A what if weekend

Cryptic ball: what if fear didn't quickly escalate?

This is surely the most delayed newsletter issue we've written. It's also perhaps one of the most important ones. As explained in one of yesterday's scenarios, bears have been able to further push bitcoin's price down - and, consequently, the rest of the cryptomarket. To better see this effect, as of now, over the past 24 hours BTC has fell 6.29% while total market cap depreciated 6.38%. At least Tether is holding strong, right? Jokes apart, panic has once again crept over the cryptosphere.

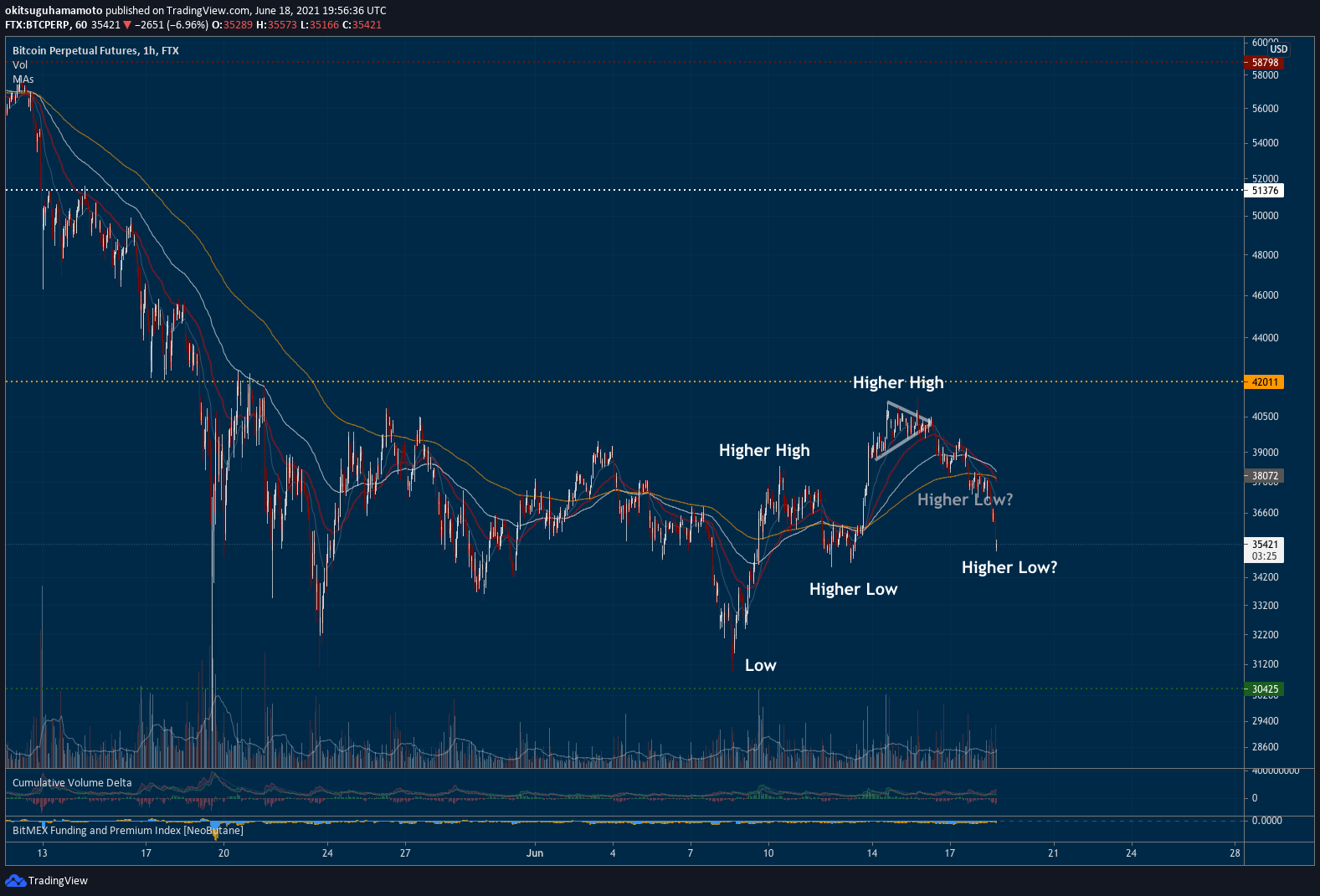

Is it warranted? Should you exit all crypto markets until the end of summer is nigh? As always, it's impossible to tell as the market can quickly change based on new information. But let's analyse what is known. 1) It's likely that the bullish market structure in formation since the beginning of month has been broken. Check today's chart art to see why; and note that it's still possible - but not that probable - that it remains intact if we don't fall further over the weekend.

