The Witcher vs Hellbound

Cryptic ball: casino open.

If you have been reading our newsletter for a while, you will remember how I enjoy volatility and love these wilder days! And how I also hope you weren't negatively affected by it. After all, yesterday I told you the macro bears weren't done with the dump and that euphoria was still present in the market and tends to be punished. Wednesday I also asked you to be safe regarding the upcoming earnings week, particularly noting how Netflix could change the tune of the (squid?) game.

Now, you probably don't want me to remind you of all the other similar announcements (remember Tuesday's flush warning?), so let's talk about what happened and what can you expect for the weekend. Firstly, today's crash was indeed caused by Netflix. Yesterday, their earnings came out after the US market closed, at 9pm UTC, causing a 12% dump in after-hours trading, which then turned itself into a massive 21% decline. I wrote in several groups that a Black Friday was likely coming and unfortunately for bulls it seems that was the case.

Bitcoin immediately reacted to the news, falling 3% in that hour and up to 12% since. Total market cap followed, showing how alts are all correlated, with none in the top 100 escaping the carnage (except stablecoins and LEO, an exchange coin tied to Bitfinex). What next? The tech exodus has pushed the S&P 500 to the first significant excursion below the 200-period moving average on the 4-hour chart since the pandemic hit the Western world in March 2020 - showing how the Fed's policy changes weren't priced in, as also noted yesterday.

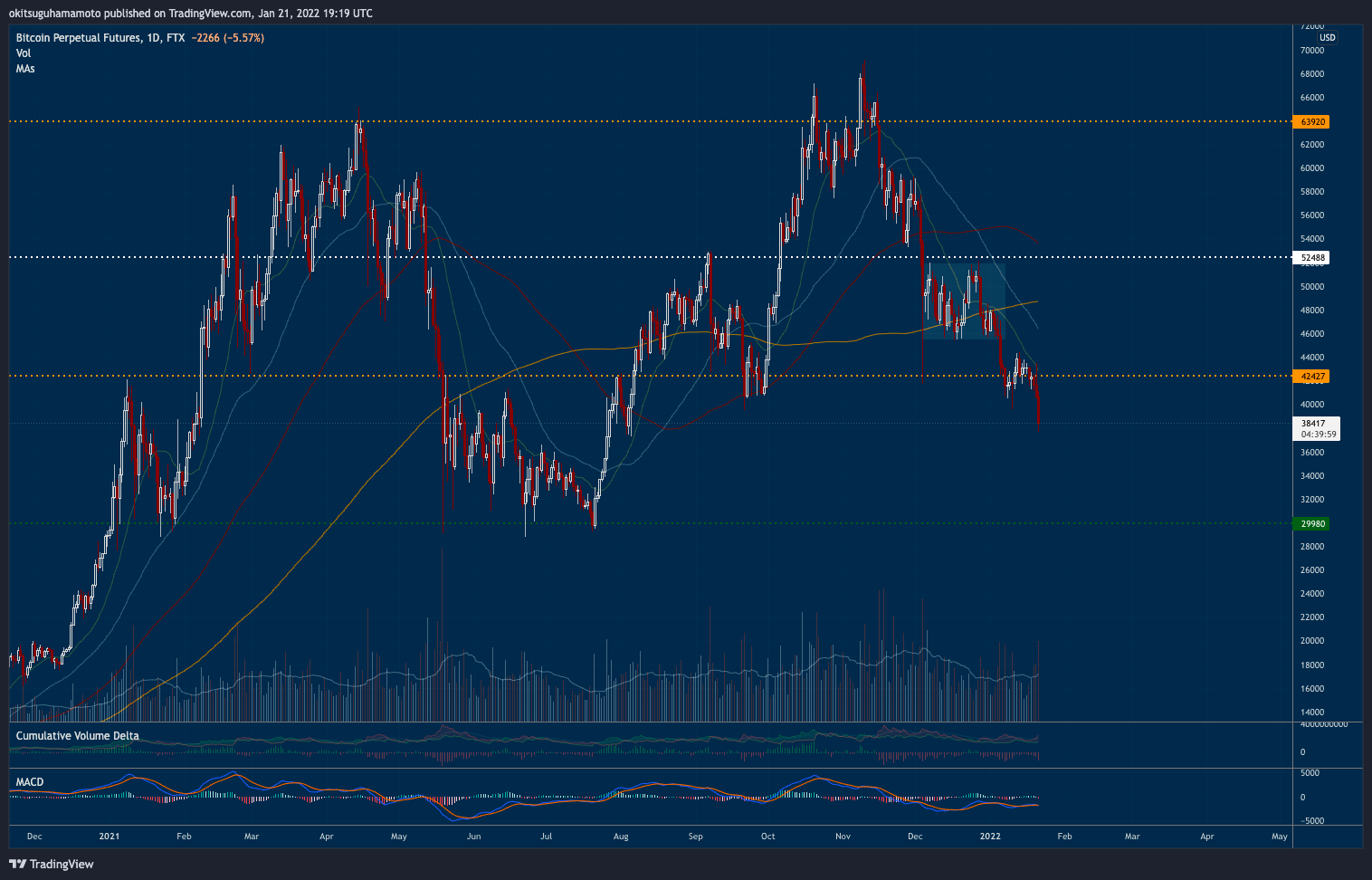

Now, I believe the weekend won't be as brutal as today. But with traditional markets closed it's important to remember most eyes will be pointed towards the 24/7 crypto casino. Still, either Sunday or in the next weeks we'll likely continue the march to $30k, as laid out in January 6th's bearish scenario. As you can see below, this is clearly a new range. And even though I believe Nasdaq and the S&P 500 may see capitulation soon - meaning we can bounce at least a bit after - this is no time to be calling bottoms. Just check today's Tweet tip to learn why.

Chart art: casino closed.

Three things: read and chill.

- If you missed Vitalik Buterin's appearance on Cobie's UpOnly TV, check CMS Intern's notes.

- If you missed Avi Felman's thoughts on the market, check his "managing a crypto hedge fund and 2022 market outlook" interview.

- If you missed longer reads, check No Sleep Jon's compilation of great posts to keep you awake while you monitor the market for the next dump.

Tweet tip: don't buy and chill.

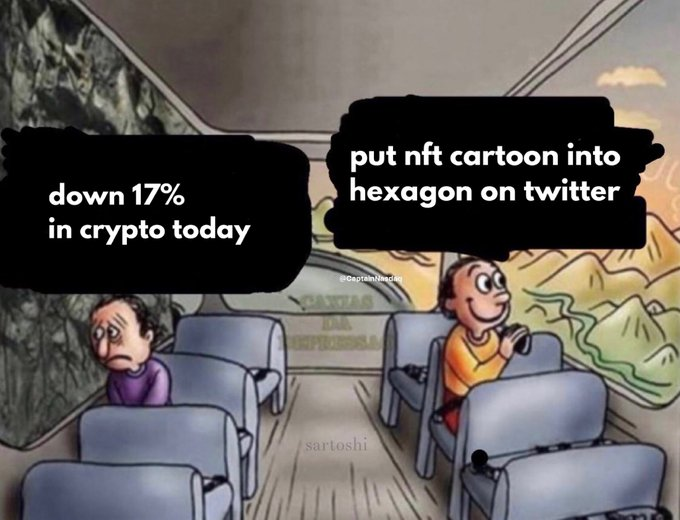

Meme moment: laugh and chill.

B21 and FV Bank: new partnership.

Get started: download the B21 Crypto app!