Heads, shoulders, knees and toes

Cryptic ball: "truth is like poetry".

As anticipated, yesterday's bitcoin scenarios remain valid for the weekend as the original cryptoasset remains rangebound, freezing most of rest of the market: with only 10 of the top 100 coins appreciating more than 2% over the past 24 hours. What else can you expect over the next days? Well, surely more FUD. Alas, even the Cayman Islands regulator claims Binance isn't authorised to operate from the tax haven, following similar announcements from several other countries.

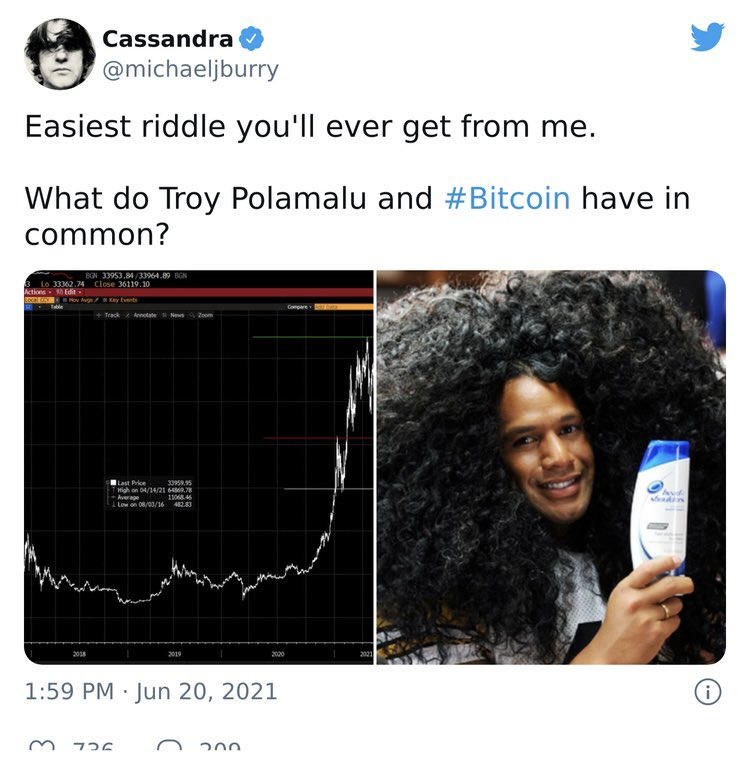

This may entice bears to renew selling pressure, and it will surely excite the likes of Michael Burry - the contrarian investor popularised in the Big Short movie - who is calling bitcoin (and meme stocks) a bubble akin to house in 2007 for a while. It started in March and has likely put serious money where his big mouth is since then, given that he remains tweeting (and then deleting) charts and memes regarding the heads and shoulder pattern that could trap bulls in the next dump.

Chart art: "and most people f*cking hate poetry"

Market musings: just a little shake, right?

Should you be worried? Well, that's a popular old-school pattern that even hedge fund investors commonly refer to, so it may be self-fulfilling. However, for the hopeful ones, note that Jurrien Timmer - the director of global macro at Fidelity, a financial mammoth which manages $10 trillion in assets - predicted June 23rd's dip one month ago. He argued there was a wider trend at play and that the H&S pattern would be resolved once $30k was tested again - which already happened.

Naturally, he is a converted long-term bull, so have that in mind. Still, in the land of the realists it's likely to consider that even if Michael Burry is right that cryptoassets and meme stocks will eventually produce the "mother of all crashes", such bear market will only begin once expectations of the end of the US Fed's role in pampering the economy become material (which could happen early next year). Meanwhile, BTC is still sideways and until that changes the plan is the same!

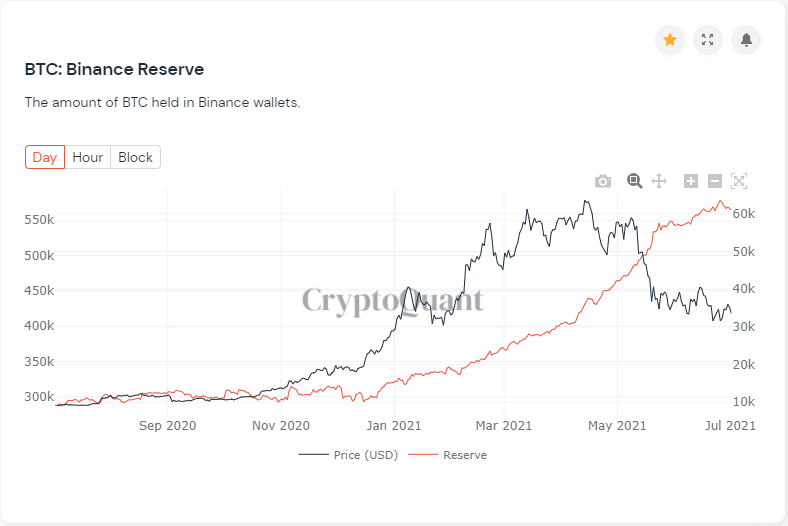

Visual block: keep following these reserves.

Three things: keep learning over the weekend.

- Curious about Decentralised Autonomous Organisations? Learn its ABCs with 1972's guide to how corporations can be automated with blockchain.

- Curious about how to take the weekend to learn more about DeFi and Web3? Messari's Ryan Selkis drafted a tough, but great two-day crash course for you!

- Curious about internet-native economies? Future, a new blog from the legendary a16z VC firm, just shared a must-read guide to the digital economy.

Tweet tip: what about India?

Meme moment: also this.

Spend your crypto profits: with B21's international card.

B21 Token: a low cap project with many use cases.

Get started: download the B21 Crypto app!