ChopOnly

Cryptic ball: when mean reversion?

The weekend is here and you must be wondering what to do. Bears are screaming so hard you can't even hear them, with negative sentiment as surveyed by AAII reaching its highest level since 2013. Time to buy or not? Well, total cryptoasset market cap is up nearly 5% since yesterday's short-lived dip and the S&P 500 is also on the rise, following Apple's record earnings - as anticipated yesterday. Overall, it should be an easy weekend, but we can't forget January is poised to be the worst month for stocks since March 2020. Do you recall what happened next?

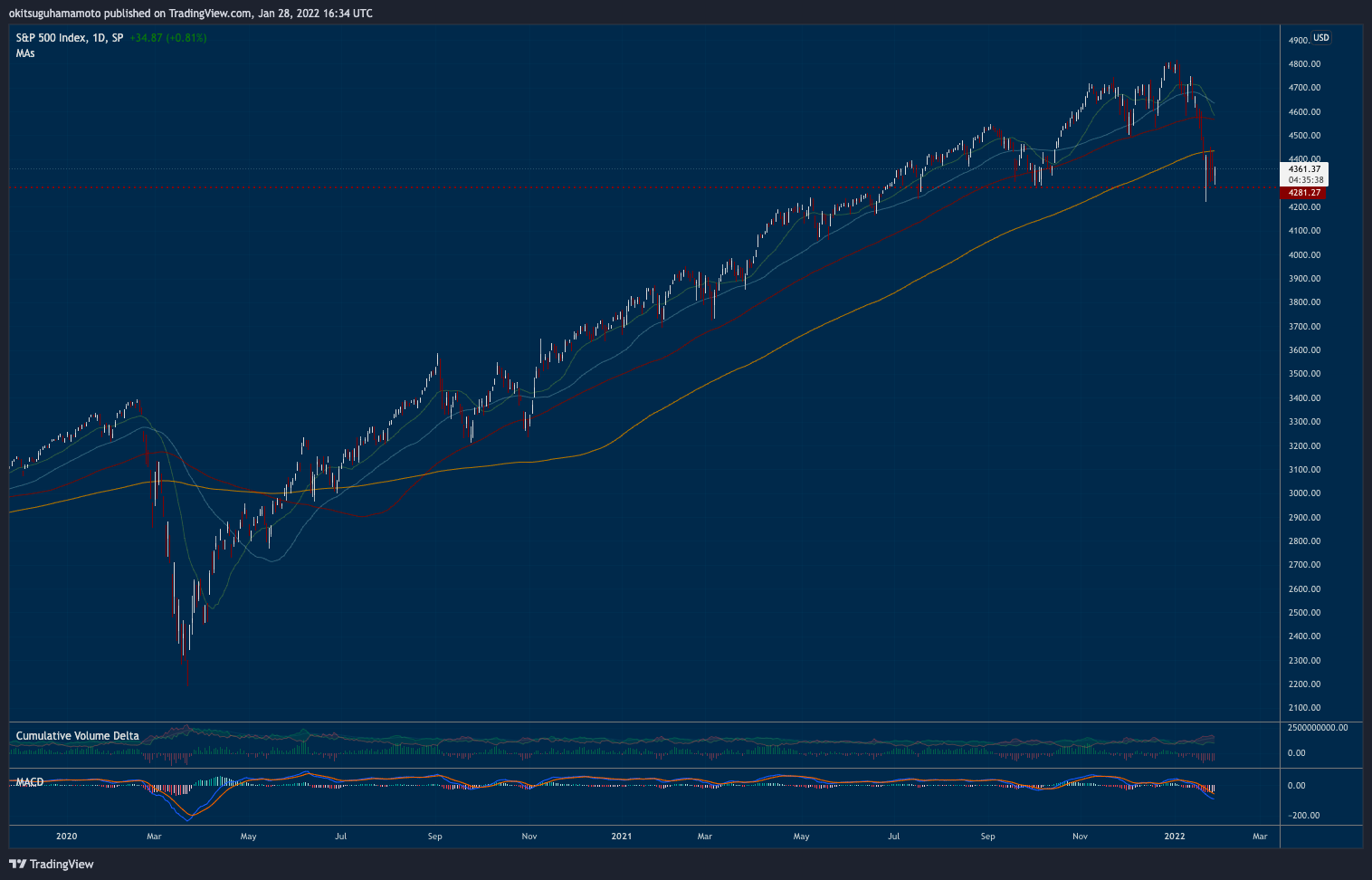

Well, it took the stock market months to recover from the initial pandemic scare, but by August 2020 the losses had been cleared and from November onward it was time to practically print a new all-time high every month - at least until December 2021. Why am I talking about this? Because even though there's more room to fall, as you can see in the chart art, it's also the case that markets tend to overreact to negative events, such as early January's threat from the US Fed, which announced it was considering tightening its balance sheet.

So, while it may be possible that we keep on crashing (no one can be sure), the level of froth filtered by this dip should warrant some peace - at least for some weeks and provided Monday's monthly close isn't chaotic. Meanwhile, remember we won't resume UpOnly mode soon. As written on January 6th, we'll likely go sideways until the end of summer, with a chance to resume the bull market when the threat of the midterms is resolved in some way. To put it simply, if the Democrats control inflation, the Fed can pump the markets; if they fail, Republicans will likely win and the Fed can also pump the markets.

And note this reference to a sideways range implies a lot of fluctuation over those months, with the initial boundaries currently established between $28k to $40k (apparently some Morgan Stanley's equity strategist also agrees with these levels, although I feel we'll see the latter sooner). All-in-all, there's no need to despair, as such a range is also aligned with the slow grind of March to October 2020, both in crypto and in the stock market. And I'm still expecting the end of the year to be good, even if due to speculation again (did you see Russia's latest rumours?).

But speculate is what we do so that's fine. Until then, it's time to enjoy the swings and try to nail them as best as we can, without forgetting an aggressive swing down can entice bears to push for one last puke to liquidate them all. Going back to the original question, this is only the time to buy if you know how to trade swings and can react quickly. Otherwise, it's better to phase your entries and place some bids around $30k. We won't likely touch it this weekend, but once BTC fails to break $40k - or if bad news breaks - we'll surely go down a bit more.

Chart art: when MA test?

Three things: when above fundamentals?

- Jurrien Timmer, Fidelity's Global Macro Director, believes bitcoin's price is below its fundamental value. When decoupling from stocks?

- Nansen, a blockchain analytics firm, released its report on the "State of The Crypto Industry Report". When open finance industry?

- Corey Hoffstein, Newfound Research's CIO, shared some things he "learned messing around in crypto for the last year". When more pearls?

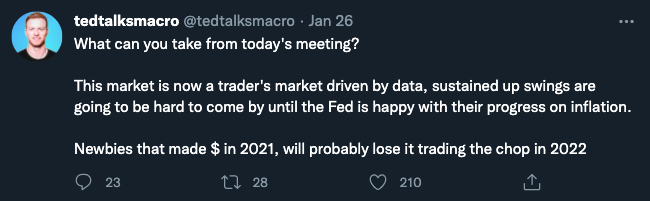

Tweet tip: when under control?

Meme moment: when party hard?

B21 App: when average in?

Get started: download the B21 Crypto app!