A 40 year high

Cryptic ball: a fear spike.

Note: Mailgun had some issues Thursday which seemingly affected the delivery of the past two newsletters. Here's the one which I tried sending 24 hours ago.

The latest CPI data has been released and the market is digesting the news. YoY inflation in the US this May stands at 8.6%, higher than the 8.3% forecast shared yesterday. MoM we're at 1%, also higher than the 0.7% consensus. What's next?

- As anticipated in yesterday's newsletter, bears are attacking - equity futures and crypto have started falling as this data shows that inflation isn't peaking yet. Remember this is the highest reading since 1981 in the US!

- Naturally, sentiment is getting worse as the S&P 500 is about to fall below 4,000 and has failed to break the 4,100 resistance. AlgodTrading, who rose to fame as an early shorter of Terra's LUNA, even argues this is just like 2018.

- I'm not that pessimistic in the long term as I agree that "the market structure is fundamentally different". Still, note I've been urging caution since last December, arguing that crypto would slow bleed until at least next September.

- I maintain that view, noting that the rest of June will be critical to see if global markets survive such removal of liquidity from the system - and then things could eventually return to "normal" in Q3 - or if this is indeed like 2018.

Let's see how US stocks behave over the rest of the day and I'll be back tomorrow to comment on the weekend ahead. In any case, some stock analysts I respect believe we're about to see the next leg down and that the bottom isn't in!

Chart art: an earnings slump.

Three things: some deep reckoning.

- Minh helps you "remove your emotions from trading".

- Kryssios helps you "get the most out of NFT bear markets."

- Aylo helps you reflect on "the mistakes from this past bull run"

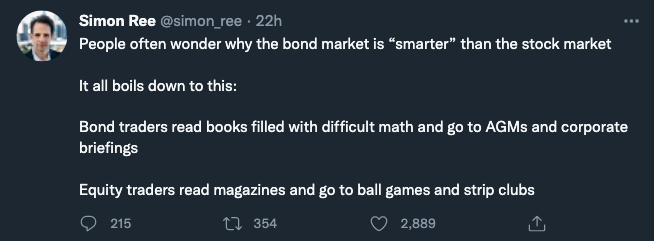

Tweet tip: some mediocre alpha.

Meme moment: some solid friendship.

.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!