About that summer solstice

Cryptic ball: let's hope this was the bottom.

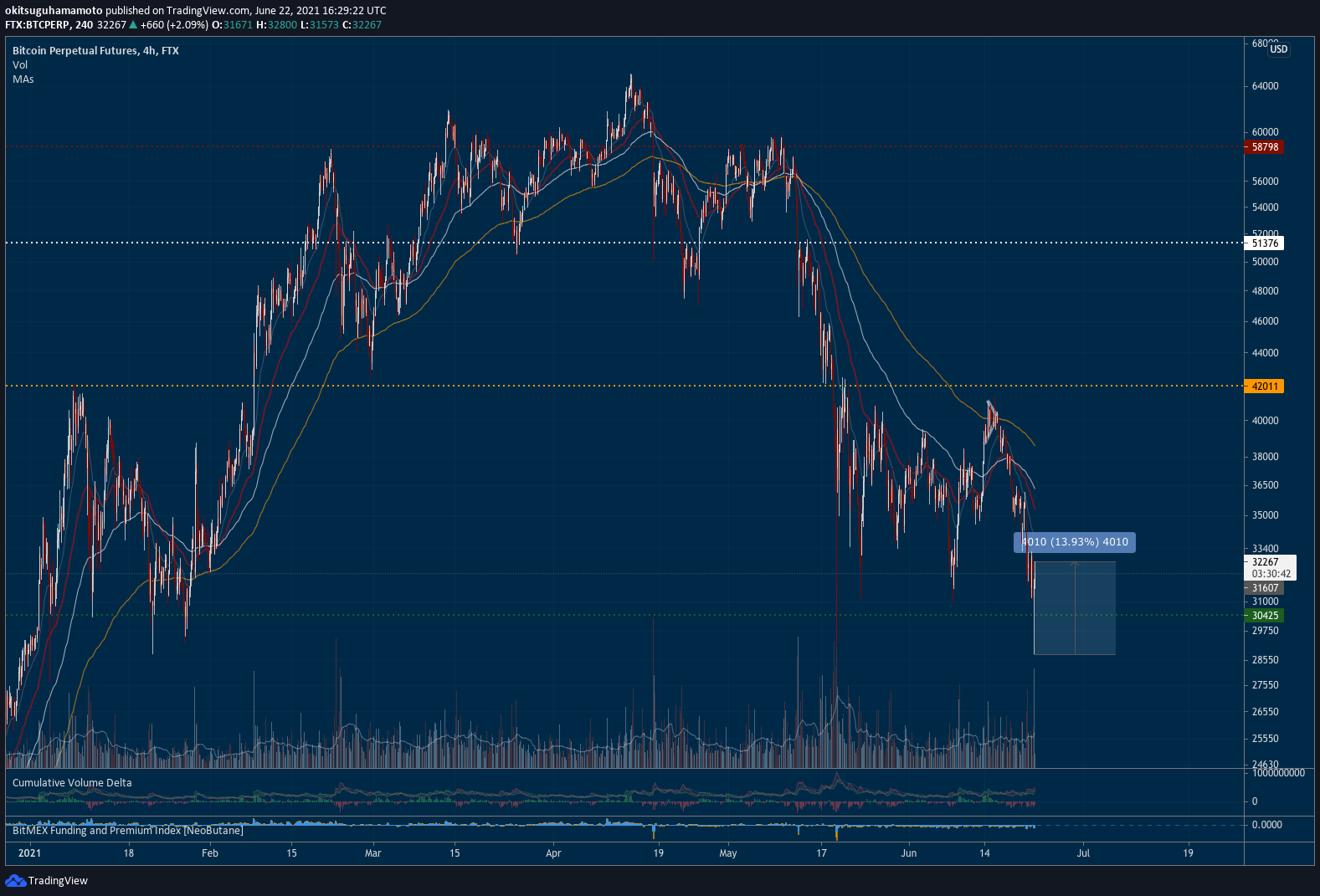

What a day! This is what crypto markets are about: volatility and trading opportunities. If bulls were trapped last week, it seems today may be time for bears to suffer after an extraordinary month for those who have been short. What happened? After seven consecutive days of selling since the failed test of $41k/$42k, bitcoin has clearly found a local bottom over the past hours - after a gruelling long day (damned solstice) where shorts pushed BTC down to $28.8k.

Why do we think that? Funding rates on Deribit, a derivatives exchange, have hit record negative levels a couple of hours ago. This typically correlates with local bottoms, as a very negative level - especially compared to the average level for the current period - implies there's more selling pressure at any given moment. And the selling pressure is highest just before the dump is exhausted (and vice-versa). This makes particular sense when the dump was supposedly cause by renewed FUD from China regarding new guidelines for its banking sector 🤦♂️.

Moreover, bitcoin has just tested the yearly lows from January 21st and strongly bounced - which finally signals some buying interest after the recent bullish hybernation. This has put the 4-hour candle within the horizontal trading range we've been talking about since May 28th - which gives further strength to those in the sidelines to enter and save the game. But is this the final bottom for now?

Chart art: let's hope we continue sideways.

