Walfart

Cryptic ball: that or walmart.

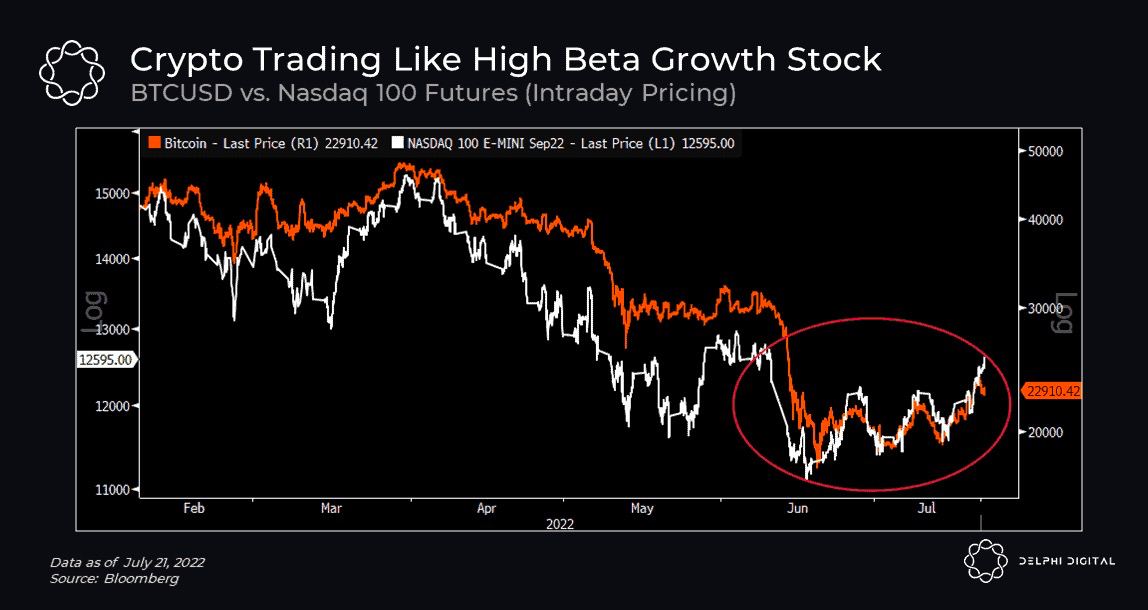

As bitcoin dipped back into June's range during this Tuesday's daily close and as this Wednesday's FOMC press conference approaches, traders are getting increasingly nervous. How should you prepare for the potential volatility ahead?

- To begin, note BTC is already 15% down in the past seven days, with ether falling 20% since Sunday's failed breakout. However, the interesting thing is that ether hasn't yet fallen to June's range, like BTC did.

- While this means ether has more space to fall in the event of adverse market conditions, it could also hint at how other cryptoassets can recover once, and if, traders feel more confident after Powell speaks this afternoon.

- At 18h UTC, 23h30 IST, the meeting statement will be released and the press conference will take place shortly after. By now, the market has priced out the chance of a very aggressive 100bps hike, so 75bps is the expectation.

- That's also an aggressive hike but everyone is counting on it, so the impact shouldn't be negative. Conversely, what can move the markets are any particular remarks from the Fed's chair while answering the press.

- Let's see how that goes and have in mind what the famous investor Mike Green says, shared in today's three things: that the Fed's hikes will wreck much needed investment while failing to stop inflation, hence the Fed should pivot.

As always, the question is when. And getting clues regarding that key answer is what I'll be looking for in the prepared statements and in the press conference. Until then, I'm expecting muted trading. After it, I'm not expecting a pump - yet!

Chart art: that or nasdaq.

Three things: that or no pivot.

- Mike Green explains why the Fed's hikes won't stop inflation.

- ChainLinkGod explains why DeFi should be called on-chain finance.

- Bill Ackman explains why Powell can't stop hiking interest rates.

Tweet tip: that or a pump.

Meme moment: that or a newborn.

FV Bank: embedded finance trends.

Get started: download the B21 Crypto app!