Now we can move on

Cryptic ball: reversion to the meme

As expected, the Fed's prepared statements and press conference did impact the markets in the buy the rumour, sell the news fashion. But, as hoped, that wasn't enough to ruin the party - at least for now. Total market cap pumped 5% in the hour before the announcement, but dumped up to 10% overnight. It has been steadily recovering since and I continue to bet BTC will test $40k before coming back down. Still, let's analyse the implication of the Fed's latest update.

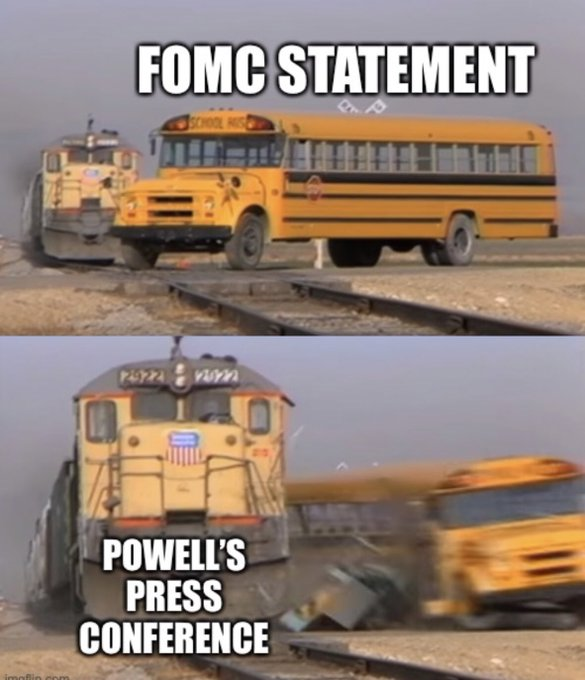

Overall, the Federal Open Market Committee's official message was slightly more dovish than anticipated, at least in its tone, given that no new action was taken. But Powell's Q&A failed to be so subtle. The Fed's chair clarified the US economy is strong, the job market is better than ever, and this allows monetary policy to tighten as much as needed to control inflation. Again, nothing new, but a sufficiently appealing position for bears to day trade on.

So, why do I think the bounce will continue - at least until BTC touches $40k? Well, Tesla's earnings were very good - even though that didn't help lift its stock. Apple's earnings look like they will also be. This goes to show that the tech sector - the one most affected by the current derisking - is healthy overall, even if there's some speculation going on (think Peloton). And that should remind investors, after all this volatility, that February is no month to panic.

Moreover, the market is pricing in more interest rate hikes than the Fed has conceded, showing how hedged investors are. In other words, there's not much to fall from here - even if bears want armageddon to come true. However, it's important to manage expectations. As Alex Krüger reminds us, we're likely forming a new range here and will trade within it for months to come - until the end of summer, I believe. If that's $28k to $42k, then some cryptoasset sectors may continue to thrive, but if we go lower then things can get nasty.

Chart art: mambo no 5.

Three things: all-time high to date.

- Ark Invest released its Big Ideas for 2022 report and half is about crypto.

- CMS Intern summarised Jerome Powell's press conference and UpOnly's Michael Saylor interview (part 2 here).

- Katalist summarised a Twitter Spaces conversation with Sam Trabucco about Trading & Defi.

Tweet tip: Telegram or Signal?

Meme moment: pow wow.

B21 App: start small, but start.

Get started: download the B21 Crypto app!