When OpenSEaC?

Cryptic ball: stocks up, crypto sideways.

If I tell you that US equities had a great day, reversing this week's losses, can you guess how did cryptoassets fare? That's right, not so bad but not as well as good old stocks. Alas, even the more risky Nasdaq index did relatively better than BTC!

- The tech-heavy Nasdaq Composite rose nearly 3% today, while S&P 500, the mother of all indexes, appreciated around 2%. Conversely, bitcoin just gained less than 3% on the day, a pale return compared to the more boring equities!

- More worryingly, ether and most alts failed to join the bounce as traders slowly lose interest in the space. But that's fine, as the best bottoms are formed in such periods of peace and silence. We just need to ensure peace isn't eternal.

- This lack of interest in crypto is also illustrated by the likes of Gemini and Coinbase slashing existing jobs or "just" freezing all hires as they try to mitigate the possible risks of another multi-year crypto winter. Yikes, so much fear!

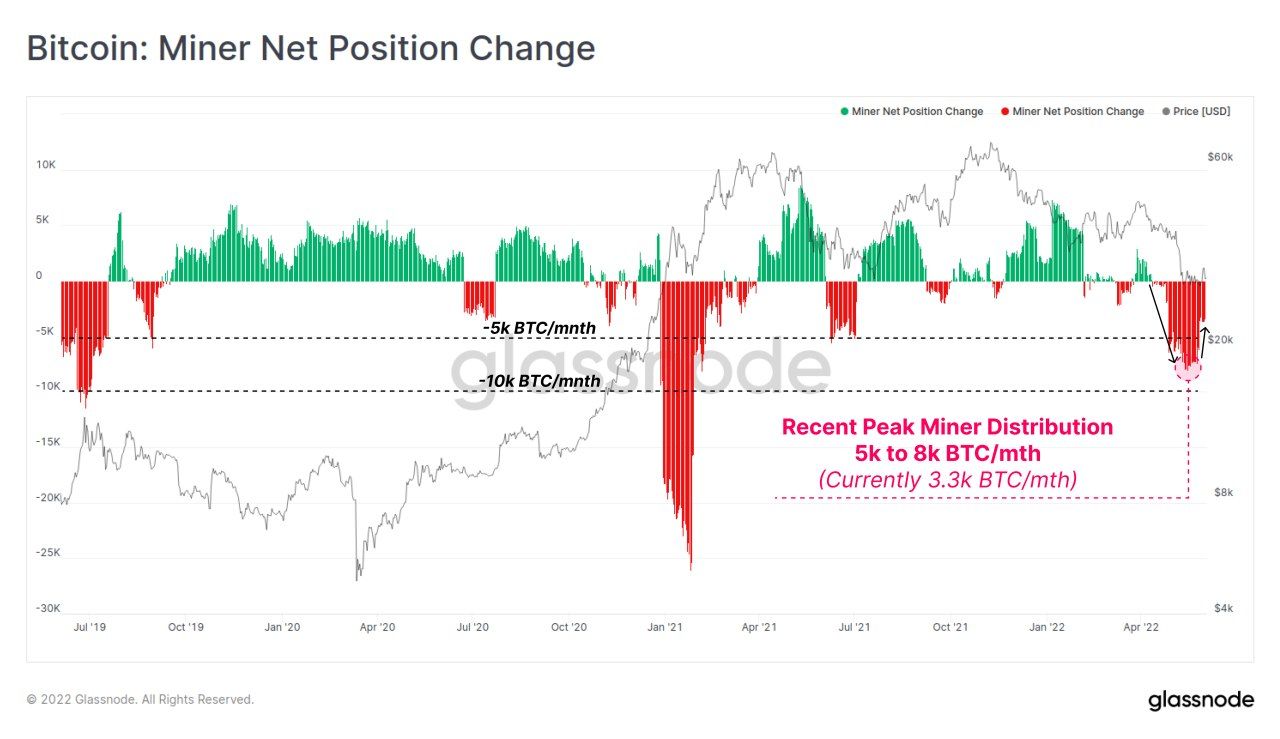

- Curiously, and as can you see below, miners are also planning ahead. The significant net outflows imply these players have been selling their block rewards or reserves to prepare for the worse. Oh, the 2018 vibes!

Lastly, if you need some solace, at least it's good to see that $30k was defended and continues to be a key level. Let's just hope this is not like the end of 2018, when bitcoin bounced so much of $6k that it eventually crashed down to $3k!

Chart art: miners selling, reserves falling.

Three things: DOJ prosecuting, community roaring.

- Hal Press convincingly explains why he "thinks Ethereum is a generational investment headed into 2022".

- Matt Levine brilliantly explains all the nuances surrounding the recent insider trading case indicting a former Open Sea employee.

- Shivsak visually explains "a bunch of practical applications for crypto" in one very appealing illustrated guide. It's not a bubble!

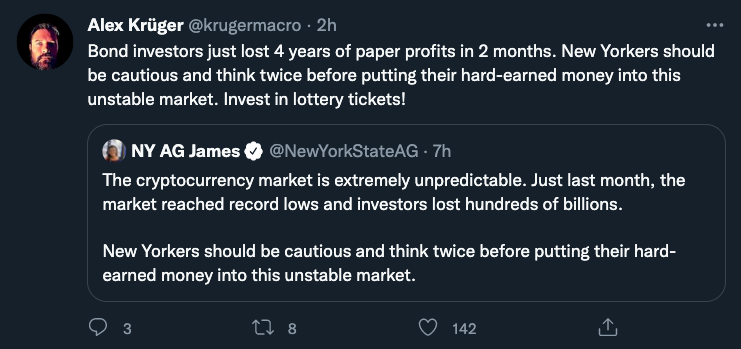

Tweet tip: TradFi barking, DeFi fighting.

Meme moment: stars shooting, alts dropping.

FV Bank: let's talk a bit.

Get started: download the B21 Crypto app!