The Surge

Cryptic ball: surge, verge, purge.

As anticipated over the weekend, crypto is experiencing a small dip, with BTC and ETH both losing roughly 8% since Friday. Ether still attempted a pump last night, but it clearly failed, as the current market uncertainty doesn't favour the bulls.

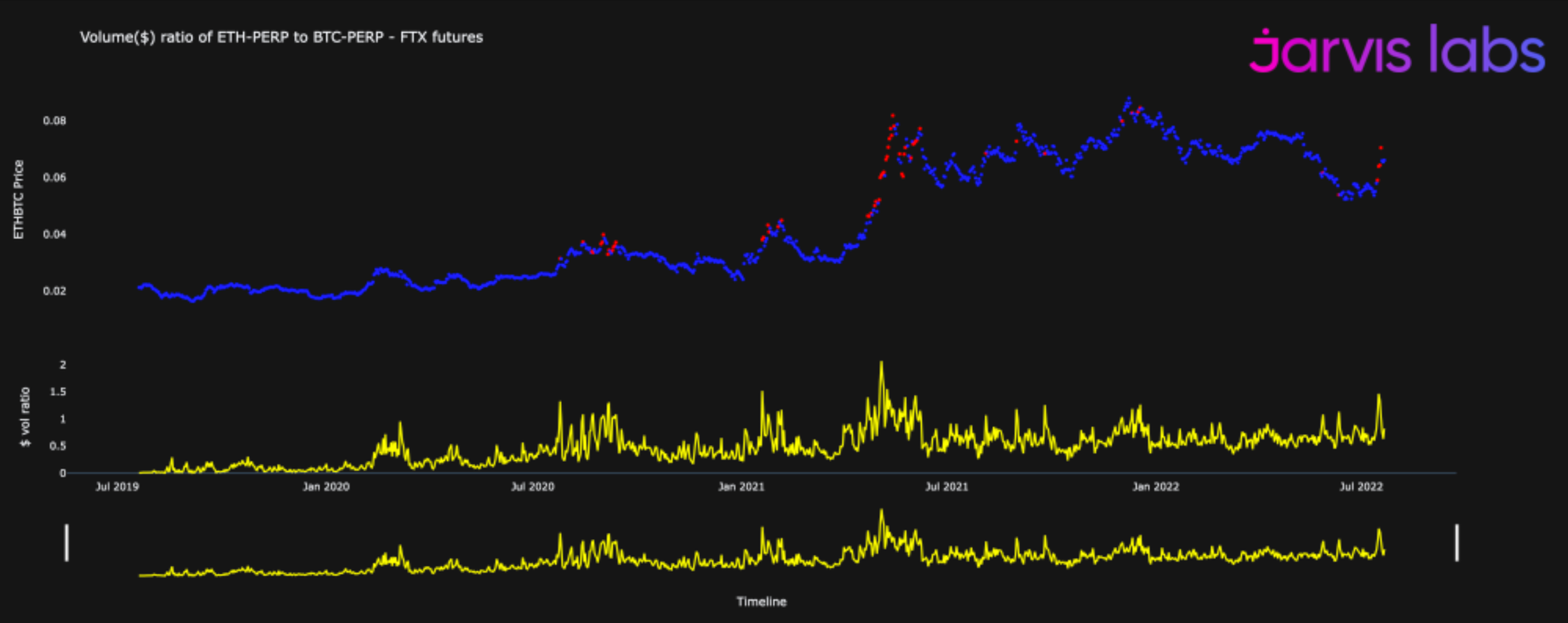

- What's more is the curious fact that ether volumes have been leading, a rare occurrence. As you can see in today's chart, the Jarvis Labs crew has been analysing the Merge pump and isn't optimistic on how sustainable it is.

- To be fair, this analysis doesn't come from Ben, someone whose posts I keep sharing and agree with, but from an intern. I don't agree with his conclusion, but it's important to be confronted with conflicting views to check our bias.

- Well, in this case, the Jarvis Janitor highlights that when ETH volumes overcome bitcoin's we typically see an exhausted trend for ETH. He goes further, though, suggesting this sometimes also coincides with a BTC dump.

- Overall, it's fair to say the ETH pump needs to rest after gaining 50% in one week, especially with the FOMC meeting this Wednesday, as explained last week. I even said we were going to move sideways with some dips on the cards.

- But I'm still confident that, if the Fed doesn't ruin the party on Wednesday's press conference, the rest of the summer will be rather peaceful, with some mild appreciation opportunities across the board. Let's hope I'm right!

- Lastly, note that equities are also likely to underperform this week, with major tech earnings scheduled. Maybe Alphabet, Apple and Microsoft can impress, but if not and stonks crash, watch out for BTC which must hold $21.8k!

In the meantime, I do agree we should stay calm as there's no need to FOMO yet. Naturally, and by definition, there's never the need to FOMO once a trend shifts, but we must remember that price action is only starting to get interesting now.

Chart art: and then splurge.

Three things: sweat, rekt, yet.

- Learn why Reid Hoffman, LinkedIn's founder, is experimenting with NFTs.

- Learn why Qiao Wang believes the "era of 4-year market cycles is over".

- Learn why Soulbound Tokens (SBTs) haven't taken off. Yet!

Tweet tip: and then bet more.

Meme moment: tick, tock, tick.

FV Bank: embedded finance trends.

Get started: download the B21 Crypto app!