Cook in June and July, dish it out in August and September

Cryptic ball: do you know how to cook a token?

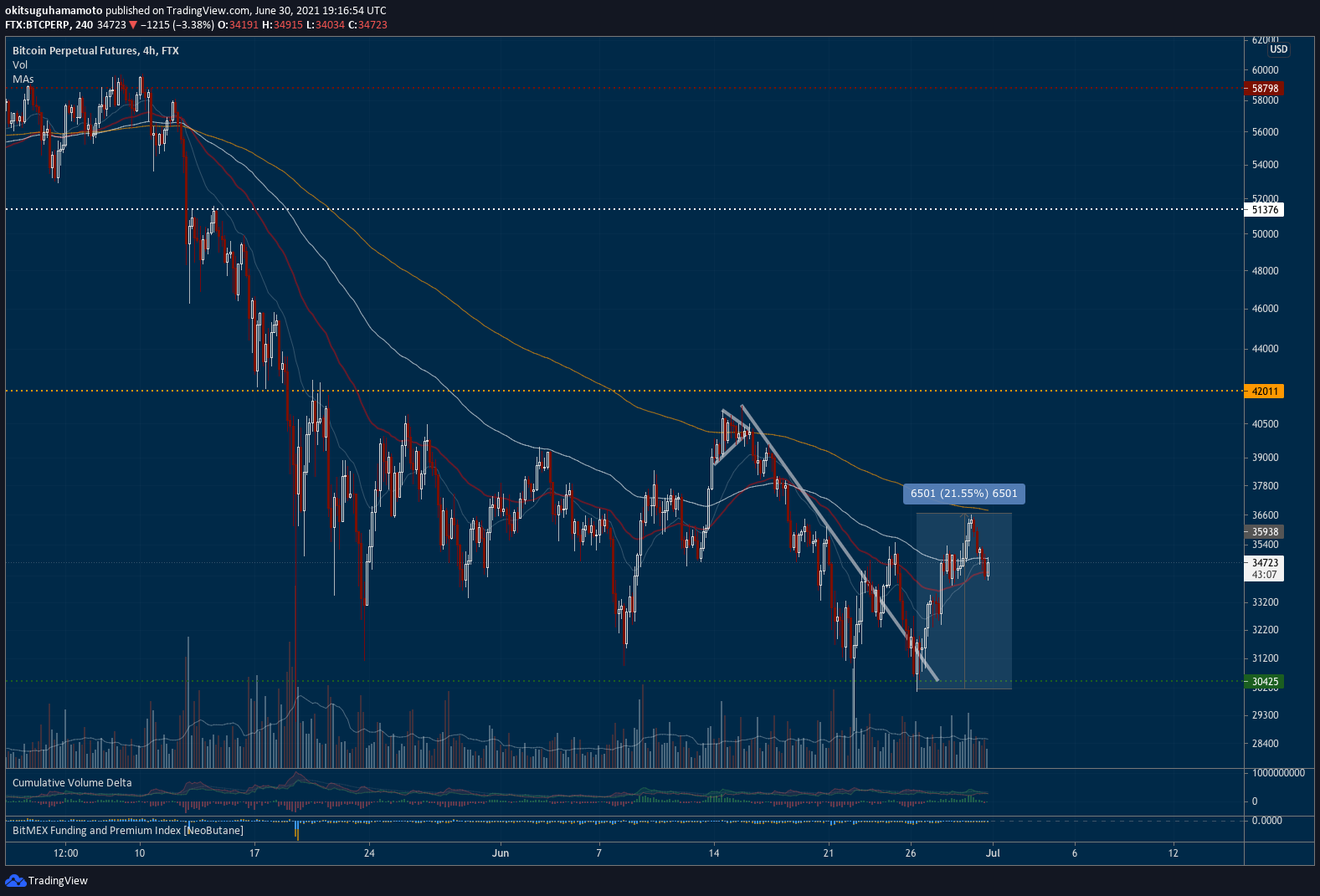

Today is the end of the month, of the quarter (which will be the second-worst so far), and of the semester - so you can expect some more volatility towards the daily close as speculators try to take advantage of the meme that institutions have been rebalancing their portfolios over the past days (which they have, but remember what we explained about gold on June 18th: the rebalancing is done before). Still, things are running pretty smooth. Yes, the orange coin has paused right at the 200-period moving average for the popular 4-hour chart, but it's bouncing nicely.

However, if bears are able to push BTC below $34k we might need to wait a bit until new support is found. Overall, even if bulls win tonight it's likely we don't leave the current horizontal range we've been sharing for a while - so remember there's no need to FOMO, at least until fund managers return from holidays, as evidenced by declining institutional interest. This is the time for you to research the technology, reflect upon what you learned over the past months, and make a plan for the second half of the year - because the party is far from over.

Chart art: do you know the basics of technical analysis?

Market musings: do you know how to decentralise stability?