Chart art: what if continue ranging all summer?

Market musings: what if bears are trapped?

What the above means is that, for the short-term, i.e. for at least the first half of summer, bitcoin remains bounded by the horizontal range between the $42k and $30k. That's the summer chop we've been talking about since April and should be nothing new for you, apart from the negation of the past two weeks's renewed bullishness - at least until this consolidation phase is completed.

2) Bitcoin hasn't been the only affected asset: physical gold also suffered its worse day in a year after six days of consecutive selling and is down 8% since May 31st, which is a very significant drop. That's because the US dollar has been soaring in anticipation and in reaction to yesterday's Fed meeting. And a strong dollar is historically connected to weaknesses in all things shiny, typically gold and now bitcoin too, as investors de-risk following the fear of higher interest rates. However, there's more to it than just forex implications, as you can read ahead.

3) Today is the third Friday of the second quarter of 2021, where several options and futures expire in the traditional financial markets in what's called quadruple witching. The settlement of those contracts paired with the necessary rebalancing of indexes that follow the market is typically associated with additional volatility. Moreover, some well-reputed investors are attributing the June dump of several commodities, including gold, to major banks trying to save their call options.

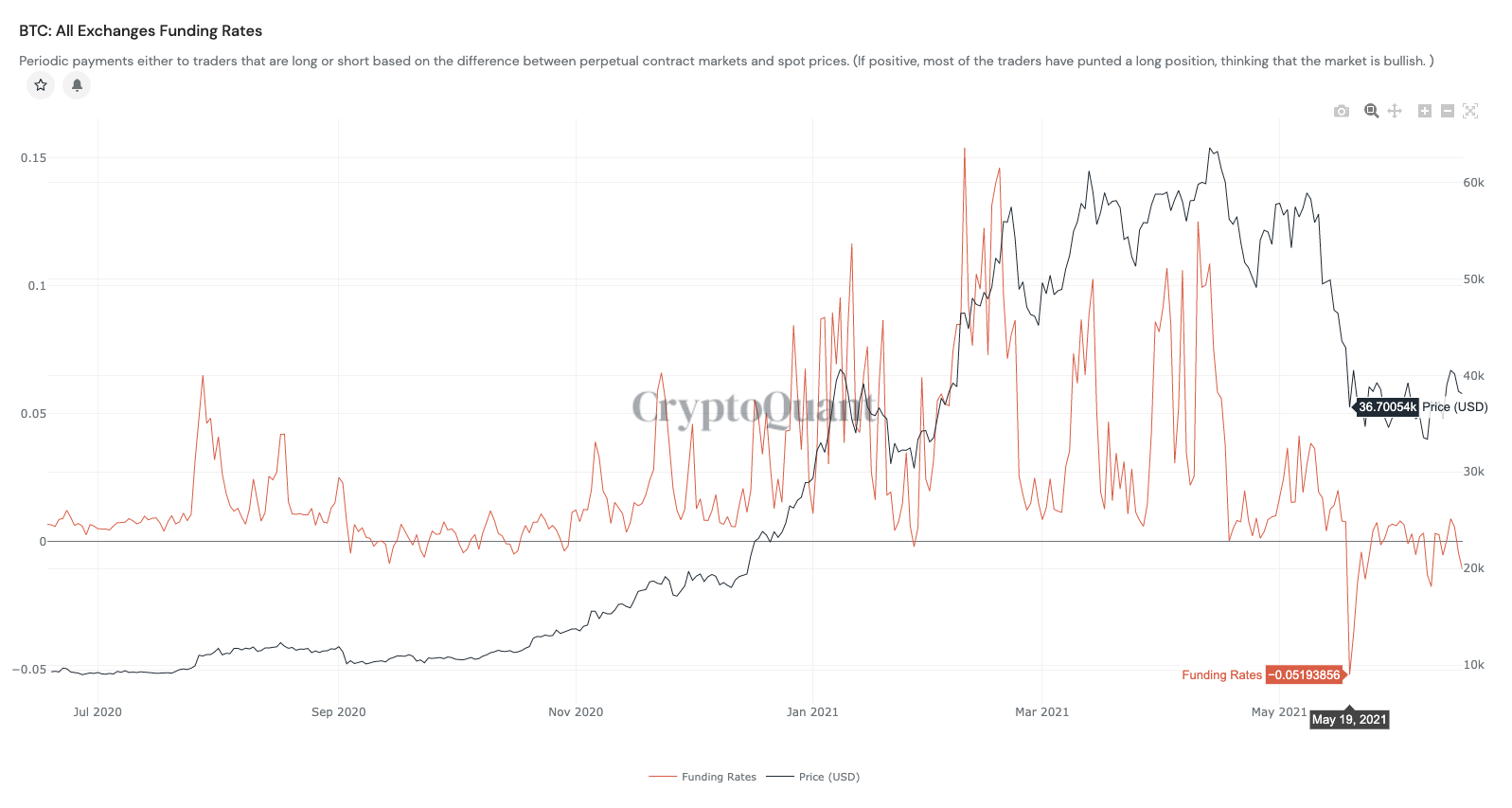

In other words, once the global markets reset Monday, we can expect at least a relief rally. And, in crypto markets, we can maybe even expect a short squeeze. Note that even though some shorts on Bitfinex have started to close after a massive rise since June 1st, the amount of leverage hold by bears is very high right now. You can follow this by checking the funding rates in futures exchanges below, which have started to turn negative again (meaning there's more bearish than bullish pressure) after recovering since May 19th and June 8th's double bottom.

