Web2 vs. Web3

Cryptic ball: oh, the dead cat.

The S&P 500 and the Nasdaq halted their pump, experiencing a normal 1.5% to 2% decline. But the average cryptoassets fell 8% over the past day. Again, this is not the kind of decoupling we need. What happened and what can we expect after?

- Equities suffered after US economic data suggested a hot labour market and strong manufacturing activity - which hints that inflation is still not under control. Nothing new there, but it clearly spooked enough traders.

- Moreover, JP Morgan's CEO, Jamie Dimon, has been voicing concerns about the economic hurricane in front of us. Again, my take is that the Fed will respond to such a concern - not from Jamie Dimon, of course, but the general fear of a recession - after summer ends and the middle class starts suffering.

- Curiously, JP Morgan's top strategist has been advocating buying the dip and believes markets will recover by the end of the year. I agree with that last part, as long as you remember there's no need to buy the dip - at least yet.

- Back to crypto, watch out bitcoin as it has lost its $30k support this Wednesday and it's back in that range I charted last week. In other words, the relief bounce may have failed - at least I don't have much confidence in the bulls right now.

Lastly, outside the market we've seen something very funny today. As news that crypto organisations are funding lobbying efforts in the US (and Europe and India), the incumbents, which feel threatened by our industry's call for fair regulation, have launched the silliest attack. I'll let you read it for yourself.

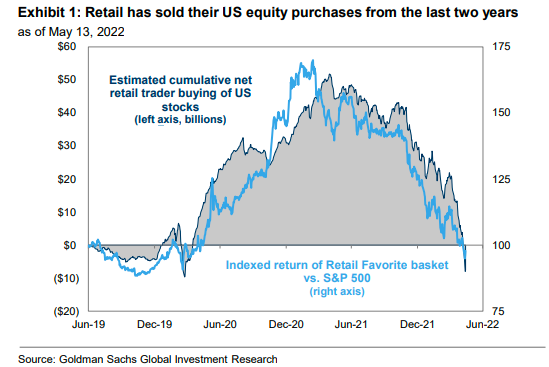

Chart art: oh, the paper hands.

Three things: oh, the rare Fat Pepe.

- Arthur Hayes is back and believes the bottom is in. I'm not sure about that but I agree with the rest. Be patient, survive the chop, and "just shut it down"!

- Chris Bummer and Rodrigo Seira wrote a whitepaper on "Legal Wrappers and DAOs", albeit mostly from a US-centric perspective. Still interesting.

- Bienvenido Rodriguez distilled the "Hitchhiker's Guide to Ethereum".

Tweet tip: oh, the irony.

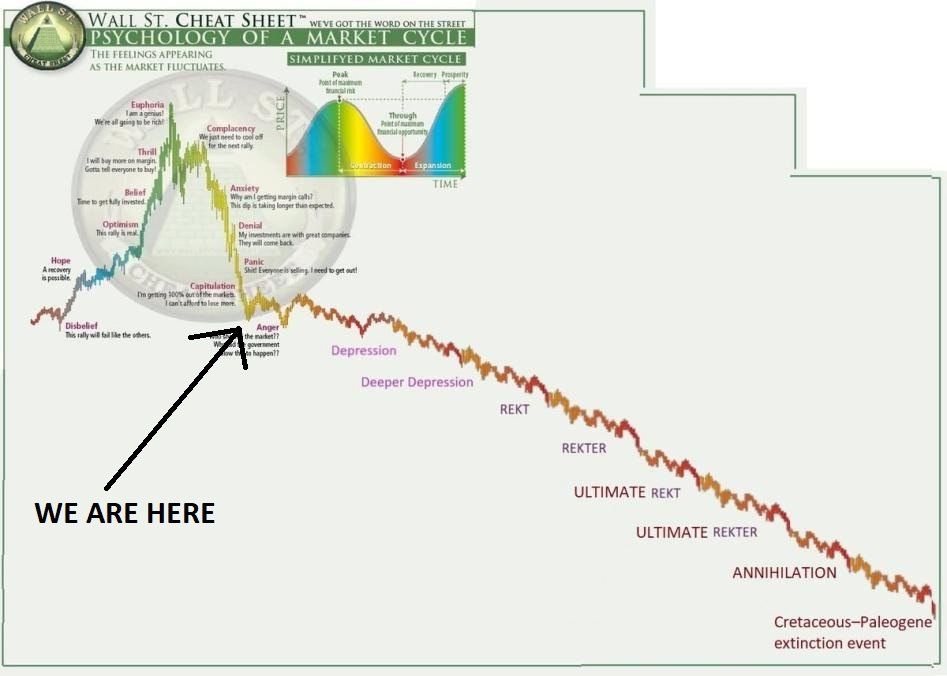

Meme moment: oh, the extreme fear.

FV Bank: let's talk a bit.

Get started: download the B21 Crypto app!