Do not sell sun in July

Cryptic ball: halfway bear.

Last night, bitcoin reached a low unseen since the June 18th crash, touching $18.6k. But it managed to close the day above $20k, even if it's now trading below that key level. What happened and what can we expect for the weekend?

- As explained this week, the monthly and quarterly close periods are associated with heightened volatility. So it was relatively normal to see that, yesterday at 11pm UTC, bulls pumped bitcoin 12% in just a couple of hours, to $20.9k.

- Unfortunately, that move didn't last and was faded almost entirely. 12 hours later, the original cryptoasset was back below $19k and has been mostly trading sideways since - with ether and most alts mimicking this behaviour.

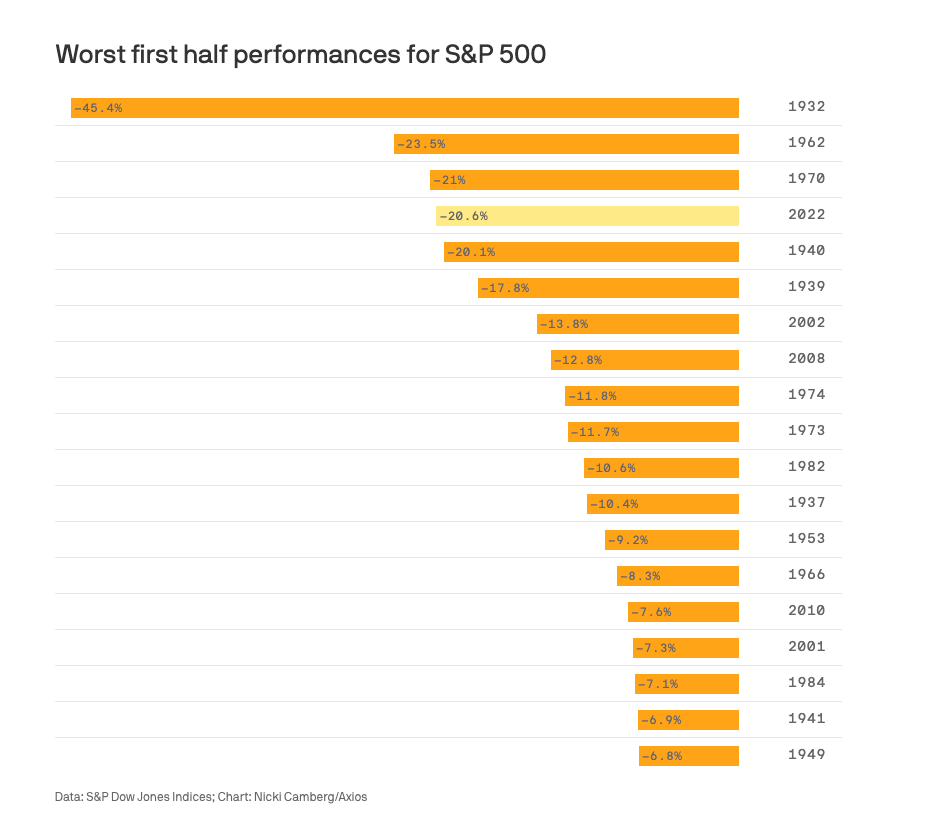

- In the world of equities, we didn't see as much volatility, and the S&P 500 futures fared relatively better than crypto - staying away from its June lows of 3,600 points. In today's US session, most stonks even closed in the green!

- However, remember what I said yesterday - the trend remains clearly negative. Michael Burry, of The Big Short fame, even suggests we're "halfway there", regarding a market bottom - both for equities and cryptoassets.

- But this permabear can't be taken for a guru. I even posit, from his deleted tweets in 2021, that he didn't nail the top and so has an interest in ensuring the fallout is deeper in order to make a decent profit from his short positions!

- Moreover, the Fed will surely need to reverse course as at least America is now officialy in a recession, with the latest Atlanta Fed estimate indicating a negative quarterly change in the economy of the USA of -2%. That's shocking!

Still, all that is medium-term talk. For now I believe the weekend will be smooth as the market barely reacted to news that Voyager, a crypto lender, suspended activities. Just watch BTC as if it falls below $19k things can get scary again.

Chart art: halfway halfway.

Three things: halfway decentralised.

- Arthur Hayes released his latest epic essay about the collapse of 3AC.

- Marc Andreesens shared his thoughts on the future of tech investing.

- Kaleo explains why bear market sentiment fuels extreme perspectives.

Tweet tip: halfway rekt.

Meme moment: halfway arr.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!