2022, part 2

Cryptic ball: I'll have those gray law suits.

Today is the end of the Q2 and of the 1H of 2022. Will the rest of the movie be as scary as this half? My view remains mostly the same. Midterm elections in the US could bring some respite - but only in Q4, not in Q3 as originally anticipated. Why?

- In brief, stocks keep dumping as bitcoin and alts remain correlated to equities. While some may attribute today's dip to $19k to the SEC's rejection of the Grayscale ETF application, that was expected and not material to the price.

- So, as often explained, it wasn't clear the bottom was in but now I'm very positive that the $20k bounce was only a dead cat. Bitcoin is due to test $17.7k very soon and after that only $12k to $13k can clearly provide some support.

- I'm not saying I believe we'll reach $12k soon. Bears are also afraid and no one is shorting heavily, so prices may take a long time to fall to those levels, and may even hopefully revert earlier - in case the macro situation changes.

- Lastly, the only scenario in which we can get some summer respite is that what we're seeing today is just that end of the month, quarter, and half-year volatility caused by major funds rebalancing their portfolios and by redemptions.

- However, remember that the unwind of Terra, 3AC, and all the other players is still going on. After all, it seems that Sam Bankman-Fried was looking to acquire Celsius but walked back after "seeing the state of its finances"!

Perhaps we can see inflows next week but it's unlikely investors will want to part ways with their hard-earned cash and gamble it in these rough waters. In any case, this has been bitcoin's worse quarter since 2011. So it shouldn't get much worse!

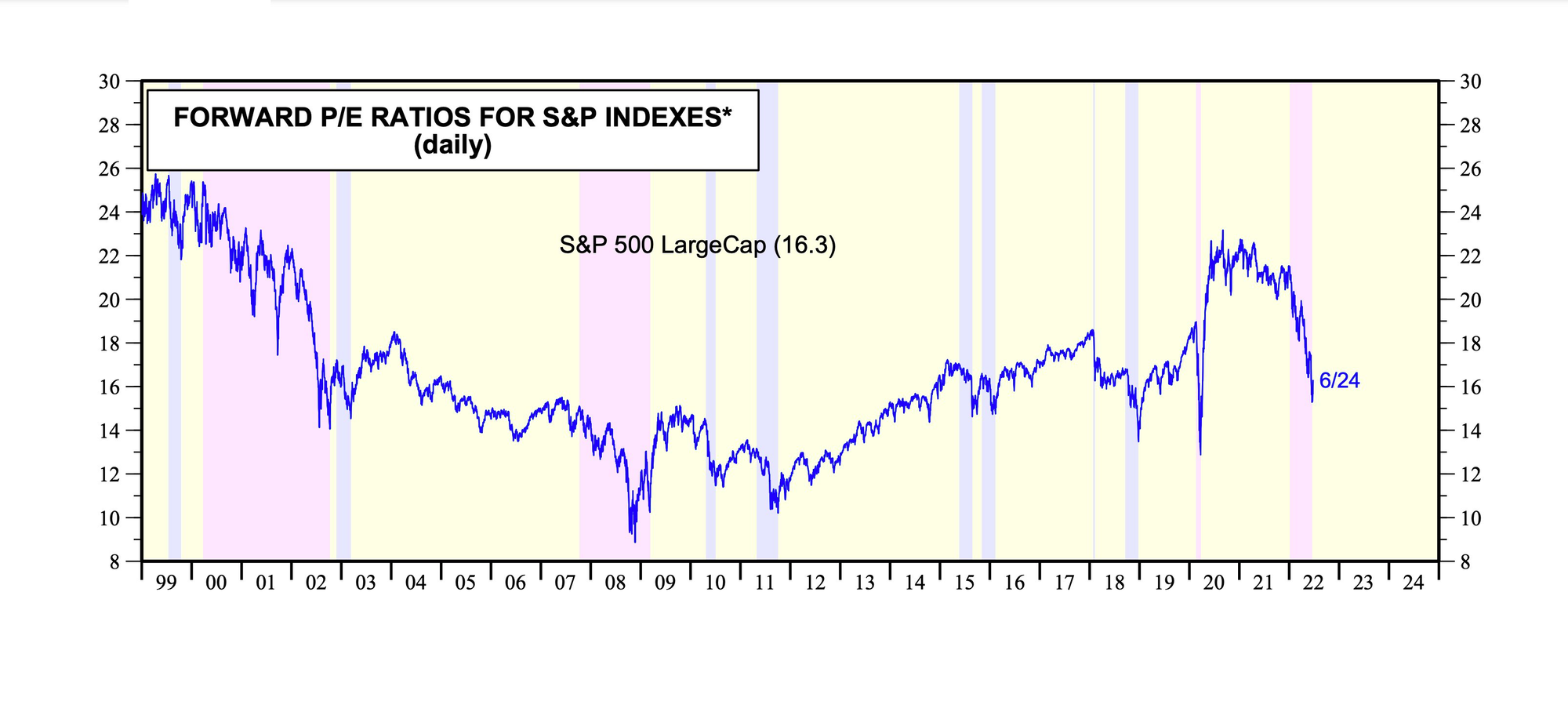

Chart art: I'll have those single digit PEs.

