Don't lose the plot

Cryptic ball: the famous flight-to-safety.

Not much has changed in crypto markets since yesterday, with bitcoin's higher low consolidation still playing out, at least for the time being (but keep following the charts as bears are trying to push price down a bit more). Meanwhile, ether and major alts continue to suffer more, as most eyes are still directed at the original cryptoasset. That's normal after a generalised dump. After all, investors feel more confident first gaining exposure to assets deemed safer - and bitcoin earns that label in this space - and only later dab into more risky ventures, like DeFi.

This is further compounded by all the attention bitcoin has been getting. From Microstrategy's macro bet on the orange coin to the Bitcoinification of El Salvador and other countries, with Panama potentially joining the group of (for now) small countries with lawmakers actively discussing how to become leaders of the token economy, without forgetting Taproot and the narrative that BTC will be a good hedge against the supposedly temporary post-pandemic inflation woes. So, if you're underwater on your alts, prepare to remain like that for a while longer.

Chart art: the famous dot plot.

Market musings: the famous FOMC forecasts.

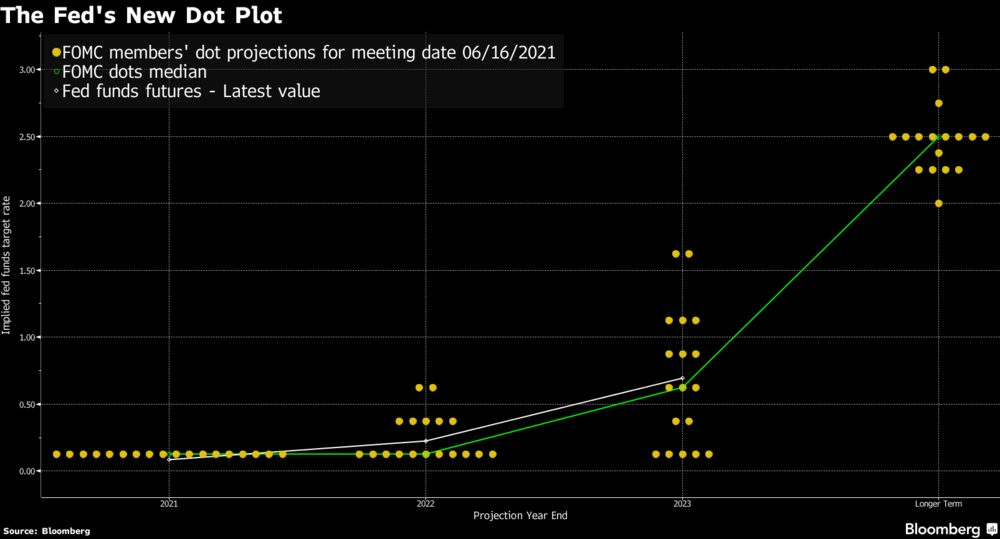

Yesterday's Federal Reserve meeting brought some volatility to the traditional stock market. But, in the end, its chair, Jerome Powell, explained that potential interest rate hikes in 2023 are still uncertain. Why? The Fed's monetary policy is dictated by twelve members, who composed the FOMC, or Federal Open Market Committee. In the meeting, it was clear some members now expect the first hikes to happen in 2023, but that depends on how the US economy fares until then.

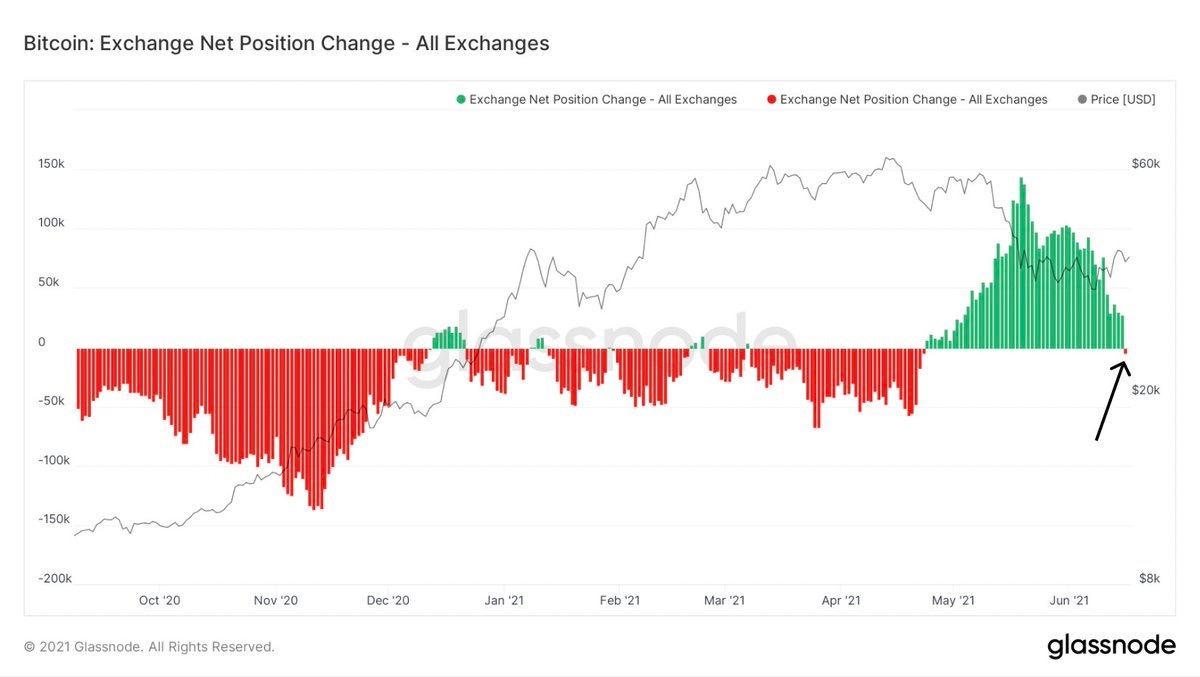

The outlook is good because at least until 2023 we can expect interest rates to stay near zero, to promote economic recovery. Which, in turn, is good for all kinds of markets. Anyway, back to crypto, this only matters as a crash in equities or in other asset classes could quickly spiral to bitcoin et al. But that's all a bit long-term. For now, consider today's visual block, which shows net changes in cryptoassets deposited at exchanges. An increase hints at investors trying to sell, and we are finally seeing a decrease since early May, which hints at accumulation.

Visual block: the famous can't sell outside an exchange.

Three things: the famous poorly-designed tokenomics.

- Everytime there's a new good DeFi explainer we'll share it, and the latest is titled how "Crypto Die-Hards Built a $90 Billion Wall Street on the Internet".

- Everytime there's a new good explainer on how El Salvador became the first crypto nation we'll share it, and the latest is titled: "Bitcoin Beach: What Happened When an El Salvador Surf Town Went Full Crypto".

- Everytime there's a new good explainer on how another DeFi project suffered a rug pull we'll share it, and the latest is about Iron Titanium token's 100% crash, which Mark Cuban recently talked about in a yield farming post we shared.

Tweet tip: the famous future you're learning about.

Meme moment: the famous cry for regulation.

The Desi Crypto Show: learn more about Near Protocol.

New news: USDC now available on our app.

Get started: download the B21 Crypto app!