Institution absolution

Cryptic ball: the US open is here.

Interesting action in the stock market. The S&P 500 closed yesterday's session nearly printing that lower low I talked about. Today it seems it is due for a small bounce, with the opening bell just moments ago and futures were hinting at some relief. But it doesn't look like macro bears are done. Fortunately, bitcoin and alts are holding quite well - even if most projects remain in the same tight ranges of the past few days - in spite of this traditional finance carnange. What next?

As TraderSkew recently pointed out, the increasing collateralisation of bitcoin in numerous DeFi applications is likely supporting the reduced volatility. While the orange coin will always surprise us with some wilder days, it is only natural to expect the leading cryptoasset to swing less in its long-term ascent to the moon. This is aligned with the supercycle thesis that I first talked about here last July, and also matches my updated market stance shared on January 6th.

Still, euphoria is always punished. In the same way Peloton's stock is down +80% in the past 12 months, some alts still have wild valuations and will continue to bleed. Now the important question is if Nasdaq's ongoing dip is bought or not. If institutions are confident buying overpriced tech stonks, then crypto can also soar. If risky equities continue to bleed, that would mean the bearish, inflation-driven macro news wasn't properly priced in - and the correction shall go on.

I'm feeling that institutions have these fears priced in, but the advent of Robinhood et al has brought more retail traders to the game, and I'm pretty sure they haven't hedged their positions yet. Hopefully, this will allow us to have some capitulation event soon and then stabilise over the next months, where I'm also anticipating lower inflation prints. This will bring back the money on the sidelines and hopefully resume said supercycle. But until then don't just count on hope!

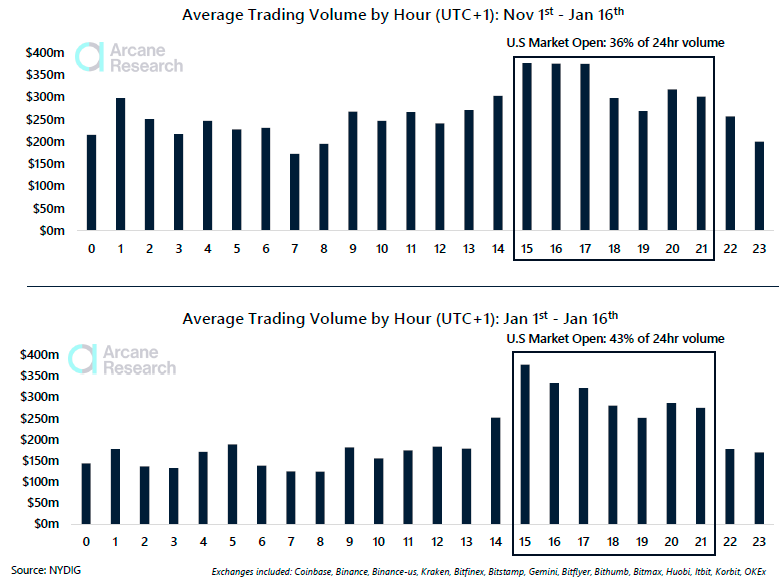

Chart art: US trading is here.

Three things: bitalik is here.

- Do you like bets? Learn how to size them with Jason Choi.

- Do you like Vitalik? Check Cobie's live interview with Ethereum's founder today at 18h UTC.

- Do you like risk? Check Lily Francus' academical assessment of risk in decentralised finance!

Tweet tip: the answer is here.

Meme moment: punishment is here.

B21 App: safe and convenient.

Get started: download the B21 Crypto app!