Desperation is no longer transitory

Cryptic ball: sell the rips.

As explained in the past days, we're continuing to see that relief rally in anticipation of not-so-bad news from the Fed and better corporate earnings during the week. Total market cap is reflecting that, appreciating 7% since yesterday morning and 15% since Monday's bottom, while some major alts are even gaining 10% to 15% over the past 24 hours and up to 40% more for the few lucky ones who didn't catch a falling knife. But are traders right in pricing in their optimism?

We'll soon know. The Fed's press conference takes place at 7pm UTC today and I'm still expecting the bounce to continue after that. Let's just hope the typical buy the rumour, sell the news dynamic doesn't ruin the party. In other words, I believe the Fed will indeed provide quite a neutral update today, but that's why we're bouncing, not why we should continue to bounce. Meanwhile, my crush Arthur Hayes has just released a new post that greatly zooms out on the macro situation.

Aptly titled "Bottomless", the former CEO of the BitMEX casino argues the current stock market crash, well predicted in his last essay, is still not enough to spook the Fed and force it to change policy. Yet. As suggested Monday, if BTC successfully tests $28k (or, failing that, at least survives the wick down to $20-ish k), we may have ground to get out of the woods. But until then, all bounces just show how bulls haven't capitulated yet and how the next wave of the dump will break.

It's also important to note how crypto has been leading the stock market's ebbs and flows, something which Arthur attributes to this market still being fairly independent of traditional finance's political manipulation. Yes, correlation is increasing, but the pureness of crypto acts as a canary in a coal mine - another thing for you to have in mind in the medium term. Anyway, to sum everything up, what should you look out for during the Fed's press conference?

The consensus is that the Fed won't announce an interest rate hike now, having only fully priced it in for March. But the FOMC will also provide guidance on its actions for the rest of the year. And the subtlety around the transition between balance sheet expansion (it will also end in March) and balance sheet contraction will likely tell the tale we need to trade. As said above, we'll continue to bounce and squeeze the late shorts for a while, but - for now - it's unclear for how long.

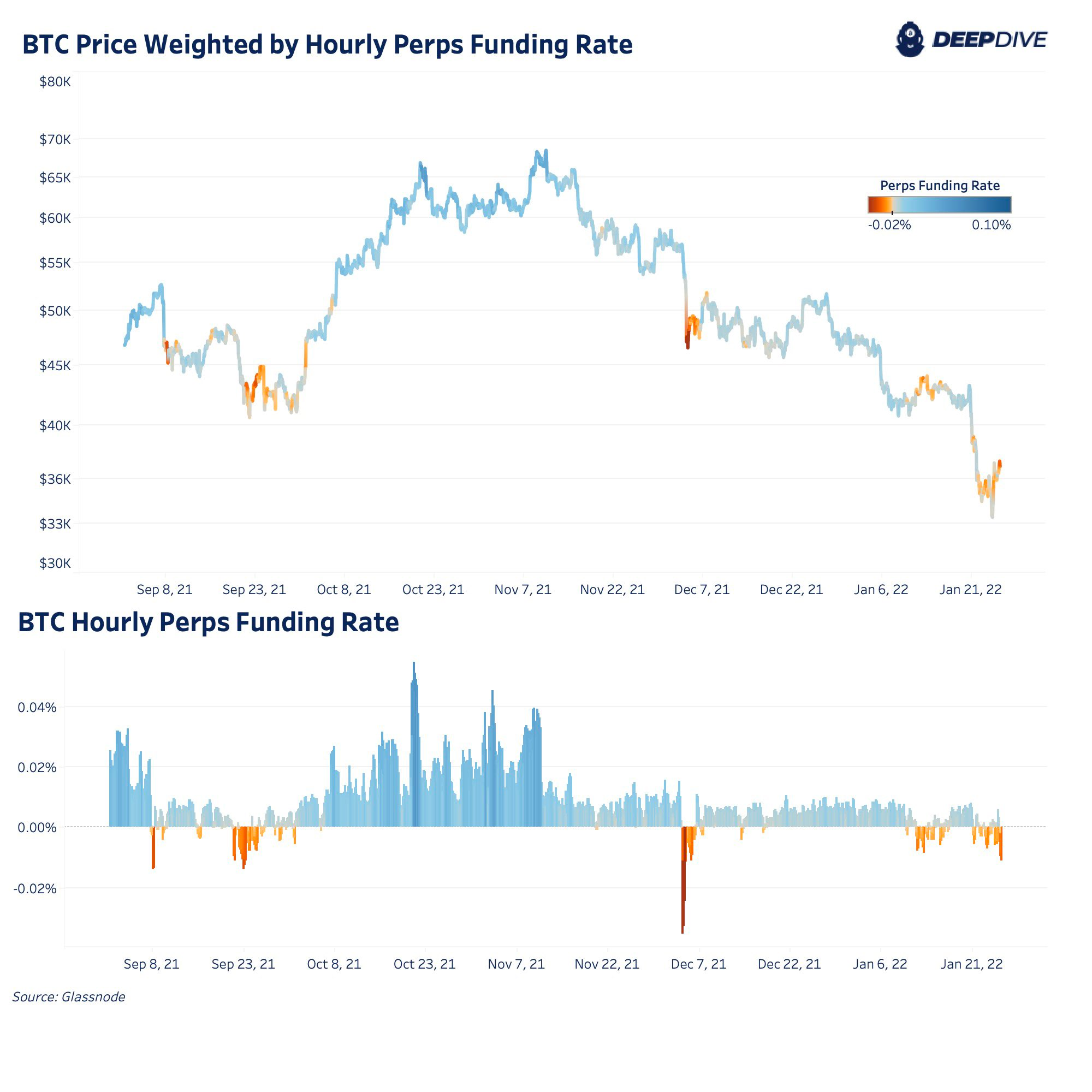

Chart art: and dodge the dips.

Three things: learn the lessons.

- The Emperor shared "ten crypto trading lessons".

- UpOnly TV is interviewing Michael Saylor today at 8pm UTC.

- Chris Dixon shared "the web3 playbook".

Tweet tip: and interpret the expressions.

Meme moment: enjoy the volatility.

B21 Team: and happy Republic Day!

Get started: download the B21 Crypto app!