ABC Delta

Cryptic ball: simple fears.

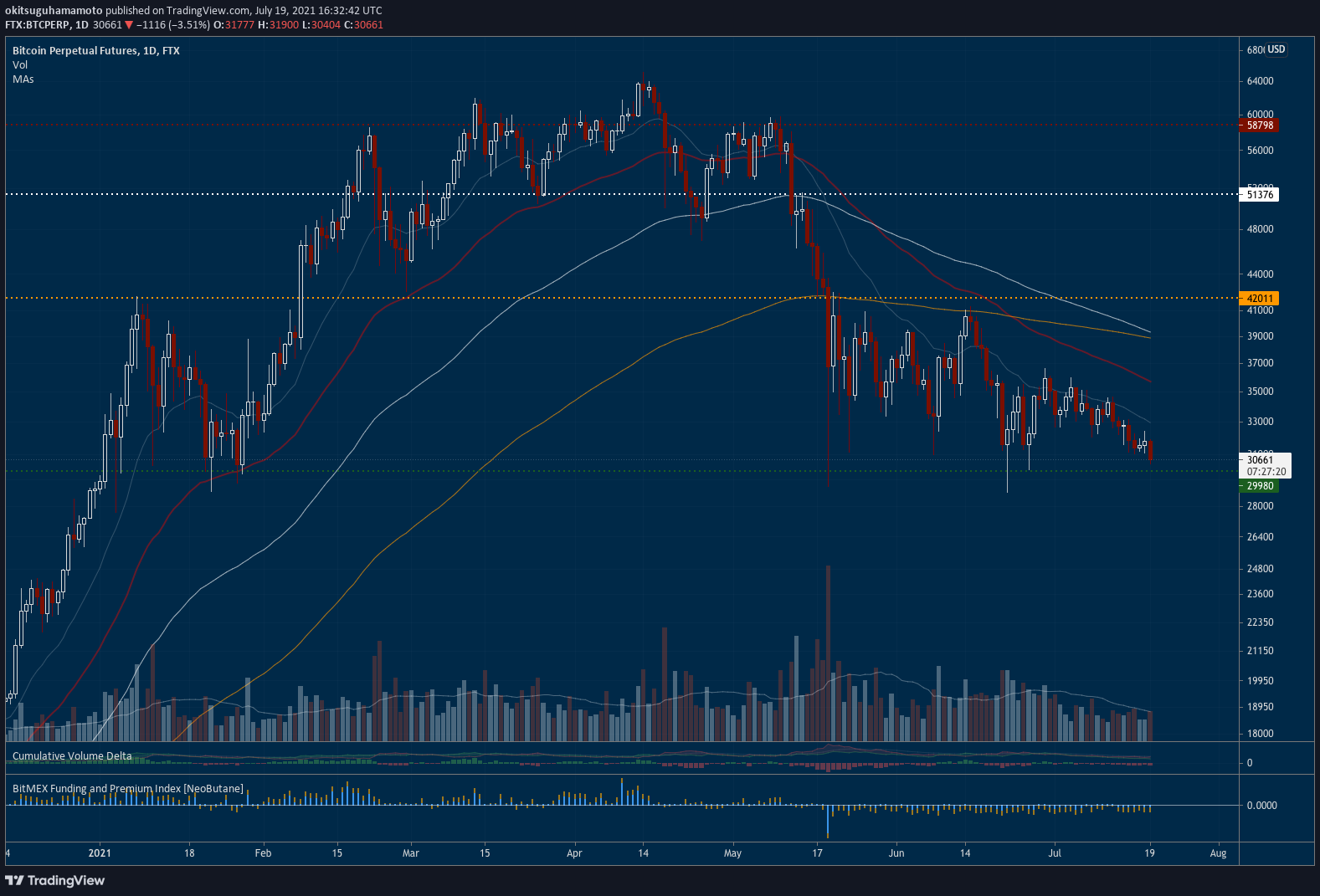

As anticipated on Friday, the slow bleed has continued, further inflicting pain in the crypto markets. To make bullish matters worse, bitcoin finally lost its $31k support early Monday morning, UTC time, albeit not by much. The volume on the small drop was considerable, at least in summer terms, but a strong bounce hasn't taken place yet. Naturally, analysts left and right resumed their calls for $20k.

Is that warranted? Maybe. On the one hand, crypto is still in the sideways range for the simple reason that traders tend to lose interest after a major crash, such as May's, takes place; especially when that is compounded by holiday time and the lifting up of COVID restrictions in most western countries. On the other hand, global stock markets have crashed today on fears the delta variant is here to stay.

Overall, we believe that such fears are good, as they will push central banks to delay tapering (i.e. slowing down their stimulus programs, in particular asset purchases which prop up many markets) and to remain committed to ensure a solid economic recovery. Once that is confirmed, global markets will surely soar again, contributing to a swift recovery in cryptoassets too. However, if such positive reaction doesn't come soon, then the overall sell-off will likely continue!

