Saylor didn't get away

Cryptic ball: did you like last Sunday's scenarios?

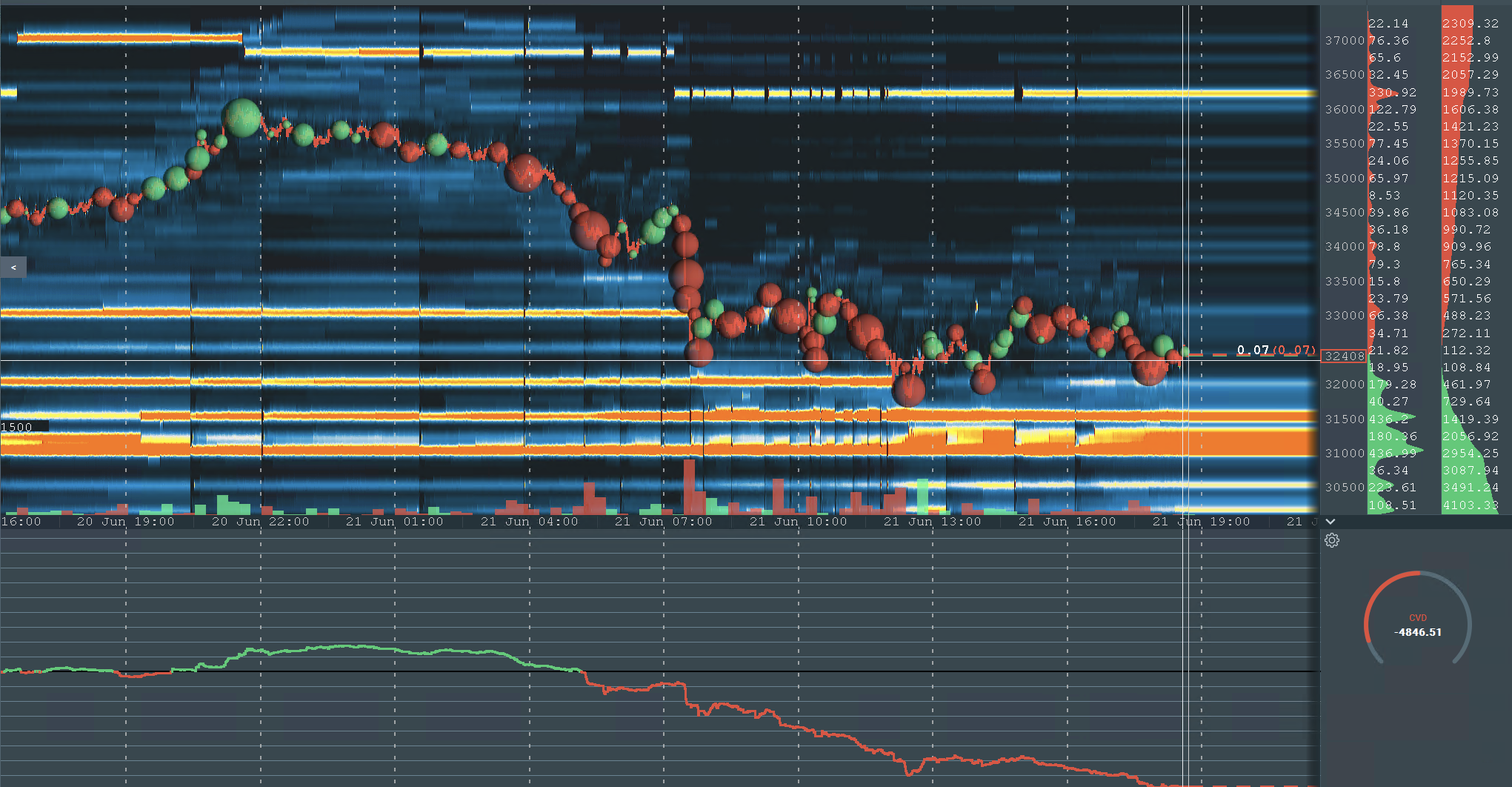

As anticipated in the high probability scenario explained last Friday, the bullish market structure of the past couple of weeks was indeed broken in a spectacular bull trap and bitcoin has tested $31.7k this morning. To be fair, the orange coin is down only 10% since the last newsletter went out. But Sunday morning it started dumping aggressively, finding strong support at $33k. This move was quickly retraced and by Sunday night BTC had fully recovered. But this was another false signal to entice the permanent bulls, as this morning the market crashed again.

Mainstream media is crediting this move on the continued crackdown on miners by the Chinese government as the culprit. But the more accurate explanation is still the same as the one shared here last week: a strong US dollar following last week's FOMC meeting, where Jerome Powell, chair of the US Fed, hinted at a less hawkish monetary policy in the years ahead - provided that the economy keeps recovering at a healthy pace. So, what can you expect this week?

