It's a Powellful day

Cryptic ball: it could be nothing.

Right after yesterday's newsletter was sent, bitcoin broke out of the pennant we described. However, despite the high volume move, bulls fell short of gas around $41k and the orange coin felt back into this choppy range we've been in. Note that $41k is where the 200-day moving average is currently sitting, and that's a level which is typically shorted when an asset is below it and tries to break out.

So far, it would be good to see a lower high around $37k h, as detailed in today's chart. For that to be confirmed, we need the bullish uptrend to resume, i.e. for bitcoin to conquer $42k. Conversely, if bears push its price below the previous lower high, i.e. under $35k, then this short-term market structure is broken. What can we expect there? Well, given this is summer you can always expect more sideways chop. Just note the worse scenario would be for bears to take advantage of fresh FUD and aggressively push bitcoin straight to a fourth test of $30k, which wouldn't likely bode well for those who are long.

Fortunately, that's farfetched! But the US Fed is meeting today and will release its policy statement at 2pm Washington time, i.e. in half hour. This means that if equity markets become agitated, you can surely bet that crypto will be affected too. The expectation is that no major announcement will take place, but watch out!

Chart art: it could invalidate this bullish trend.

Market musings: it could make these managers bet more.

As explained yesterday, the whales are still bullish. While all the Microstrategy news make it very attractive for bears to bet against Michael Saylor's greedy all-in, it would take a lot of money to counter the tide of good news we're seeing. Still, if that happens it's more likely later in the year, once the crypto epidemic spreads to proper bubble-territory levels and Microstrategy's CEO isn't the only greedy one.

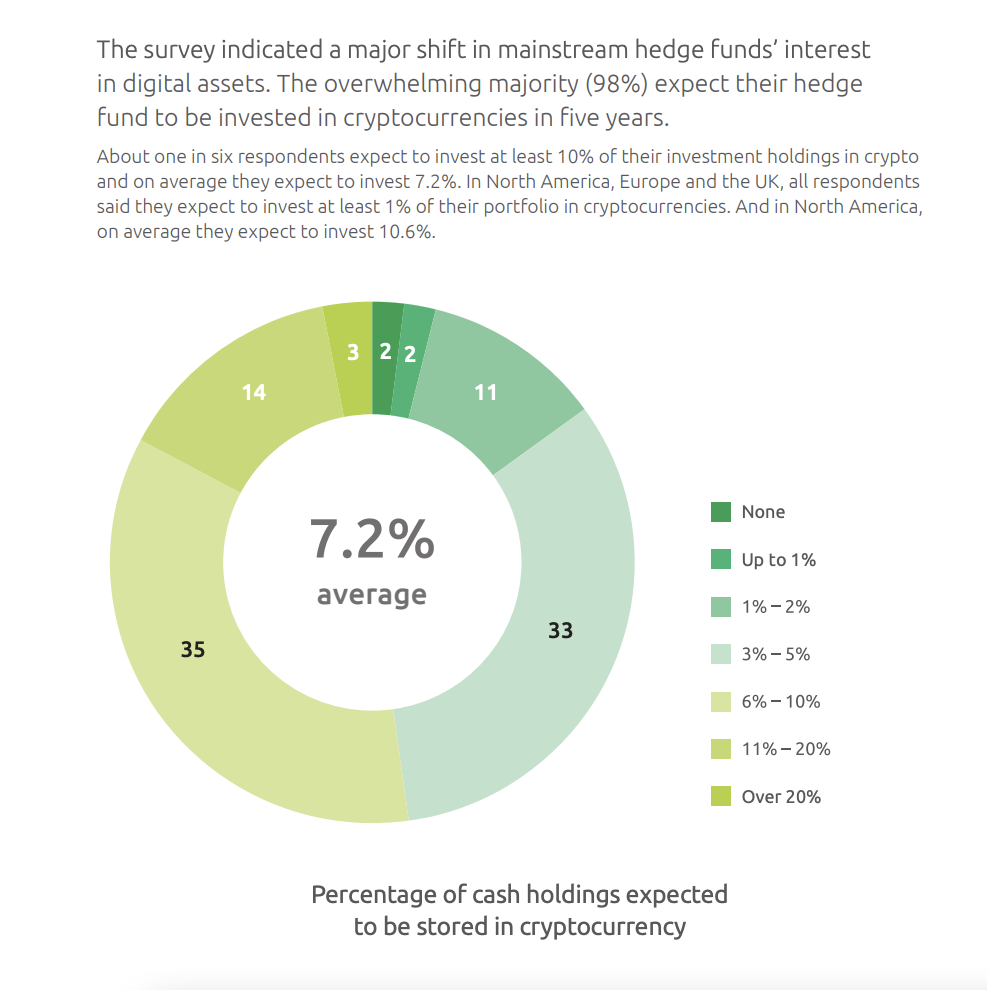

After all, even the Financial Times is reporting a survey done to 100 global hedge fund managers. The results indicate that all executives in North America and Europe plan to have at least 1% of their portfolios in crypto within 5 years. This is for diversification purposes, as bitcoin is deemed to have a negative correlation to traditional asset classes over high time-frames. More interestingly, it seems that, on average, these managers want to allocate 7.2% of their portfolios to crypto.

And if you consider North America only, that number rises to 10.6%! If you recall a report by PwC we shared here on May 24th, their sample of hedge fund managers indicated they have on average 3% invested in digital assets. With 86% saying they want to buy more later in the year - likely after they have enjoyed their summer!

Visual block: it could amount to $312 billion in inflows.

Three things: it could remind you about that inflation article.

- Want to know more about why some people crave, and even need volatile bearer assets like gold and bitcoin? Lyn Alden's great long read explains it.

- Want to know if it's better to enjoy a summer of DeFi farming or instead just hold on to your ether? Glassnode Insight's latest analysis focused on that.

- Want to know the big difference between a digital dollar and a CBDC, aka Central Bank Digital Currency? Bloomberg's Joe Weisenthal has you covered.

Tweet tip: it could be manipulation that benefits you.

Meme moment: it could be degenerate.

The Desi Crypto Show: learn more about Near Protocol.

New news: USDC now available on our app.

Get started: download the B21 Crypto app!