Three things: I'll have that decentralised github.

- Evan Conrad details "where are all the crypto use cases".

- Stu explains "how public key cryptography in Ethereum works".

- Simon Chamorro how growth in web3 works just like in web2.

Tweet tip: I'll have that 8th hit.

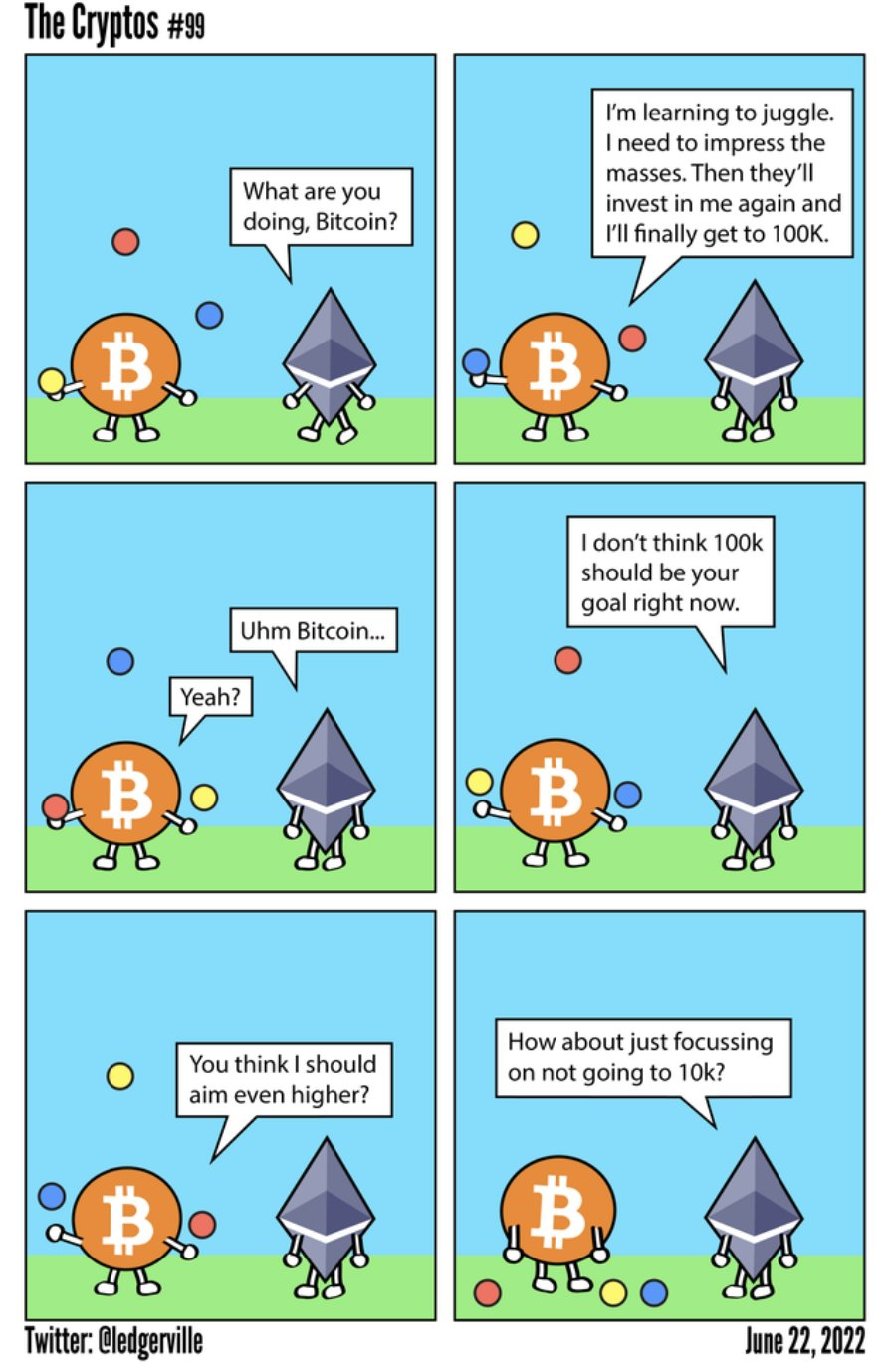

Meme moment: I'll have that goal.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!