Whatever July and August do not boil, September cannot fry

Cryptic ball: the summer can't be wasted.

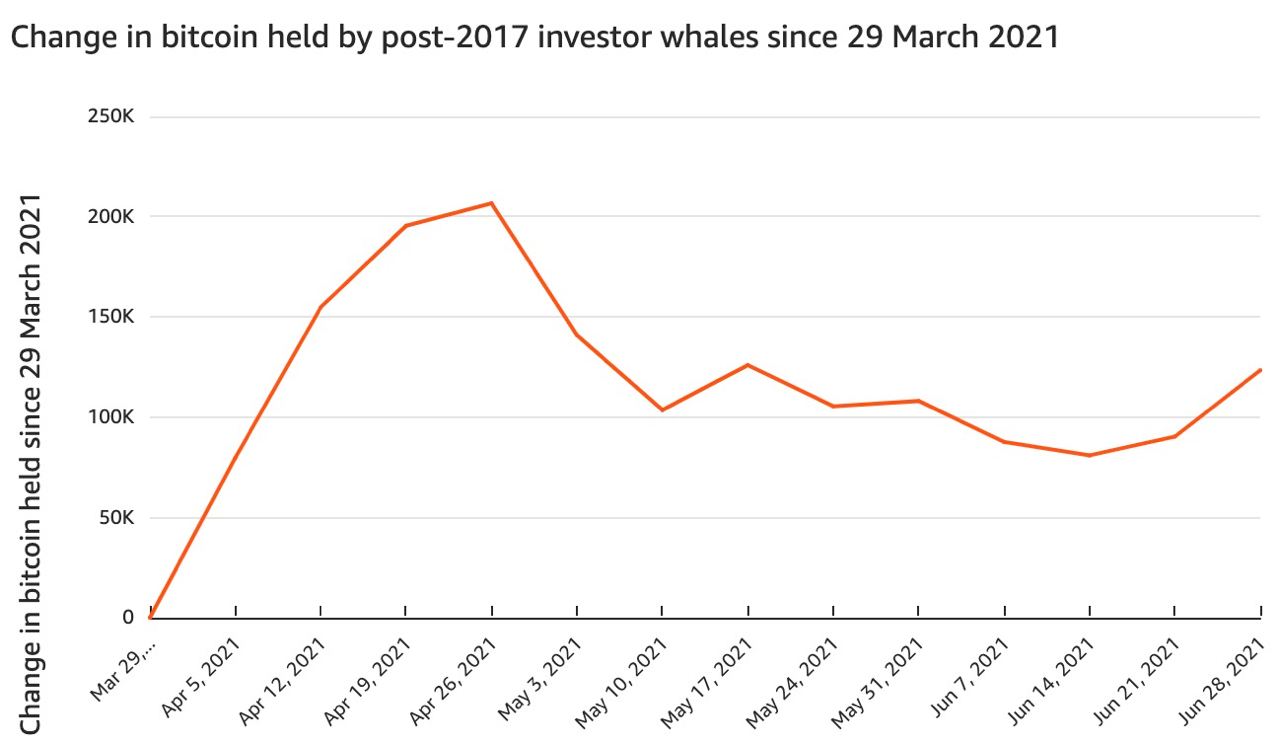

Crypto Twitter has turned bearish again, apart from some solid analysts focused on whale activity. This is normal as peak negative sentiment tends to occur in the disbelief phase of a market cycle, as often shared here in April. While in the greater scheme of things we remain convinced the bottom is in - and even if it isn't the current risk/return favours long bets - there are always minor cycles within, and we're clearly experiencing the aftermath of the thrill and euphoria recently felt after the musical shibairs game ended. In popular words, the summer is slow.

It's our view things won't change until bitcoin first breaks the historical $42k resistance and then its current all-time high of $65k. Only after can ether and alts start mooning again, even with all the hype regarding the changes that EIP-1559 will bring later this July. What does this mean for you, dear reader? That your correspondent will only deliver this newsletter three times a week until September arrives, unless bitcoin starts pumping earlier, or ETH bulls prove us wrong.

Chart art: whale oil and data can't be wasted.

Market musings: short-term trading opps can't be wasted.

As explained above, we'll send this newsletter Mondays, Wednesdays, and Fridays until the end of summer is near, unless bitcoin moves warrant a more regular coverage. Our goal is to help you understand the crypto markets in simple terms, so with all the noise out there we want to ensure all our messages get the focus they need. Naturally, regardless of the slow summer, there are always trading opportunities. Only at the peak of a crypto winter can we say that trading is dead.

Still, three days a week are more than enough to help you understand any setup that is relevant to share. Take today's example: if bitcoin holds the current support at $33k, then you can expect a new test of $37k, which, if successful, will rise all(t) boats. If it fails, expect bears to show up for another test of $31k. However, it's more likely BTC remains sideways until tomorrow - as macro traders are focused on crude oil prices, which are pumping hard - so the previous phrases will will be valid for the typically volatile weekend. As always, make a plan and sit back!

Visual block: wealth management fees can't be wasted.

Three things: vertical space can't be wasted.

- Travis Kling made a great visual overview of all the FUD coming from China past June. It's so long it doesn't fit in this newsletter, so check it out here!

- Willy Woo popularised the first on-chain metrics for analysing bitcoin's price. Check out his latest interview at the great What Bitcoin Did podcast.

- Ali Sheikh made a great meme matching top alts with Game of Thrones characters. Again, it would lose if we pasted it here, so do take a look!

Tweet tip: poetry can't be wasted.

Meme moment: trends can't be wasted.

Spend your crypto profits: with B21's international card.

B21 Token: a low cap project with many use cases.

Get started: download the B21 Crypto app!