Bulls ran

Cryptic ball: dead cat.

What did I tell you? Bears attacked hard, but many bulls were ready to bid, creating a double bottom on the S&P 500 which amounted to the most spectacular intraday bounce since March 2020 and the third most spectacular intraday recovery since 1977. Still, bears managed to wick the popular stock index below its October lows for three hours before the selling pressure was absorbed.

Was this it? Or are we going lower? As explained yesterday, it's still early to decide which of the following scenarios is more likely. On the one (bullish) hand, this was a high volume day for stonks (although not even in the top 10 since the pandemic redefined trading), which is typical behaviour for a V-shaped bounce, dead cat or not. Moreover, it seems retail traders led the capitulation - which suggests the bounce can continue once fund managers unwind their hedges after the Fed's meeting minutes became public tomorrow, at 7pm UTC.

On the other, more bearish hand, most of these intraday bounces have occurred during bear markets, as prices naturally spring back after a liquidation cascade, but at the same time change the prevailing trading bias. The best example of this is that stocks are once again falling this Tuesday, even if crypto is fairly stable. In other words, even if fearful retail traders caused this chaos, aided by all the shorts from big funds trying to protect their positions from the Fed's actions, that doesn't mean we resume UpOnly once the Fed clarifies its economic agenda.

Not only because it's unlikely the Fed will stop its inflation fight at least until the matter is controlled in anticipation of the US midterm elections in November, but also because the crash can change the market structure. In this case, the prices of both cryptoassets and equities are trending lower, printing lower highs and lower lows, which is indicative of further downside since the beginning of trading times. If this wasn't clear, there's no rush to buy as of yet - unless you're a trader betting on a relief rally in anticipation of an absence of bad news tomorrow.

Lastly, while many are now calling for a fully-fledged crypto winter and stock market crisis, I remain convinced cryptoassets and equities will end the year higher than now, with a bullish Q3 and Q4. Biden's presidency is already suffering and will be doomed if Democrats are deemed responsible for financial woes. And, even if they indeed manage to crash the markets, the Republican victory will make them roar once again. Meanwhile, it's all about conserving your capital!

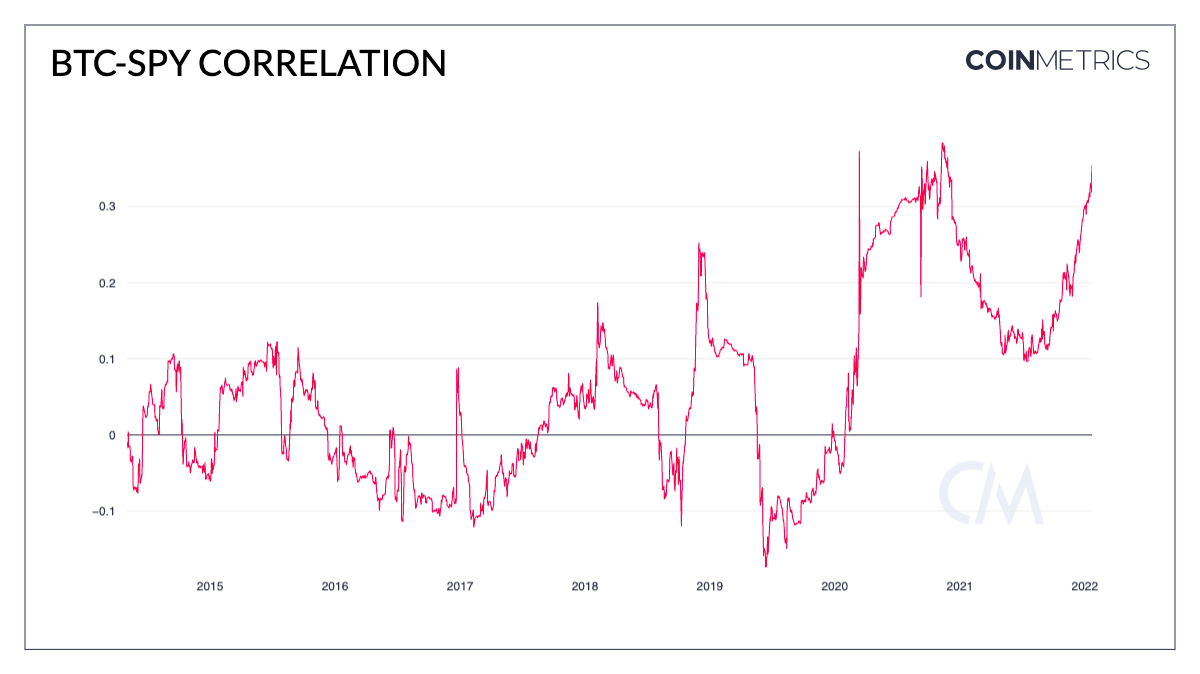

Chart art: lively correlation.

Three things: green chicken.

- Doomberg is back, covering the risks associated with Michael Saylor's MicroStrategy bitcoin gamble (follow this tweet from May to better understand the fallout if MicroStrategy has to liquidate its holdings).

- DonAlt and Cred are back, interviewing the popular CMSIntern on crypto's complex terminology.

- Multicoin Capital is back, shilling their latest investment in Project Galaxy, an "universal Web3 credentialing network".

Tweet tip: funny joke.

Meme moment: painful liquidation.

B21 Search: mystery puzzle.

Get started: download the B21 Crypto app!