Cheapotle

Cryptic ball: crypto for burritos.

The first week of June is coming to an end with some volatility. Better than expected jobs data in the US prompted equities to fall and close in the red, as it shows the economy is hot and so the Fed can further hurt stocks. What's next?

- Bitcoin and most alts followed along and fell into choppy waters. The original cryptoasset lost $30k and is back hovering within the tight range that defined most of May's trading. If it loses $28.5k again things will get nasty.

- Conversely, ether is testing the key support level from May to July 2021. There's not much visible support below it but I reckon there's strong demand for ETH that would prevent a major crash - even if it can go lower this summer.

- However, zooming out it's becoming clearer that inflation is peaking and the economy is about to slow down. This should soothe the Fed a bit over the summer, even if we'll surely still get the expected hikes in June and July.

All-in-all, I believe the weekend will be boring but next week volatility will resume in anticipation of the Fed's FOMC meeting. In the meantime, rejoice at the fact Chipotle is now accepting cryptocurrency in its 3000 US stores!

Chart art: ranges for chop.

Three things: rebuttals for breakfast.

- Preston Byrne "debunks the 'concerned dot tech' letter". A must-read!

- The Calculator Guy asks "what do we do about ponzinomic protocols".

- Conon Ryder deep dives on "the stablecoin trilemma".

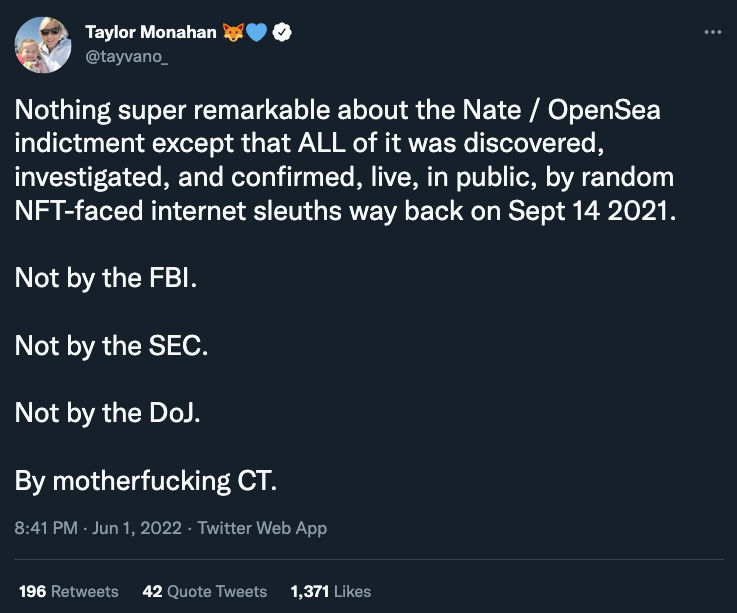

Tweet tip: tweets for indictments.

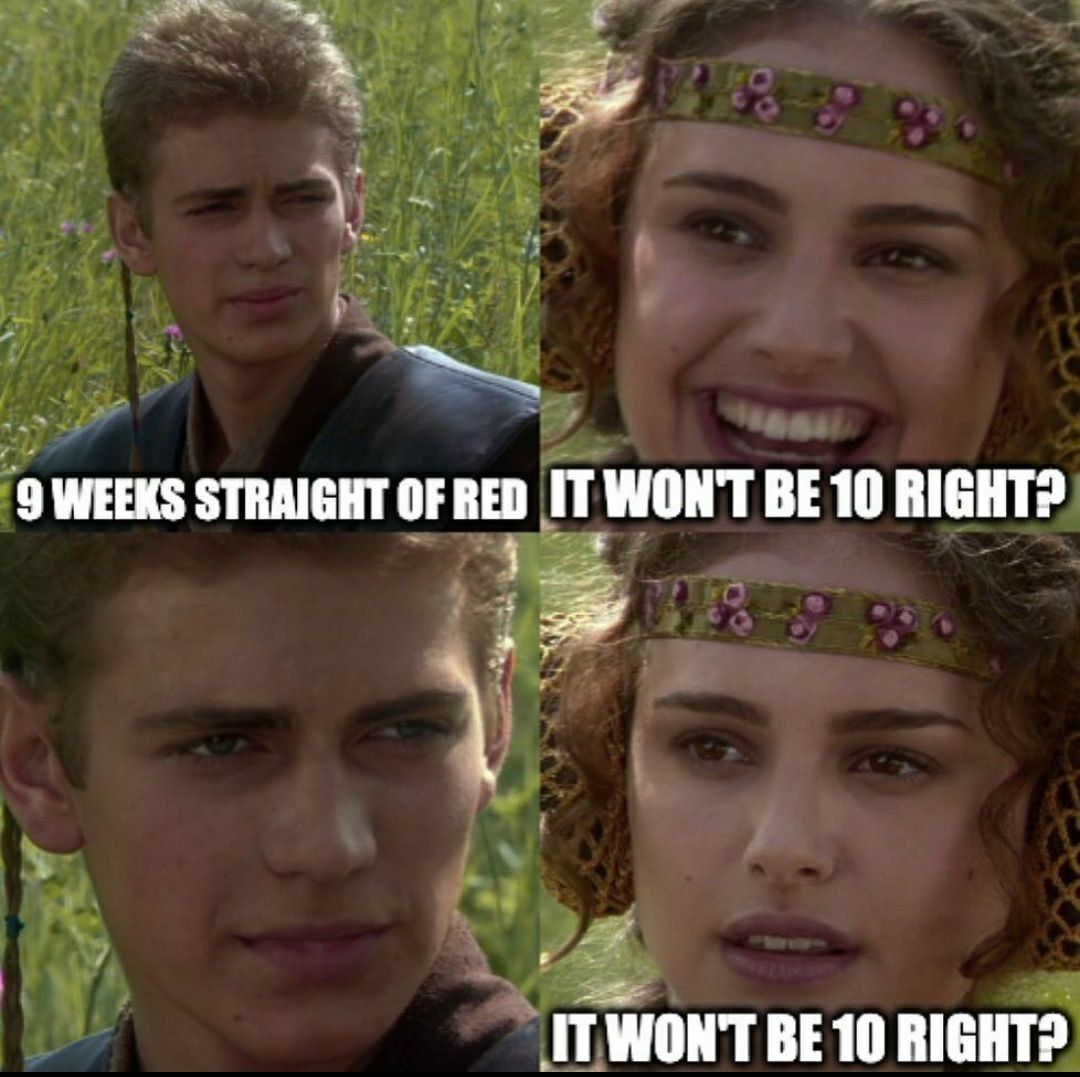

Meme moment: memes for statistics.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!