Minutes minutiae

Cryptic ball: old news.

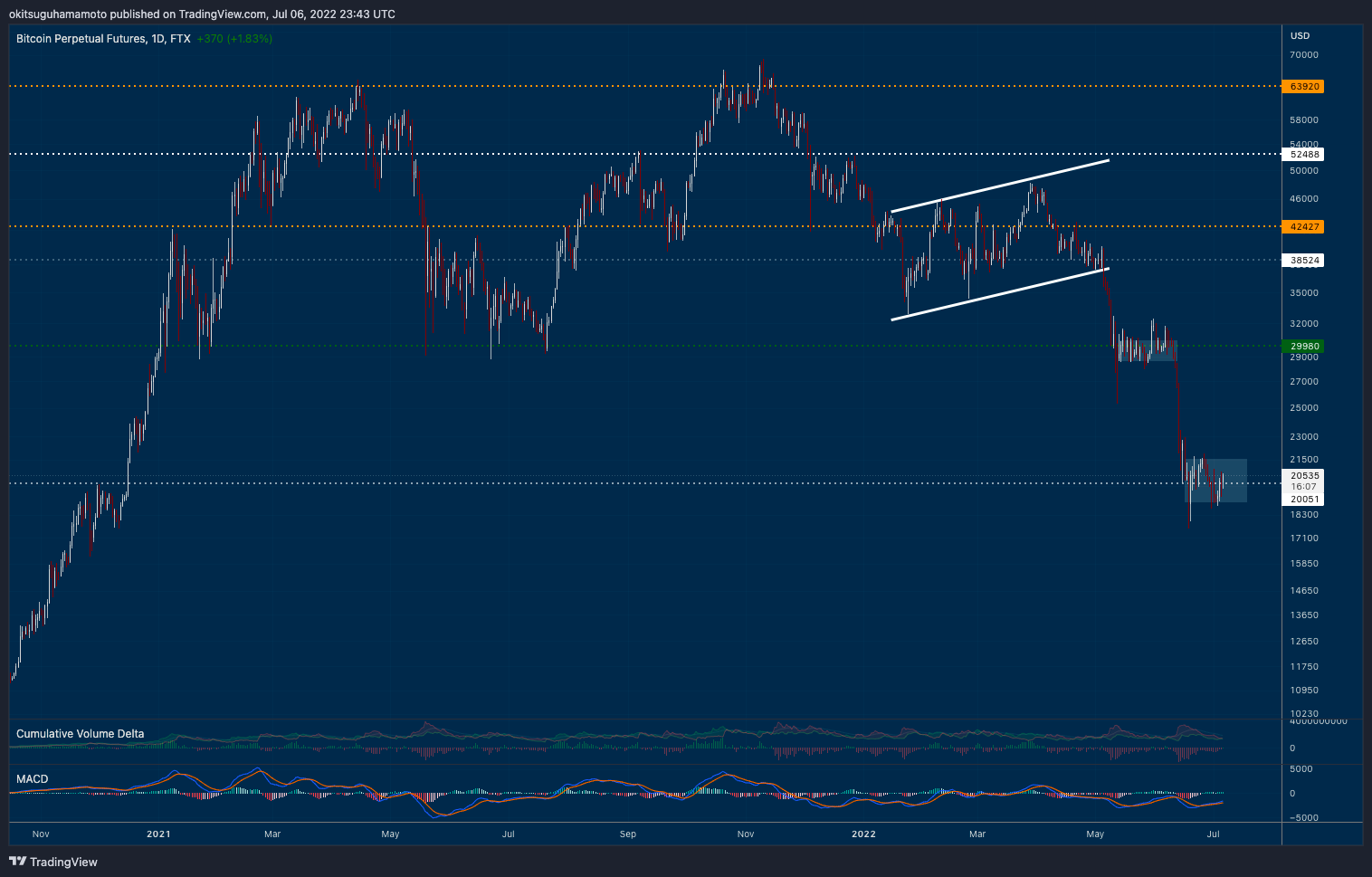

This was a rather boring day for cryptoassets, even if bitcoin and the average alt pumped some 3% since yesterday's newsletter was sent. Still, bulls haven't broken out of that $20.7k resistance, having just recovered lost ground. What's next?

- On the bright side, traders around the world didn't flinch at comments from the Fed claiming the central bank could be even more aggressive in fighting inflation, if need be. Translated, the market believes inflation is under control.

- More interestingly, today's Fed minutes (from last June's FOMC) also confirmed it's likely this July's interest rate hike will be of 0.75bps, instead of 0.5. The market also had this priced in as most tech stocks closed in the green.