Now, all does this all ties-up with the existing narratives? It's clear that bears are taking advantage of the negative market sentiment and the upcoming death cross indicator, which can happen this weekend. However, betting against the market is the easy trade right now. According to Santiment's data, smaller investors are selling heavily while whales and medium-sized investors are holding (i.e. at least on-chain, it's possible that they are selling on exchanges and we can't see that).

Still, fear is rising on sentiment indicators and on social media, meaning there are few buyers now. So, if short sellers are able to further push bitcoin price below $35k, expect at least a test of $31k/$32k later in the weekend. And if that support fails, then capitulation will be near as Michael Saylor and other whales surely have their bids around $20k, right? However, note we don't think it's that probable that support will fail. It's more likely that we remain ranging in the current chop.

Still, for the bulls who want additional hope, consider the possibility that Monday we open with a short squeeze that traps all the late bears jumping into the crowded short game. If this is all too wild for you, consider remaining away from the market until a clear trend is defined again. If not, make sure you have a plan and that you are not overleveraged. And keep following the funding rates shared below. See how how local lows correlate with bottoms - especially May's one?

Visual block: what if we didn't have funding rates?

Three things: what if we always shared three things?

- Looking for alts to investigate while staying away from the sideways charts? Check Grayscale Investments plans to add "new potential products".

- Looking for a video to watch this weekend? Check Jawad Mian's interview with Steve Cohen, a legendary hedge fund billionaire trader who is now also bullish on crypto. Hurry up as the video expires in less than 48 hours!

- Looking for a technical read? Decrypt's Matt Hussey explains what is the Ethereum Improvement Proposal 1559, scheduled for July's London hard fork.

- Looking for one last piece of hope? The Block's Larry Cermak is one of this industry's most critical voices, providing excellent commentary since 2017. Well, he just summarised his thoughts and believes we're not in a bear market!

Tweet tip: what if Cryptunez doesn't get a girlfriend?

Meme moment: what if if fresh FUD hits the market?

The Desi Crypto Show: learn more about Near Protocol.

New news: USDC now available on our app.

Get started: download the B21 Crypto app!