Saylor Moon

Cryptic ball: such is fear.

It seems our double bottom at $30k scenario was right. As everyone was feeling the fear and trying to enter new shorts, bitcoin quickly bounced from $30.9k to $35.5k, a 15% gain, as buyers with cash on the sidelines decided to trap bears and provide some relief to alternative cryptoassets. No particular news coincided with the current bottom, but everyone's trying to justify the move on El Salvador, which has officially ratified the bill, and on an announcement from Microstrategy that their recent corporate bond sale was heavily oversubscribed. What does it mean?

Well, the analytics company headed by Michael Saylor, a famous Bitcoin bull, bought $1.1 billion in BTC in 2020 at an average price of $15.9k. That's 70,470 bitcoins! As of May, they had raised that number to 92,079, for an average purchase price of $24.5k. Now, they aimed to raise $400 million from investors to buy more bitcoin in exchange for interest from the bond, which yields 6.125% a year. But had to increase the offering to $500 million after receiving $1.6 billion in orders! Did anyone say (indirect) institutional interest in Bitcoin was dead?

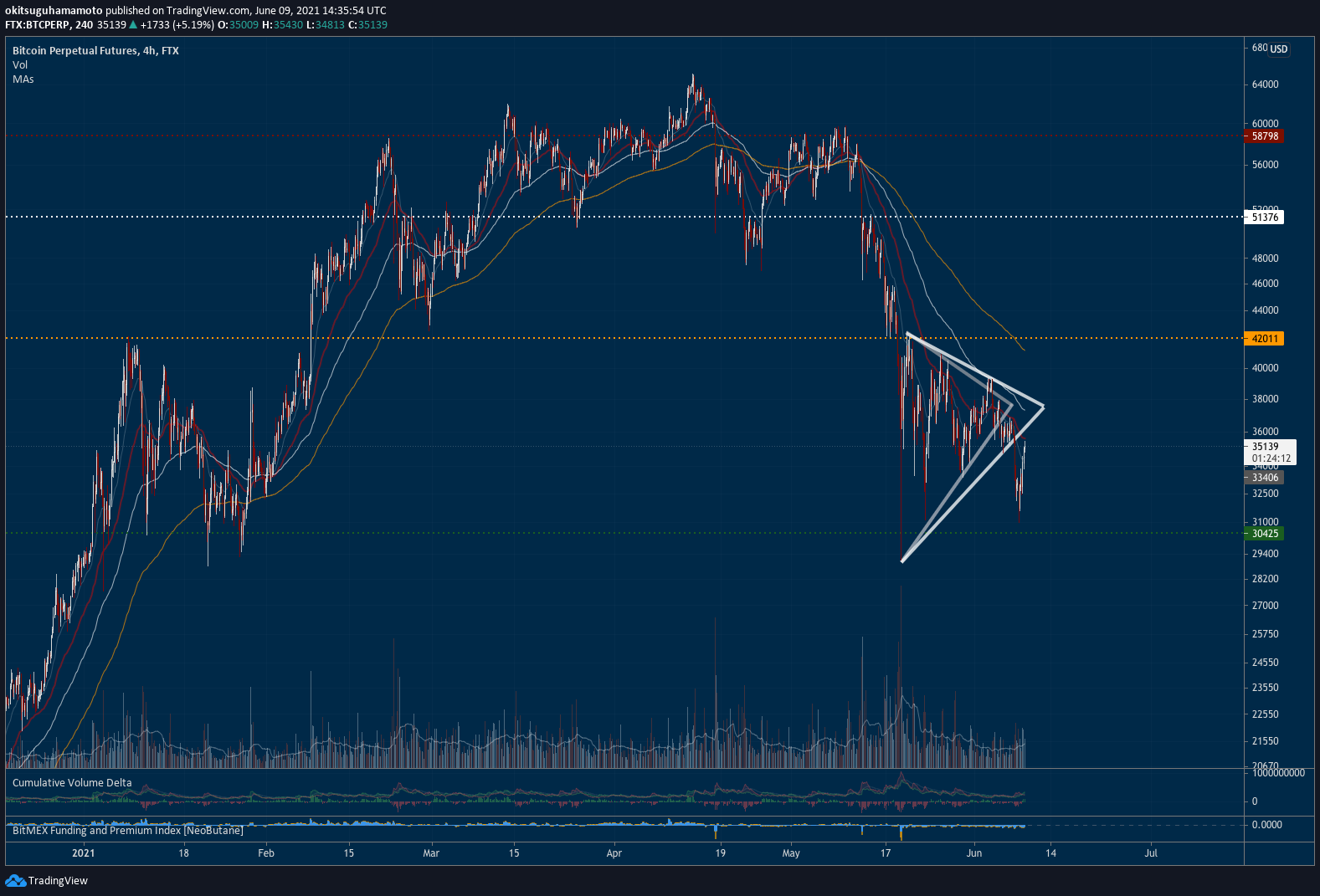

Chart art: such is a range.

Market musings: such is a saviour.

