Like wildfear

Cryptic ball: but not like Terra's demise.

In yesterday's newsletter, sadly only sent today due to an issue with our mailing provider, I've mentioned I'd be back this odd Saturday to comment on how stocks closed Friday's session in the aftermath of the highest CPI print in 40 years.

- What happened? As stock futures anticipated, the S&P 400 gapped below 4,000 and is just 2.5% away from this year's low. In other words, the recent relief rally is likely just a dead cat bounce and extra caution is warranted.

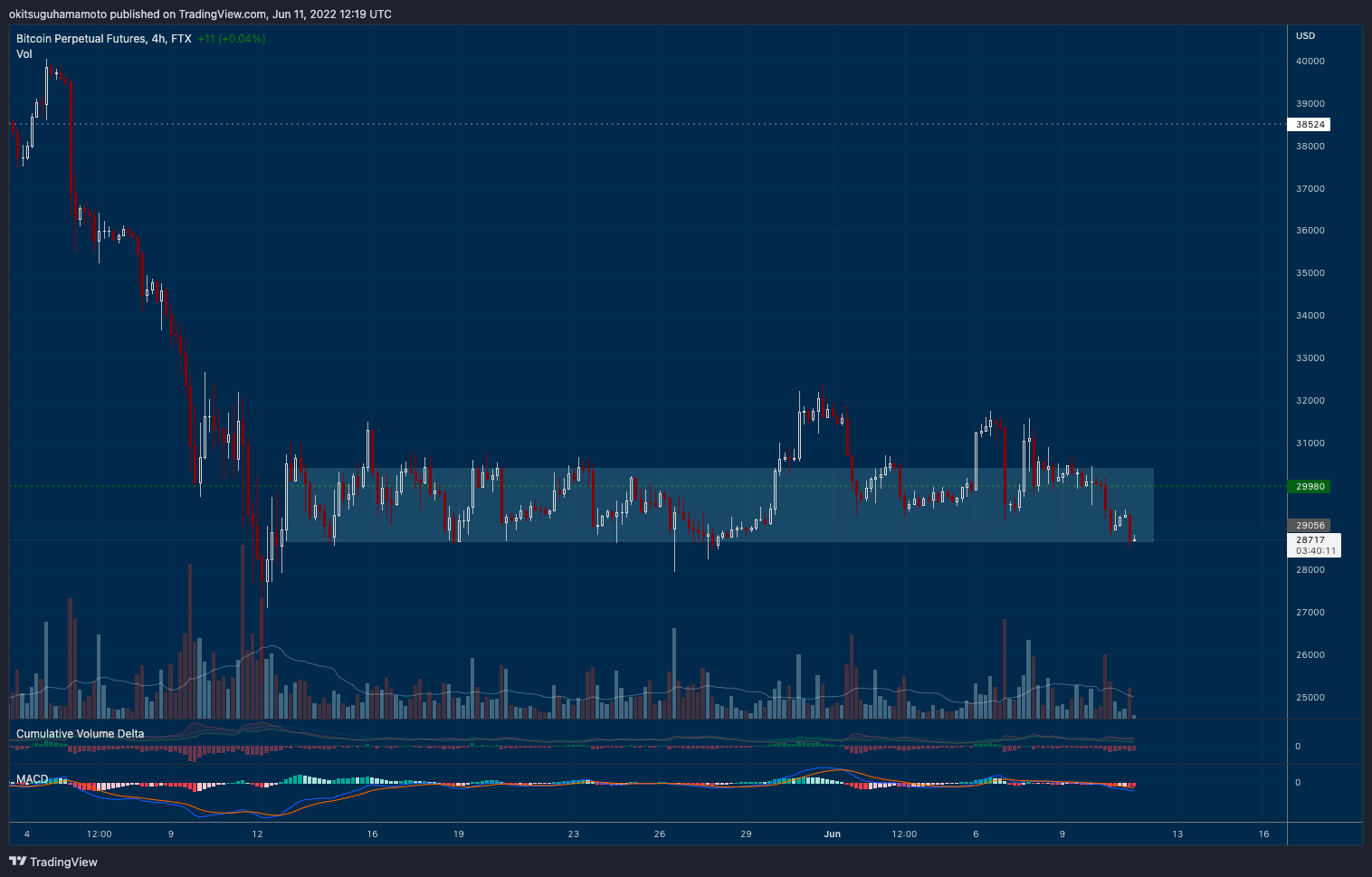

- Bitcoin also crashed below $30k but it's great to see it hasn't fallen below the past month's tight range - at least yet. As you can see in today's chart, this range has defined crypto trading since May's crash and it's key we don't lose it.

- Why did I say at least yet? Because price drops beg more price drops as protocols exhaust their treasuries to keep operations running and some companies threaten insolvency as liquidity evaporates from the market.

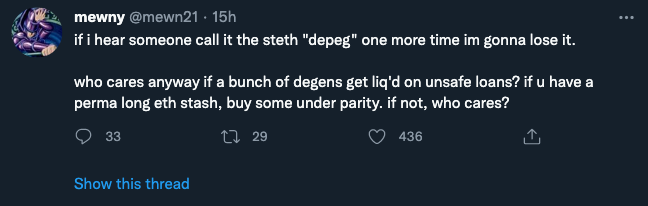

- A serious case that's spreading fear like wildfire is the second "depeg"" of stETH (Lido staked ETH) and ETH this month. Note this is not a stablecoin, but a kind of vault - so it shouldn't create a market-wide sell-off as Luna did.

- This happened as there's a small possibility that Ethereum's merge gets delayed again, and this hurts the valued of Lido staked ETH. That's why "depeg" is in quotes, as this is not about a depeg, but about token valuations.

- Still, degentrading warns that if the situation gets worse and the panic compounds, then we can see a bank run on Lido that further hurts its liquidity and trigger the collapse of some major DeFi and CeFi players, like Celsius.

All-in-all, it's clear regulators will continue to attack this space, forcing it to become more stable. Stablecoins are the obvious angle, with the New York State DFS recently issuing new guidelines for dollar-backed stablecoins.

And DeFi is next. For both cases, the US-patented stablecoin design that myself and Miles Paschini were granted last year will definitely help. Backed by government debt, Yuga can enable the future of DeFi innovation!

Chart art: but not like the grand canyon.

Three things: but not like a real bear.

- Haseeb Qureshi discusses the "globalisation phase of blockchains"

- Ken Deeter discusses "how to stay engaged during a bear market".

- Paradigm discusses "how to evaluate web3 job opportunities".

Tweet tip: but not like a real depeg.

Meme moment: but not like a sin.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!