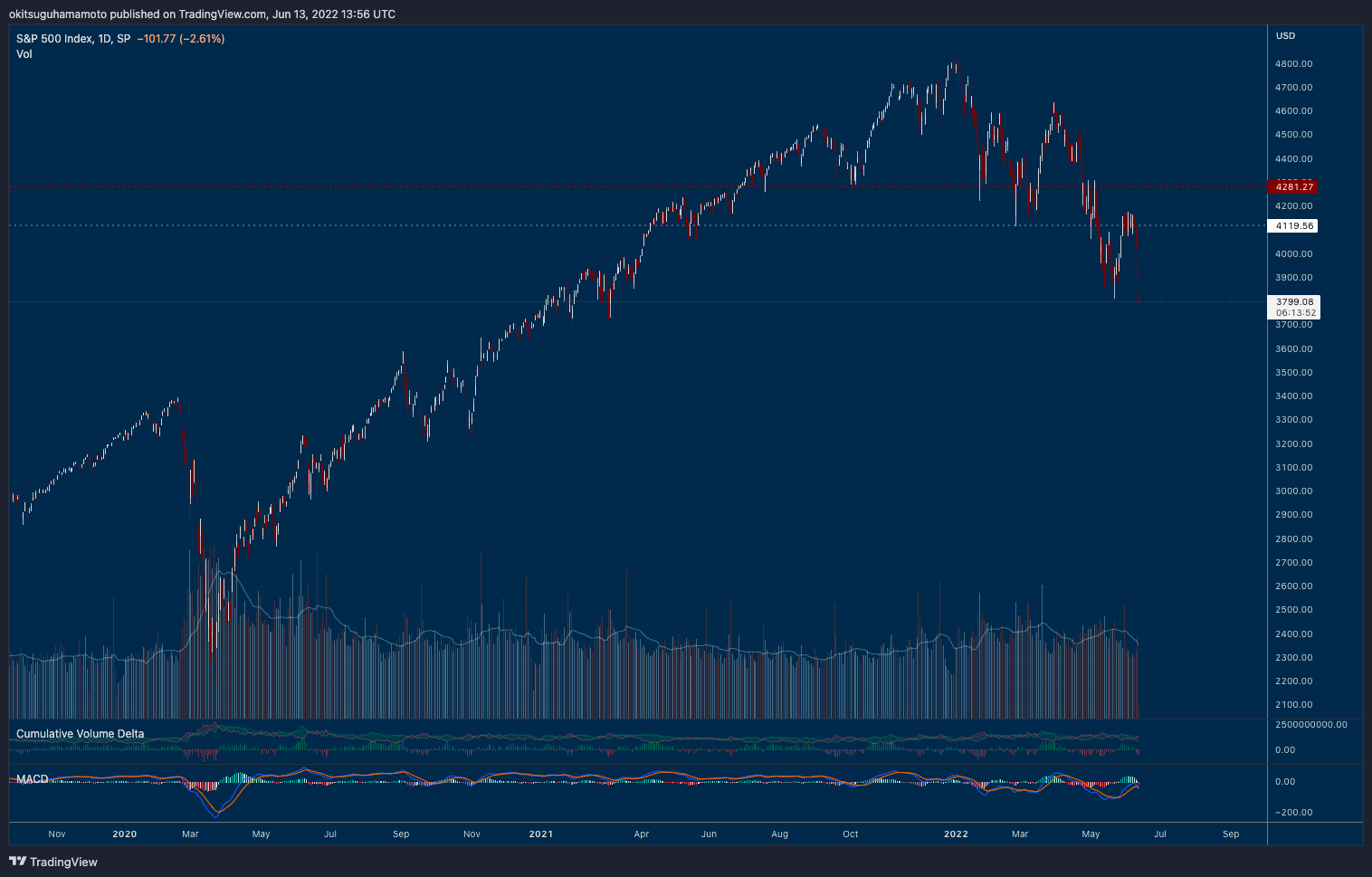

- Why did this happen? I've explained it dozens of times, but it's always important to recap: the Fed lost the plot and investors feel it can't control inflation, so they are pricing in more aggressive interest rate hikes.

- The next one is due to be announced this Wednesday and the consensus is still that it will only be a 0.5% one. But the market is now anticipating a 0.75% one over the next couple of meetings after June, i.e. before September.

- Now, should you panic? The time to panic was last December, when bulls were euphoric. Now it's time to consider how far we are from the bottom. While no one can provide an exact level, the bottom will happen once the Fed pivots.

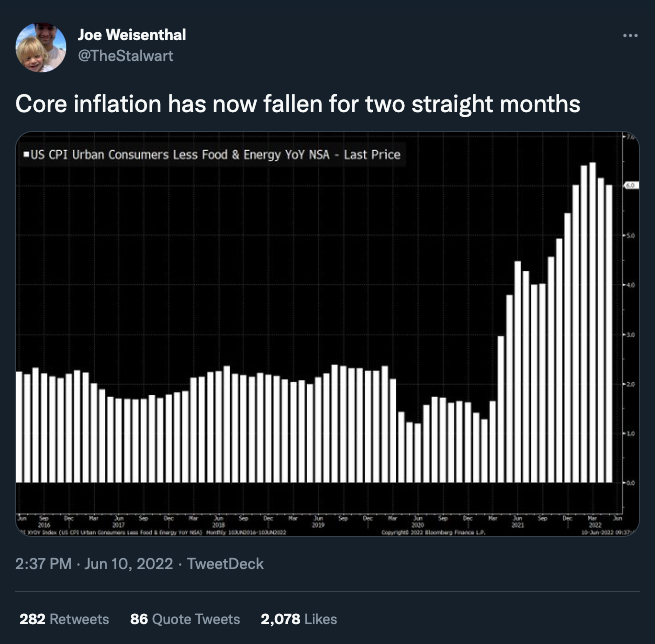

- Or, to be more specific, once the Fed announces it will pivot. That will be when inflation is controlled, which can take a full year. But it's good to see that core inflation, i.e. excluding energy and food prices, is potentially falling.

Lastly, remember Tesla and Microstrategy continue holding to their bitcoin, with combined impairment losses of up to $1.5 billion as of now. They can continue holding, but let's see what shareholders say as things can get worse.

Chart art: all about key ranges.

Three things: all about web7.

- The DeFi Edge breaks down "17 different styles of crypto investing".

- Qiao Wang helps you choose which crypto conferences to go.

- Jack Dorsey and the TBD team announced web5, an extra decentralised platform that combines web2 and web3. Snoop Dog is on web6 now!

Tweet tip: all about inflation.

Meme moment: all about $26 now.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!