If it wasn't clear, we don't think Saylor's bond offering had anything to do with the bottom as Microstrategy's love of Bitcoin is priced in for a while. Still, it's a positive reinforcement to mitigate the overextended fear felt by many. While it's true that we're not out of the woods yet, as plenty of shorts remain open, it's also the case that those shorts likely have thin margins now, meaning they can get liquidated soon, which would push prices higher.

For this scenario to play out as expected, look out for similar price behaviour as the one described here. Meanwhile, don't forget that bears haven't suffered yet, so they can resume an attack provided the right incentive comes up. Moments ago, Coinbase, the world's most popular exchange, suffered some temporary downtime. While this sometimes happens to a subset of users, note it's the kind of event that can create widespread chaos, if it starts to affect a larger percentage of traders. As always, don't panic nor FOMO, and trade according to this chop.

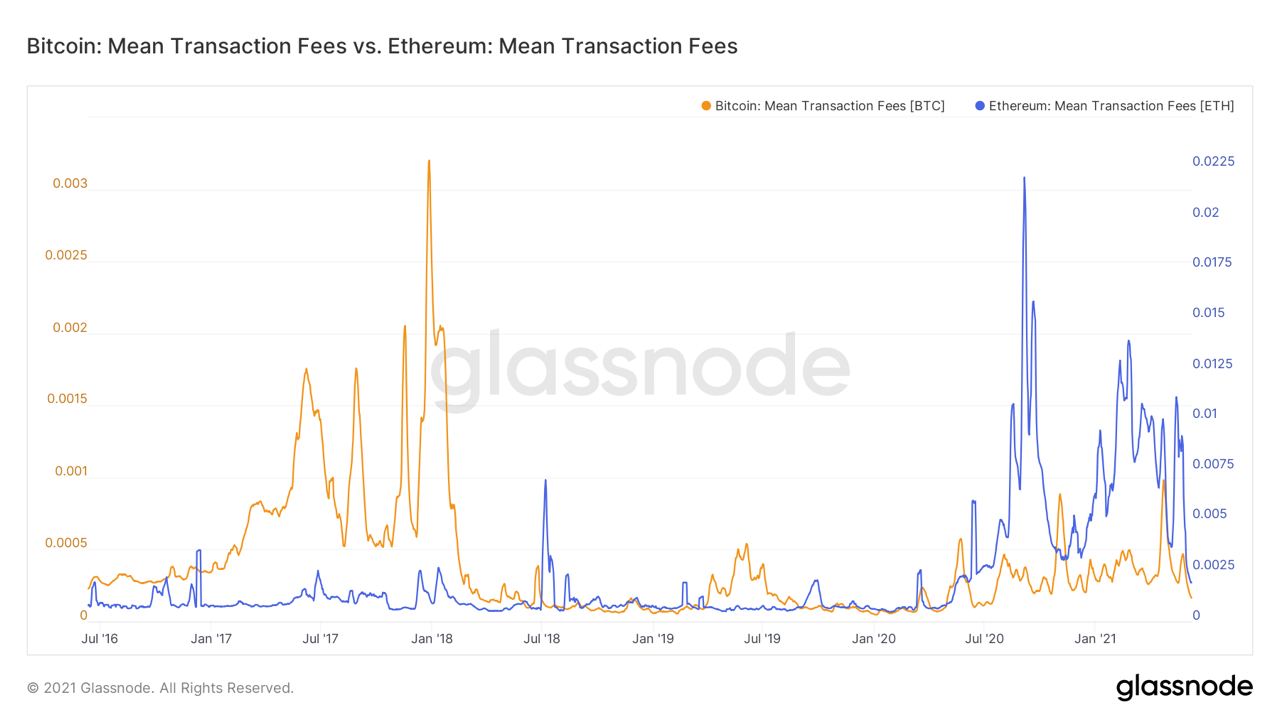

Visual block: such is an acceptable fee.

Three things: such is love and hate.

- Are you a Jack Dorsey fan or hater? In both cases, we recommend this Bitcoin-focused interview with Twitter and Square's founder.

- Are you a China fan or hater? The literally popular country has banned search results from top exchanges to be shown to their netizens.

- Are you an Elon Musk fan or hater? The latest manipulation attempt from the billionaire targeted an infamous sh*coin and pumped it %350!

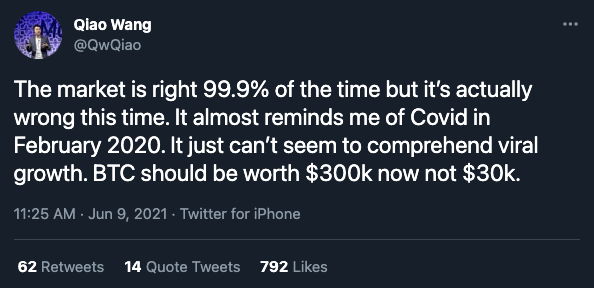

Tweet tip: such is the truth.

Meme moment: such is life.

The Desi Crypto Show: learn more about QuickSwap.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!