Kung Flu fighting

Cryptic ball: bulls vs bears.

What did I tell you? Total market cap is up 3% since yesterday's newsletter was sent out, with bitcoin looking poised to test $45k tomorrow. The pump took place as the CPI's December data showed year-on-year inflation in the US was 7%, the value expected by the market. Yes, it's record-high and bad, but it was priced in. That's why the relief rally could continue across all markets, with the S&P 500 also reacting positively to the bearish news. But how long can the short squeeze last?

Funding rates are mostly negative for BTC even as the price is rising, showing how bulls are confident enough to pay for the privilege of betting on a price increase. The US Dollar Index is also falling, having hit a two-month low, suggesting global markets have made peace with inflation fears and are no longer buying as much of Uncle Sam's currency as an investment of last resort. So keep an eye on the dollar's price as it is showing an inverse correlation with bitcoin and other risky assets.

Lastly, note the rest of the week will likely be volatile, as this bounce is contingent on how bitcoin fares on the test of $45.5k, the support of last month's sideways range which has now turned resistance. If we enter the range on the first try, bulls will be confident enough to test its upper level, around $52k. But even then we're not out of the woods until +$60k is conquered. Meanwhile, if the $45.5k attempt is clearly rejected, we can expect another fall towards $42k - with alts amplifying any one of these moves. Beware of the chop and watch out for lower highs.

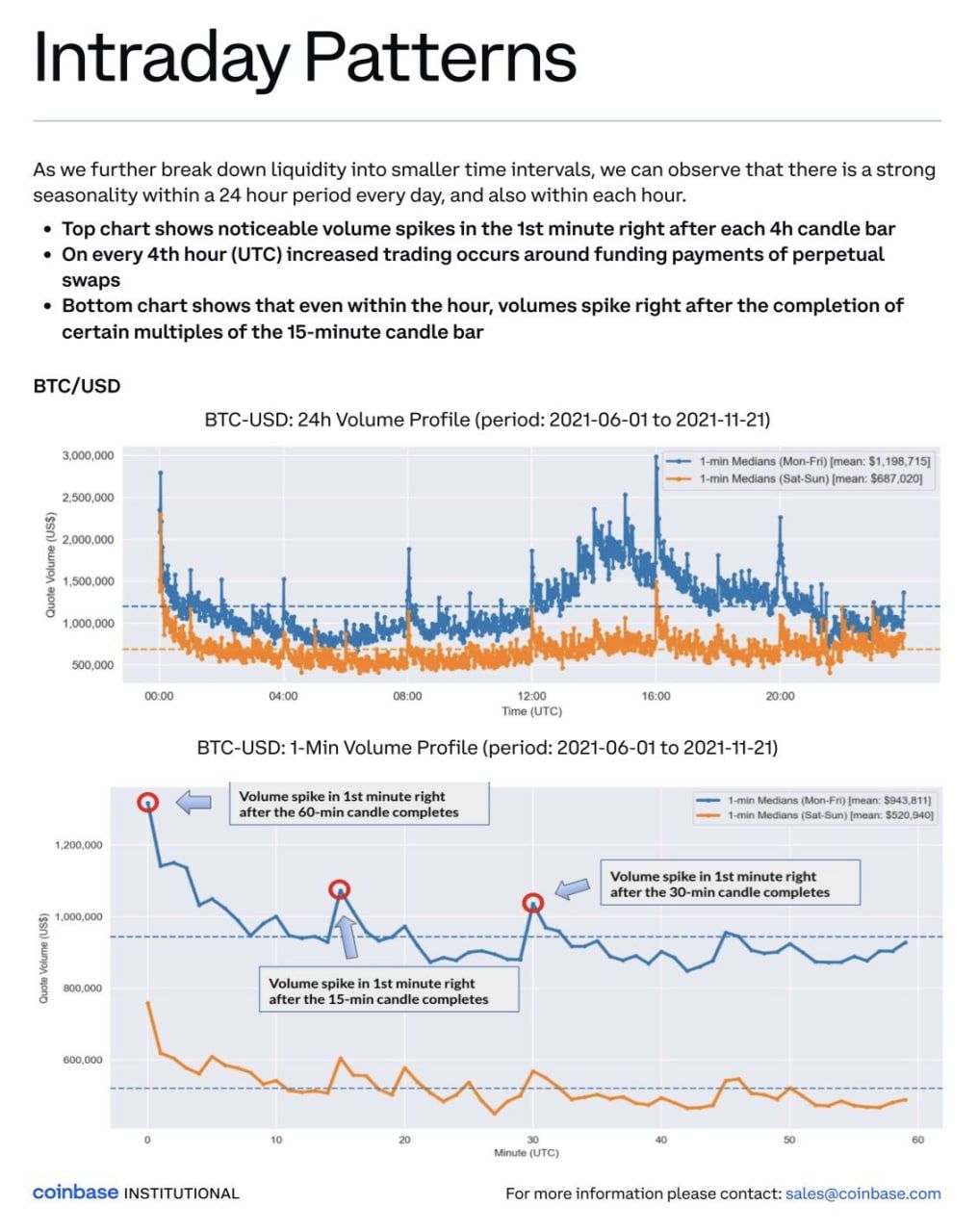

Chart art: bots vs humans.

Three things: web2 vs web3.

- There's a new great reply to Moxie's critique of Web3 from Dan Finlay.

- There's a new cool article on the future crypto art from Maxwell Cohen.

- There's a new visual report on crypto fundraising from Dove Metrics.

Tweet tip: growth vs value.

Meme moment: dips vs falling knives.

B21 App: bitcoin and alts.

Get started: download the B21 Crypto app!