For He's a Jolly Good Saylor

Cryptic ball: can't control the wind, but can adjust the sail.

As hinted, this has been a stable day in the crypto markets. And that's good. As the more we remain around $40, the more chances we have of climbing higher, as traders are interpreting this move as a pennant - as you can see in today's chart. This pattern suggests consolidation after a high-volume breakout, which is typically followed by another breakout. Moreover, a solid close above $42k makes us feel the chop is behind us and bulls are back! After all, even the director of Global Macro at Fidelity, a trillion-dollar asset manager, believes the bottom is in!

Why? On the one hand, and as always remarked since we started warning about the euphoria in the market, it wasn't likely that May's crash was the end of the bull market - unless an unexpected event would happen, like an exchange going bust. Secondly, fundamentals continue getting stronger! Take the most recent news that Goldman Sachs will start trading ether for its clients. Or that Microstrategy, after raising another $500 million to buy bitcoin, has just announced another $1 billion to buy more BTC! As the trader Hsaka says, "the man is redefining going all in".

Chart art: "we each have our oceans and seas"

Market musings: "a ship in the harbour is safe".

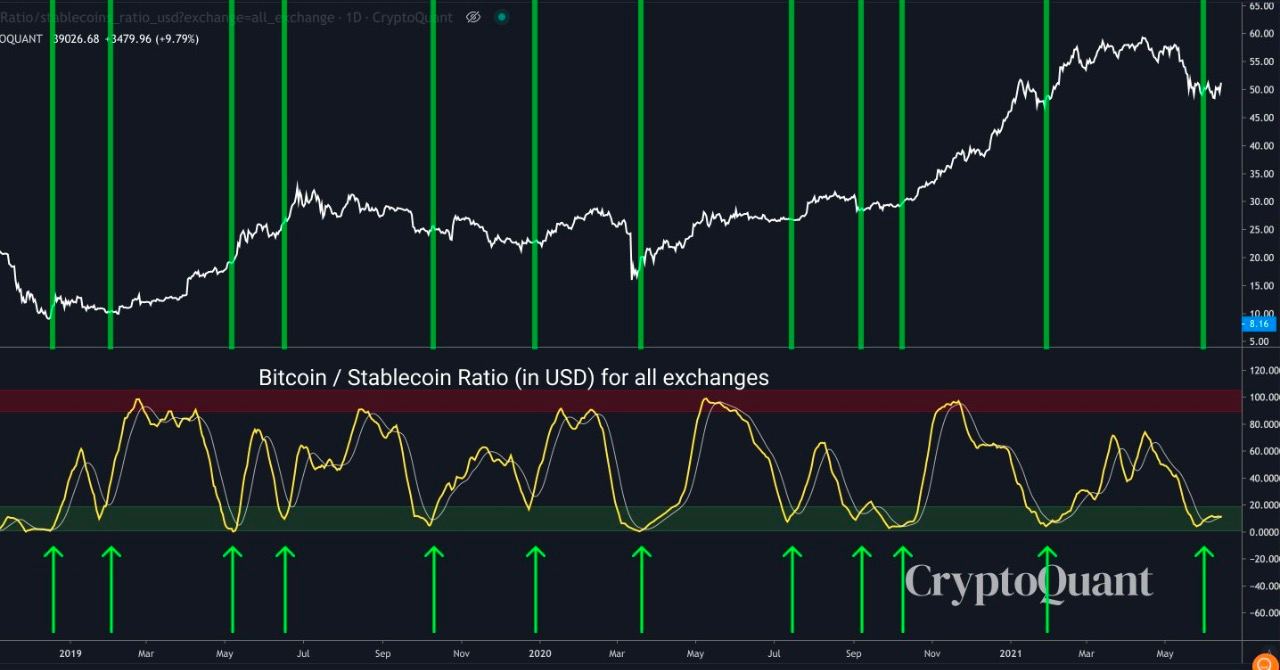

There's an additional on-chain indicator that's worth looking for hope. The stablecoin ratio compares the market cap of bitcoin to the market cap of all stablecoins held at exchanges. An increase in this ratio indicates cryptoasset exchange users are holding more BTC than stablecoins - which represent fiat currency used to escape the volatility and to take profits.

Conversely, a decrease in this ratio typically indicates selling pressure, as the value of stablecoins - the denominator in the formula - is rising compared to bitcoin's. And what happens when the ratio bottoms? Selling pressure is likely exhausted, which allows for bulls to regain control. As you can see in the chart below, that has been the case for the past two years! So, as we've now reached again that critical support level, remember ships weren't built to stay in the harbour.

Visual block: do you yearn for the vast and endless sea?

Three things: the optimist expects the wind to change.

- A recent article claimed "DeFi may be illegal". But Arca's Peter Hans argues this is nonsense and DeFi's regulatory risks are overblown.

- Still don't know what DeFi is all about? Check John Street Capital's long take on how fintech and DeFi can change the financial markets infrastructure

- Okay, you know what DeFi is, but yield farming and liquidity providing are out of your depth? Check Mark Cuban's brief post explaining them!

Tweet tip: "to succeed at sea we must keep things simple".

Meme moment: "the sea finds out everything you did wrong".

The Desi Crypto Show: learn more about Near Protocol.

New news: USDC now available on our app.

Get started: download the B21 Crypto app!