They sold in May. Will they go away?

Cryptic ball: not the month we expected.

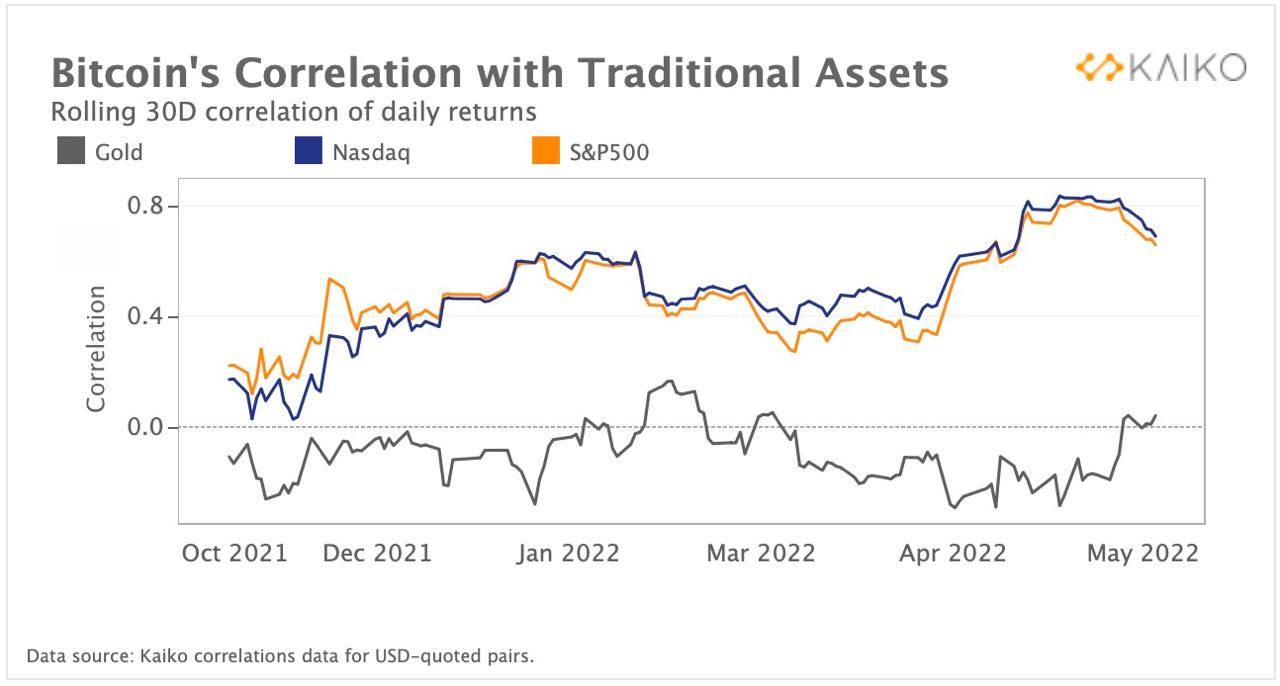

And the month of May has closed in all global markets. The S&P managed to end May at the same level where it started, after falling slightly today. However, both the Nasdaq and most cryptoassets experienced another red month. What's next?

- Inflation fears in Europe are rising, but it seems the old continent is just late to the party. Still, top US Fed officials met Joe Biden this Tuesday to discuss the fight against rising prices. News of such discussion will move markets soon.

- The more pessimistic Fed members want to keep hiking interest rates by 0.5% for "several" Federal Open Markets Committee meetings until inflation reaches 2%. Bears will attack if that view is echoed during June 15th's FOMC meeting, even if such hikes are expected in June and July with +95% probability.

- Moreover, we must be reminded that it will also be this June that the Fed will start tightening, or tapering, its balance sheet. This will further reduce liquidity from the market and I'm not sure its ripple effects are fully priced in.

- This has a positive effect though. As higher interest rates start hurting families due to the increase in mortgage costs, the Fed will face political pressure to ease the hikes and just focus on its quantitative tightening program.

While it's unclear the effect of such a move, I believe it's aligned with my updated outlook for the rest of the year. The summer will remain mostly stagnant in terms of prices, with a possible slow bleed in case this dead cat bounce is faded quickly. But by Q3 we should begin to experience some real relief and also have more clarity on what 2024 could bring to this highly chaotic world. Until then, BUIDL!

Chart art: not the decoupling we wanted.

Three things: the alpha we needed.

- Ben Lilly explains why the Fear and Greed Index has some of the "best risk-adjusted returns in crypto, making it one of the easiest trade strategies to add to your arsenal". An absolute must!

- Shivsak explains "where are DeFi's high yields coming from".

- Cold Blooded Shiller explains how to deal "with the emotion of a very strong rally in negative market conditions". As I said, no rush!

Tweet tip: the kling for king.

Meme moment: not the emotion you need.

FV Bank: let's talk a bit.

Get started: download the B21 Crypto app!