Let's take a Voyage

Cryptic ball: let's hope I'm wrong.

Finally a truly good day for crypto. As explained yesterday, it was very important for bulls to break out of the tight sideways range formed in mid-June, when bitcoin fell below $20k. Well. we're just now getting that test! Let's take a better look.

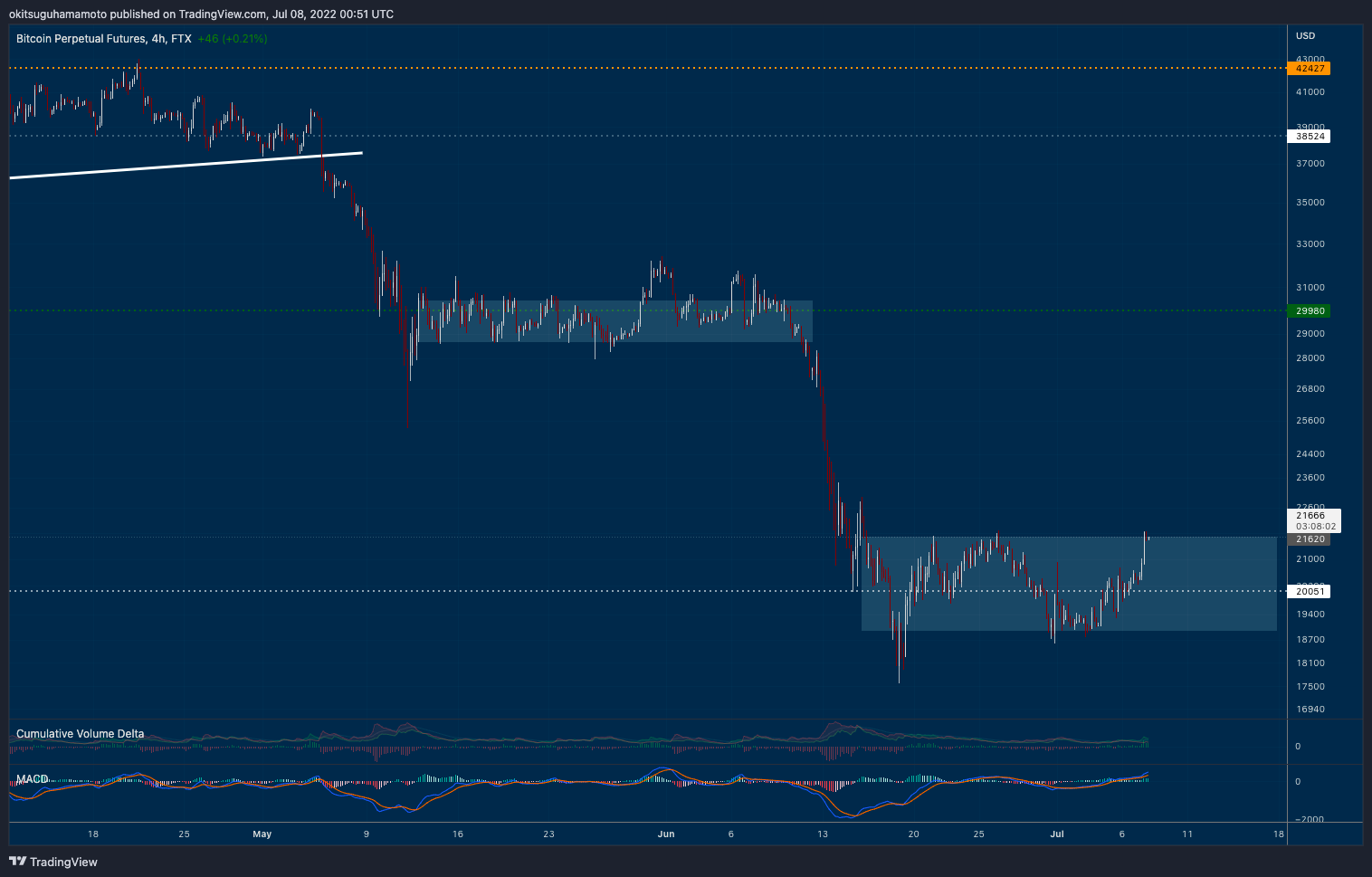

- As you can see in today's chart, which zooms in on yesterday's macro view, we can see this Thursday we had a very good attempt at breaking such a dreadful range - with BTC pumping some 7% more, for a nice 15% gain this week.

- However, this weekend we need to see some follow-up or else we're destined to test the lower end of the range again. And if you've been reading my newsletter for a while you'll surely remember how powerful this kind of range has been!

- What's simultaneously problematic and an interesting opportunity is that the S&P 500 has also risen every day this week - on par with this year's best winning streak for stonks. Another day in the green may make bulls cocky.

- Moreover, it's not just that extra confidence that warrants caution. It's a very high level of hedging currently expressed in the VIX, a volatility index for the stock market which tends to rise with fear, which reached a 2.5-year high!

While I'm optimistic that the week will close nicely in the green, we can't forget next week the speculation around the end of July's FOMC meeting will increase and that noise can wake up bears again before equities fully capitulate!

Chart art: let's hope bulls win.

Three things: let's hope Matti keeps posting.

- Matti wrote one of the funniest posts of the year: "getting the devs jacked".

- William M. Peaster wrote a great guide on "valuing NFT fundamentals".

- Sébastian Derivaux brilliantly analysed how to "build a useful financial system on top of DeFi to finance the real economy".

Tweet tip: let's hope alts can gho on.

Meme moment: let's hope we are.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!