This 14% bounce from the new yearly lows at the bottom of the past month's range is quite convincing. It's always a bet to buy low, but that's what we all want, right?

Still, for a safer play, consider that bulls will feel better longing the breakout of this channel.

Market musings: let's hope bears are trapped.

As always, that's impossible to tell. So far, we're still stuck in the chop. If those waiting on the sidelines waiting for a good entry decide to join the party, then it's likely we see a bigger short squeeze. What's that? In brief, it's when price rises against those who are betting against it, forcing them to close their positions (i.e. buy back) which creates more buying pressure. And it seems that this morning, on Crypto Twitter and on Telegram groups, many bulls finally decided to short.

Alas, even in yesterday's newsletter we fell prey to the meme that a break of $30k would immediately mean $20k, like the break of $42k immediately meant $29k. True, many alts fell up to 40% today, but it seems we have found some relief. Jerome Powell's prepared remarks have pacified the traditional markets - leading the S&P500 and NASDAQ to all-time highs. This has also helped bitcoin find a bottom. Moreover, the market is less leveraged now - so it's normal that we see slow bleeds instead of violent movements. Still, there are always incentives to trap those who spotted a trend change late in the game.

All-in-all, remember summer just officially started yesterday in the northern hemisphere, so there's a lot of sideways activity we may still have to bear. And there's still the case for continued bearish activity as many alts haven't tested the same yearly lows as the orange coin. As for what's next, it will be interesting to watch the live testimony from the Fed's chair, as new insights can come up from the questions and answers session! Look for signs that investors remain confident that the leading central bank will continue propping up the global markets by following USD exchange rates and the DXY, also known as USD index.

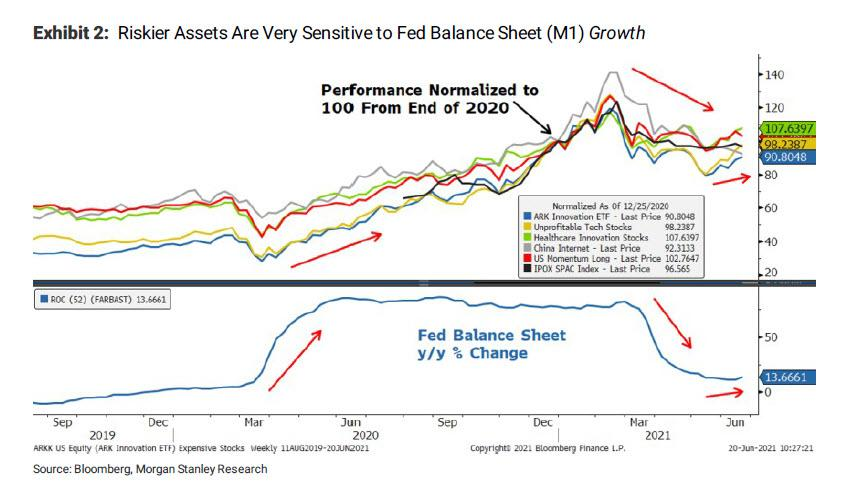

Visual block: let's hope the Fed delays tapering.

If the US Fed stops its asset purchase program then investors will likely turn bearish.

Three things: let's hope all the tourists have left.

- Tyler Cowen, a popular economist, explains what crypto people don't understand economics. It's a piece for the long-term and you should read it.

- Arca's Jeff Dorman, a popular crypto investor, explains the irony behind why the US Fed's slightly hawkish stance has been impacting cryptoassets.

- David Hoffman, a popular ether journalist, explains why he believes now is the time to dig in the crypto markets: it's all about getting rid of the tourists!

Tweet tip: let's hope @UpOnlyTV doesn't rebrand.

Follow today's episode at 7pm UTC through this link.

Meme moment: dogecoin fell 40% today.

Still funny.

Learn about: FV Bank, B21's sister company.

We've just launched a fundraising campaign on BnkToTheFuture, where Celsius, Robinhood, Coinbase, Bitstamp and Kraken have also raised funds! We've already reached our $5.5 million goal but qualifying investors can still join this round.

Get started: download the B21 Crypto app!

Subscribe to our newsletter

Follow us on Twitter

Join our Telegram group

Find us on Instagram

Watch us on Youtube

Our newsletter offers opinions and insights from analysts in the cryptoasset space. It is not intended to be investment advice, and should not be treated as such. You must not rely on its information as an alternative to financial advice from a qualified professional. Without prejudice, we do not undertake or guarantee that its information is correct, complete or non-misleading; or that the use of guidance in the report will lead to any particular outcome or result.

- 942 words

Post settingsUpload post imagePost URLPreview

b21.ghost.io/b21-ddd-jun-22-2021/Publish date(UTC)Tags

- Daily Decentralised Digest Post access Public Members only Paid-members only ExcerptAuthors

- B21 Crypto :: Invest | Earn | Spend

- Meta dataExtra content for search engines

- Twitter cardCustomise structured data for Twitter

- Facebook cardCustomise Open Graph data

- Email newsletterCustomise email settings

- Code injectionAdd styles/scripts to the header & footer

Feature this postTemplate Default Full Feature Image Narrow Feature Image No Feature Image Page With Form Delete post