Super cycle vs. super building

Cryptic ball: capitulation soon.

As anticipated in the last post, bitcoin's weekend wasn't that volatile, revolving around $35k, the lowest point of Friday's dump. Still, bears made an incursion to $34k on Saturday and, today, they finally broke below that level - meaning we're back on the march to $30k I talked about (or slightly below it, around $28k if last summer's support means anything). Naturally, most alts suffered more than BTC - with an average drop of ~10% vs bitcoin's 2% over the past 24 hours.

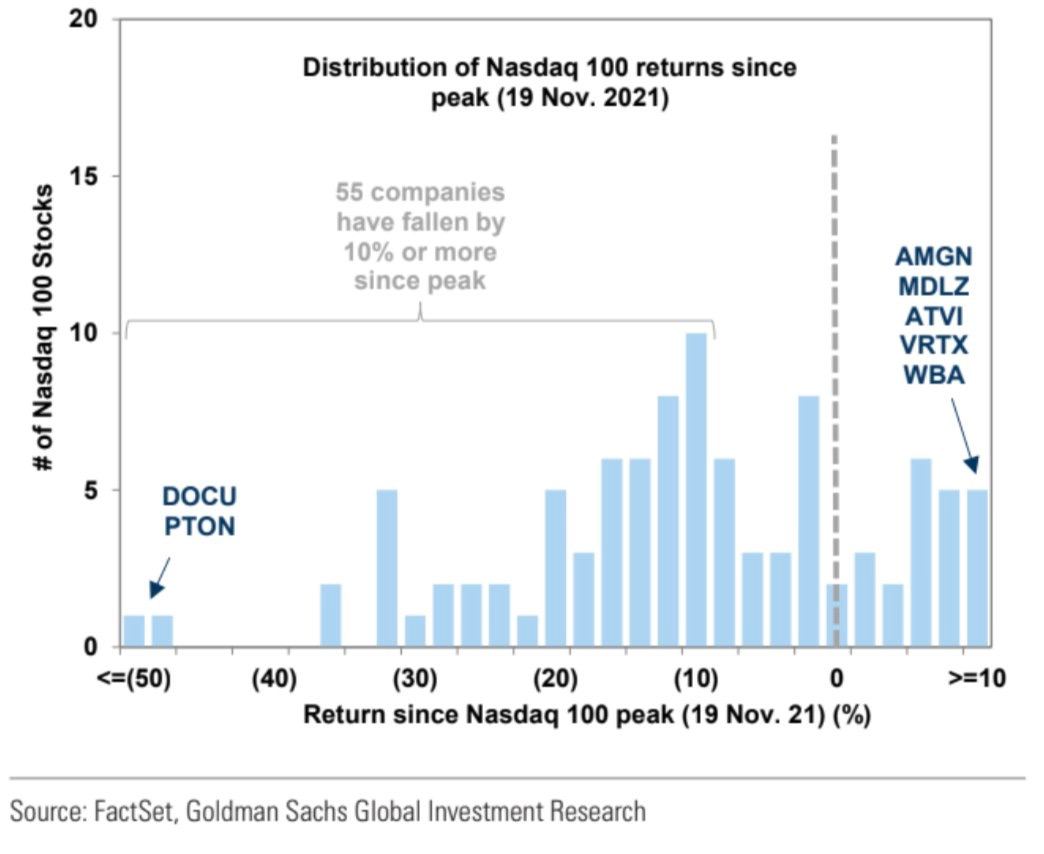

Meanwhile, we're about to experience one of the most interesting weeks of the year. Many are arguing US stocks are now in a bear market, after the S&P 500 fell more than 2% today, extending its pullback from January's all-time high to 11%. The world's most-followed equities index is now testing the support level formed last September, which is creating a lot of anxiety for traders and investors around the world, while the tech-focused Nasdaq 100 index is about to have its worse month since October 2008! But there's one last hope for macro bulls.

Firstly, the tech carnage has been wild already. Robinhood's stock is already down 86% since its all-time high in August. That's shitcoin level. Even ether "just" lost 95% in the last crypto winter (meaning such tech stonks can still fall up to 65% more). Yes, it's true that tech valuations are still ludicrous, and they work less well in a higher interest rate environment - meaning they can continue getting punished. But the double bottom on the S&P 500 will also entice many to bid.

Secondly, the US Fed has its first policy meeting of the year tomorrow, lasting until Wednesday. Most investment banks are pricing in four rate-hikes in 2022, but if the Fed caves to the market's knee-jerk reaction we may get some relief. What could that look like? The expectation is that the Fed announces the first hike in March, after the tapering program comes to an end. Bears got excited in the first week of January once it became clear the Fed was planning to tighten, i.e. shrink, its balance sheet later in the year. But if Jerome Powell announces that is out of the cards then bulls will surely rejoice. How likely is that?

In my humble view, I feel that's unlikely given how pervasive the fear of continued inflation is. The Fed's chair may even be happy with the stock market puking like this. But you know how the Fed's nuanced statements, which will come out in Wednesday's press conference, can be interpreted in multiple ways. That, combined with Microsoft and Apple's earnings coming out Tuesday and Thursday, which I believe won't be as bad as Netflix's, means we can see a bounce soon.

The question is what happens after that? I believe this dump is finally reflecting the full bearish outlook for 2022, which implies we can go up as long as inflation doesn't get worse from here. But remember the current fear is turning many into bearish mode, shorting every bounce and derisking their positions more than they would otherwise. So don't forget things can still get worse before they get better. We can't predict capitulation, but it will be easy to spot it in real-time.

Chart art: bottom soon.

Three things: boredom soon.

- The Generalist's Mario Gabriele asked around and listed "what crypto projects/trends are worth paying attention to in 2022".

- Mingh Zhao made "a DeFi crash course for normies".

- JKey writes about the differences of "Crypto Venture Capital".

Tweet tip: fear soon.

Meme moment: regret soon.

B21 App: bank transfers

Get started: download the B21 Crypto app!