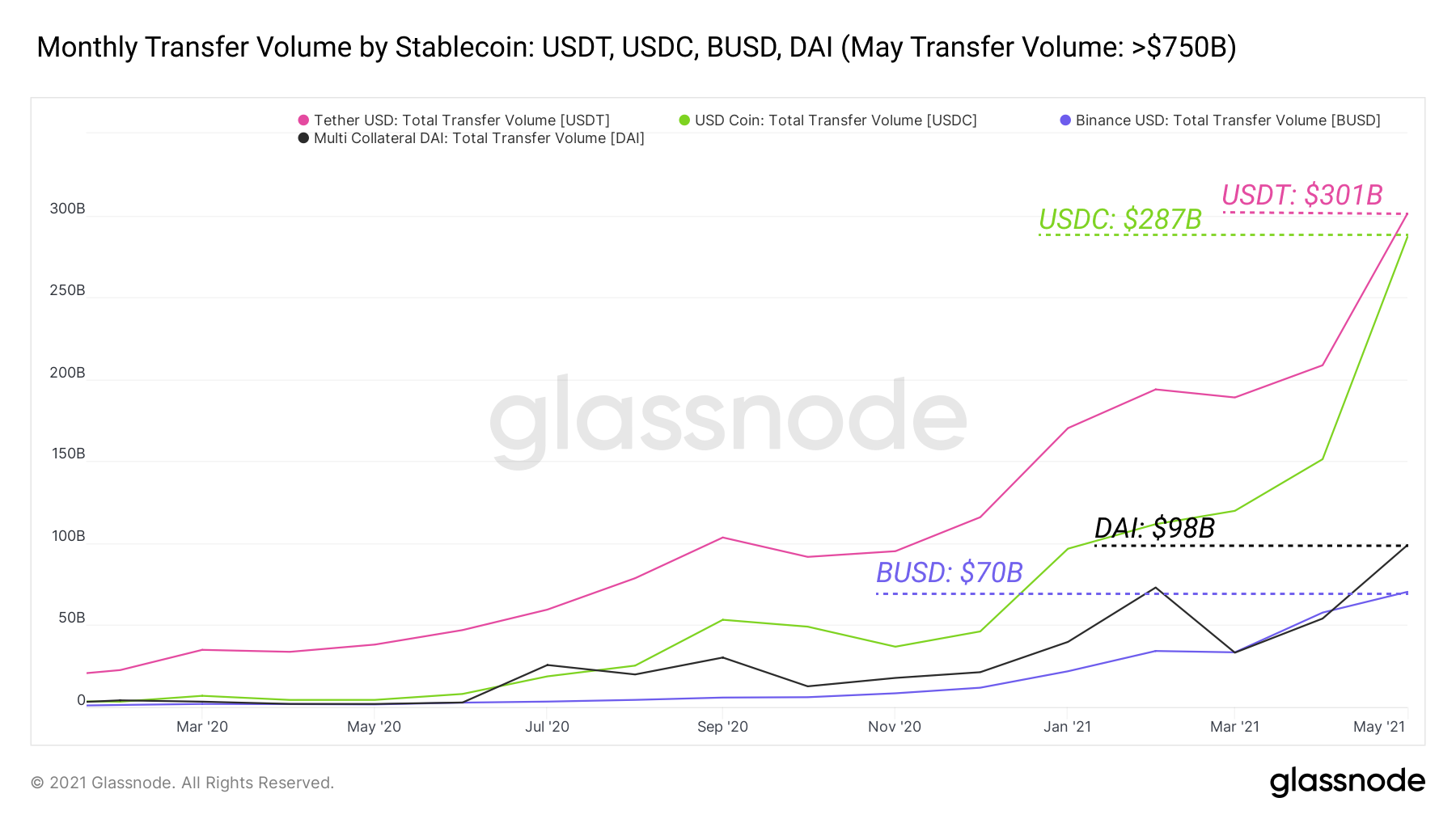

USDC, powered by Coinbase, is the second most used stablecoin in the space and has announced support for 10 more native blockchains, out of four currently. Why is this important? Because another good thing about the recent crash is that Tether FUD became fashionable again. This is a strong opportunity for other stablecoins to replace this infamous source of uncertainty in the space - at least now that China became FUDless following the exodus of the many miners operating in the middle kingdom, which where threatening the power of the single party.

And while it isn't good that Coinbase continues controlling a significant part our industry (imagine if US congressmen who are asking for blockchains to have 'cryptographic backdoors' get their way?), we're at least seeing signs of positive change. After all, cryptoasset innovation requires interoperability and diminished barriers to entry so that competition can foster new players to defy the old. Alas, even Bitcoin is constantly challenged - that's why its status as leader of the pack is so significant! Now, the trillion dollar question is if DeFi will ever be able to produce a reliable, decentralised stablecoin. Is it even possible?

Visual block: do you know how to use DAI?

Three things: do you know how to differentiate Om from Ohm?

- Curious about decentralised stablecoins and decentralised reserve currencies? Learn about the latest in DeFi experimentation, from DAI to OHM!

- Curious about Ethereum Improvement Proposal 1559? We've shared many things about it here, but here's all nicely summarised in a new pdf report.

- Curious about why central banks are considering digital currency, which are different from digital versions of fiat currency? This speech from a top US Fed member explains it very well. It's a must-read if you like the topic.

Tweet tip: do you know how simple the alt cycle is?

Meme moment: do you know what falling behind means?

Spend your crypto profits: with B21's international card.

B21 Token: a low cap project with many use cases.

Get started: download the B21 Crypto app!