The Marge vs. The Merge

Cryptic ball: don't bring Bart back.

As anticipated Friday, the weekend was indeed boring - with bitcoin and alts trading within the range I've been talking about. Then, right after the weekly close, BTC pumped 5% as equities futures indicated a solid week ahead. But we still we're sayling in choppy waters, so the move was faded this Tuesday. What's next?

- It's the second time this June that the original cryptoasset broke out of the tight range we've been in since May 13th, only to lose what it gained a couple of days after. This was a very popular occurrence in the previous crypto winter, which was jokingly called the Bart pattern. Now it seems it's more like the Marge!

- In and of itself, this move only means there's a generalised lack of interest to sustain a rally for more than a short while, but also that there's enough demand to ensure bears can't crash the market rapidly. Not so bad, but also not ideal as the longer we spend in the doldrums, the more likely is it that we drift lower.

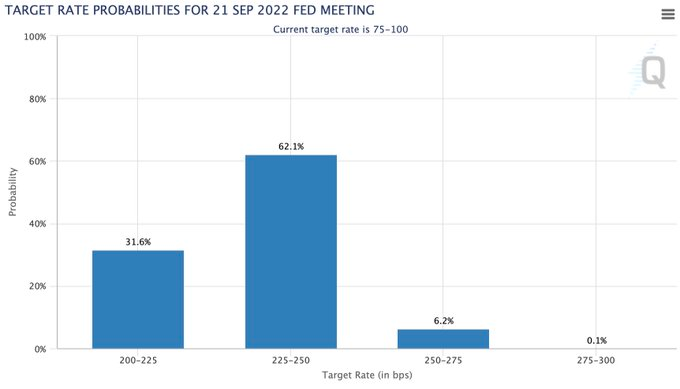

- This leads us to the good old macro commentary. As I've been writing, I'm convinced inflation data is about to get better and Goldman Sachs agrees. However, even if the Fed doesn't become more aggressive than expected, it's likely that the continued monetary tightening hurts stocks and crypto.

- Why? The top JP Morgan strategists (I'm not saying we could trust them, but I tend to agree) believe this is just a dead cat bounce and most markets will continue falling between the end of July and August - when companies report Q2 earnings. That's because inflation will surely have eaten into their profits.

Lastly, for this week you should note that this Friday the latest US CPI data is released and traders are expecting the print to come pretty high. My bet is that they will be wrong and we rally a bit more on the good news. But I'll update my view during the week as we speculators start their positioning.

Chart art: don't wreck the expectations.

Three things: don't call it a bear yet.

- Nat Eliason offers a framework for evaluating crypto projects.

- Greg Clayman helps you navigate web3 jobs in this bear market.

- Jason Choi discusses the state of the crypto bear market.

Tweet tip: don't ruin that feeling when.

Meme moment: don't break Solana again.

FV Bank: don't miss out.

Get started: download the B21 Crypto app!