- Now, while a sideways market in face of bad news is good, as it shows bears are out of ammo, we can't also forget bulls won't magically recover their strength. That will take time, so first we need to break out of one range at a time.

- In the meantime, we can't forget BTC is up 10% since this weekend's local bottom, while the average alt is up ~8.5%. This shows how there are still trading opportunities in such brutal tides. And also how corn is king.

Overall, the market has changed a lot since mid-June as the Fed's minutes mostly refer to an outdated picture. All that matters is how the future is priced in, so let's keep an eye on this July's FOMC meeting and press conference on July 28th!

Chart art: old lines.

Three things: old wars.

- The DeFi Surfer explains "why the 1% doesn't get crypto".

- Dennis Porto suggests "burning Bitcoin culture to the ground".

- Macro Manoppo explores how can tokens accrue more value than equity.

Tweet tip: old signs.

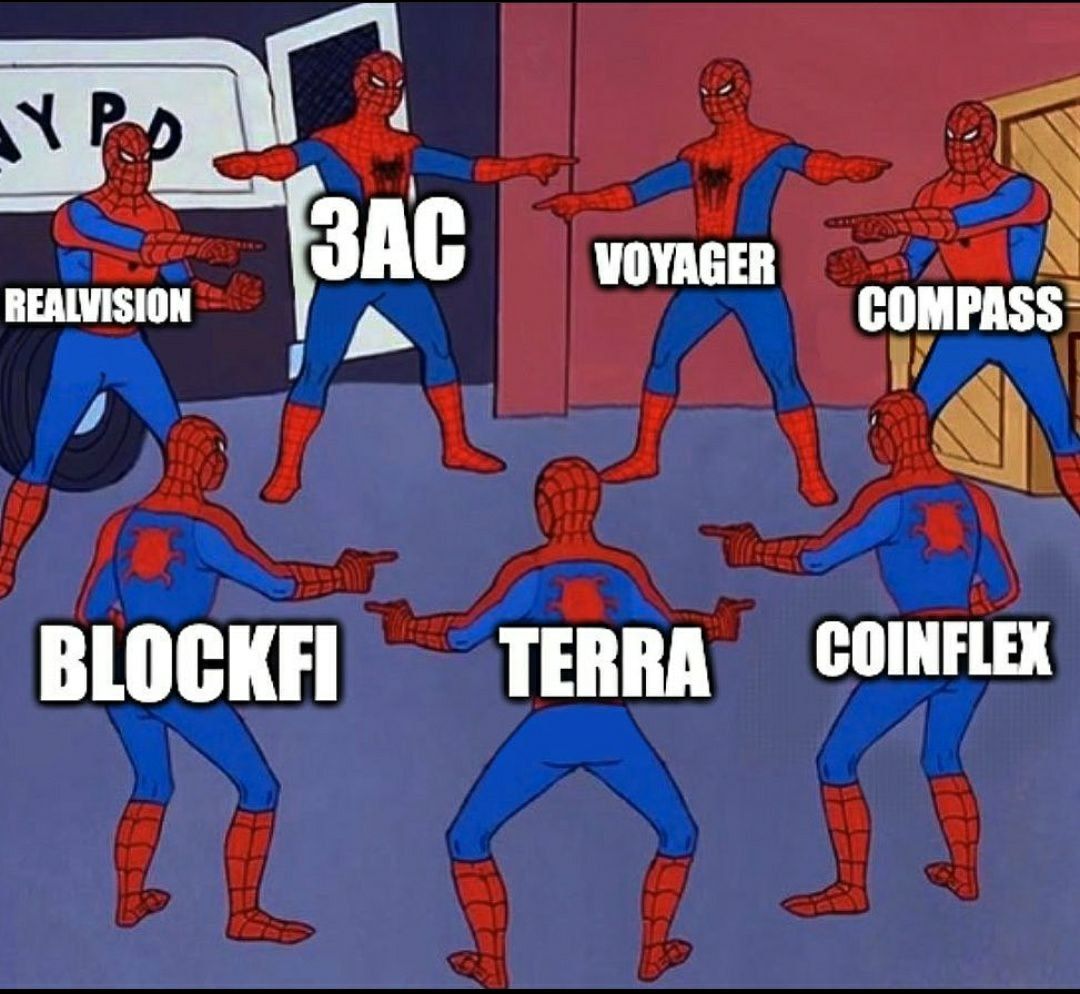

Meme moment: old nature.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!