Chart art: simple charts.

Market musings: simple strategies.

In summary, time is of the essence. But consistently timing a market is always the most difficult thing for any investor or trader, if not even impossible. Hence the abundant advice on dollar-cost averaging and index fund investing. In any case, we remain positive that central banks will continue to prop up markets and this will be felt in the crypto world too, given the recent correlations between asset classes.

The question is when will what happen and what can the rest of July and August do to prices if such reaction takes its time. While we feel that a rapid drop to $20k is unlikely, as there's no leverage to drive it, it would be interesting to see a swipe around this year's opening level of $27k, as suggested by TraderXO. This would trap both bulls and bears and set the stage for the end of this consolidation phase.

We'll continue assessing the likelihood of such scenario. For now, be mindful that even the strongest alts will follow bitcoin and that many are showing critical signs of weakness. And note that the more time we spend without a volatile move the more likely it is we experience one. Let's just hope it's not next Wednesday, when Elon Musk and Jack Dorsey will be speaking together at "The B Word" conference!

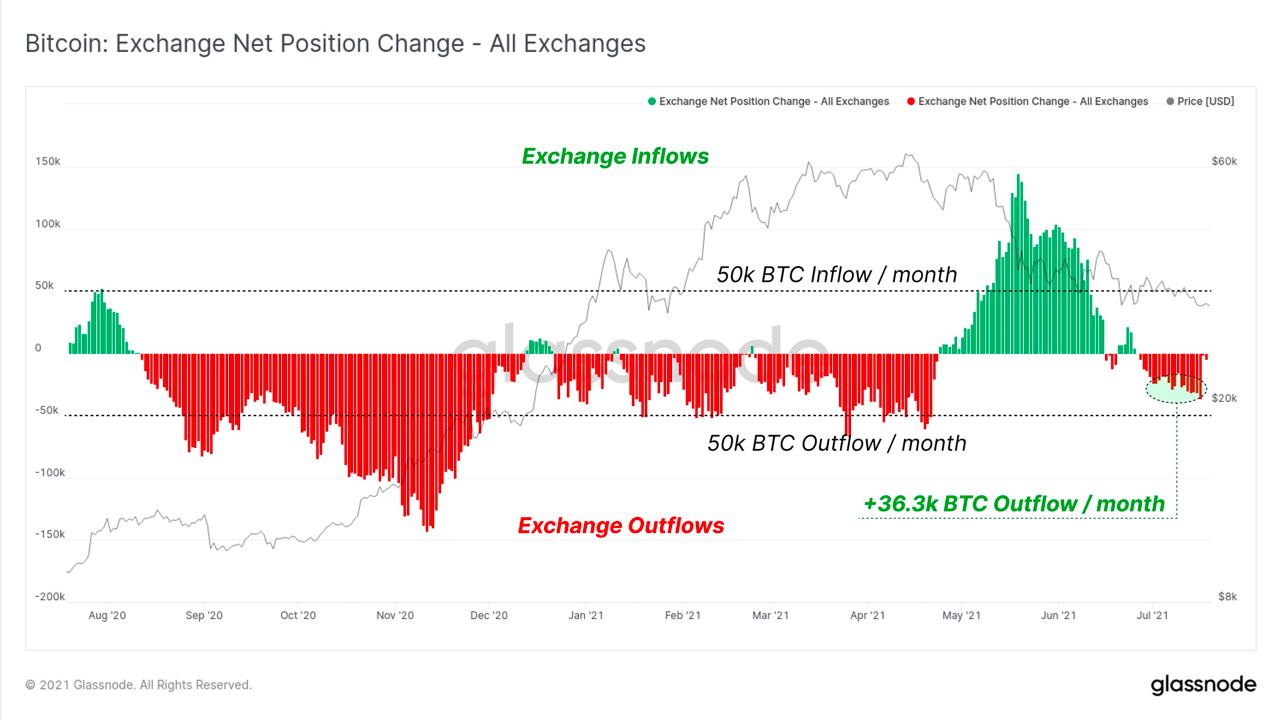

Visual block: simple flows.

Three things: simple challenges.

- Pete Humiston, from Kraken Intelligence, explains why inflation exists and how can you protect yourself from its effects in a great, visual thread.

- Gary Gorton, a Yale economist, released a paper titled “Taming Wildcat Stablecoins”, which argues private stablecoins shouldn't exist. Check it out!

- Arthur0x, a DeFi investor, shared his thoughts on the structure of crypto markets and "why it leads to extreme volatility throughout the market cycles".

Tweet tip: simple metrics.

Meme moment: simple patience.

New giveaway: win an exclusive SupDuck NFT!

Get started: download the B21 Crypto app!