A bull is born

Cryptic ball: even bears are relaxing.

Right after yesterday's newsletter was sent out, bulls tried to break $20k but failed. A second attempt some six hours later also met resistance, with bitcoin dumping nearly 6%, to $19.3k. Why was this and why are we back above $20k?

- The move followed US equity futures, which started falling in anticipation of this Tuesday's session. Then, the US market opened in the red but traders soon realised America's technical recession will actually hurt bears.

- Stocks formed a double bottom from June 29th's lows and the S&P 500 pumped +2% from that level, while the Nasdaq 100 rallied nearly 4% - in what become quite a volatile day for this traditional asset class.

- All-in-all, and as I've been writing since May, the highly anticipated technical recession of the US economy will force the Fed to reverse course and cut interest rates by 2023. This should provide extra liquidity to speculators.

- Moreover, recession fears are finally crushing the price of oil and energy prices, as this commodity typically sees its price falling down to "roughly the marginal cost" in times of economic hardship. That should also help lower inflation.

Maybe the Fed's plan always considered this and the goal was just to crash asset prices as soon as possible to spook businesses and managers, thus creating a technical recession to lower surging energy prices. Or maybe not!

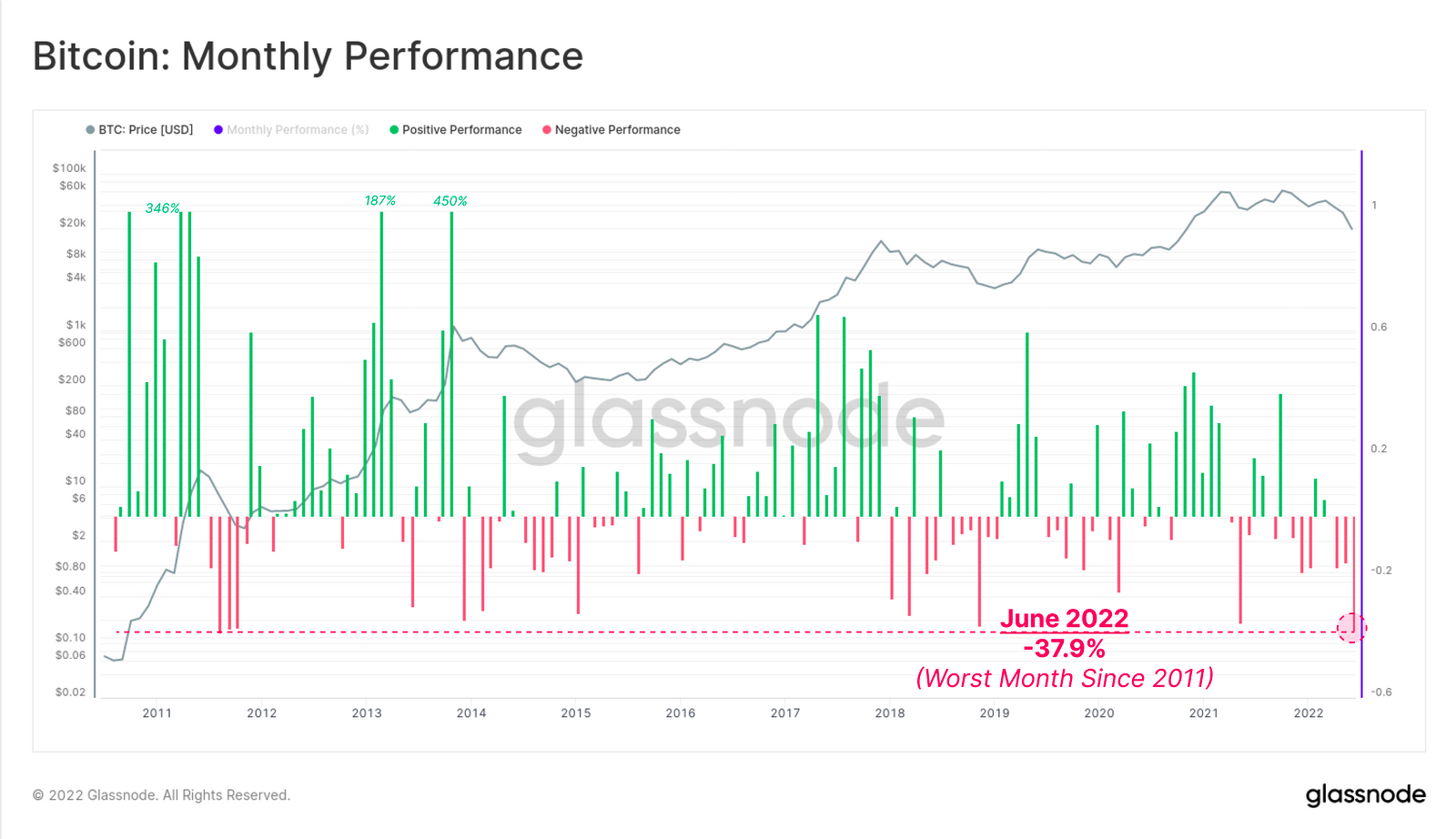

Chart art: even bulls know it can't get worse.

Three things: even top builders share their top ideas.

- Sam Sun explains how "crypto stealing hacks" take place.

- Qiao Wang explains +100 ideas for dApps and crypto infrastructure.

- ChainLinkGod explains how tokenising real-world assets will scale DeFi.

Tweet tip: even those who capitulated know the drill.

Meme moment: even those who lost it know they won.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!