Chart art: Saylor failed to cause a proper bounce.

Market musings: it's all about the Fed now.

To begin, (physical) gold has stopped falling but it hasn't bounced yet. And just five hours ago Michael Saylor, Microstrategy's CEO, has finally announced the analytics company has bough an additional $500 million in bitcoin at an average price of $37.6k! If this was still a bull market, all the desks knowing this would have prompted large investors to buy everything they could. But these summer doldrums are so aggressive that not even the strongest spot buyer had a chance.

For now, everything is hinging on a new Congress testimony by the Fed's chair happening tomorrow at 2pm Washington time. This is because the House of the Representatives convened several policymakers following the confusing outcome of last week's FOMC announcement, which was interpreted as dovish. If Powell clarifies the Fed will continue boosting the economy, we might get some relief. Otherwise, it's likely that we'll break the $30k support and quickly drop to $20k while ether and alts fall like if there's no tomorrow. So plan ahead and watch out!

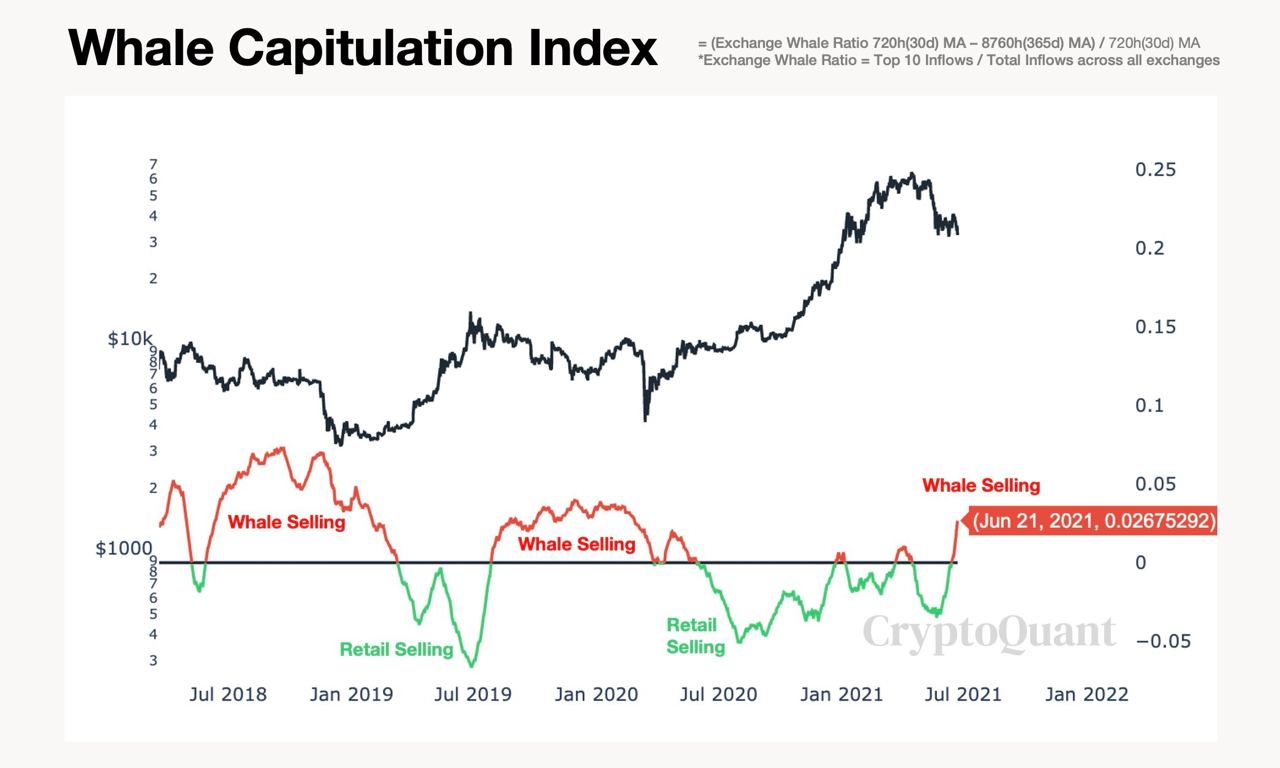

Visual block: even whales are afraid.

Three things: ignore the markets and just learn away.

- Vitalik Buterin has shared a new post (about Verkle trees) and, as usual, it provides an interesting glimpse at the technicals behind blockchains.

- Deribit Insights has shared a new post (about market structure) and, as usual, it provides an excellent glimpse at how derivatives markets work!

- Bitcoin Magazine has shared a new post (about the history of cryptography) and, as usual, it provides a compelling overview of the evolution of this space.

Tweet tip: true, you should try it!

Meme moment: this could be said of bears right now.

The Desi Crypto Show: learn more about Near Protocol.

New news: USDC now available on our app.

Get started: download the B21 Crypto app!