Consumer Pump Index

Cryptic ball: pump it.

The latest Consumer Price Index data comes out in minutes, at 13h30 UTC. Bears have been dominating the fight so far, shorting any bounce. But they haven't won as the fall of $40k was successfully defended by the bulls who bid the dip. And, as written yesterday, I feel the relief rally will continue because it's more probable that the latest inflation statistics won't be above the market expectations.

As Alex Krüger says, everyone and their mother are now talking about price increases and how they impact the real economy. Consensus expects year-on-year inflation to have been 7% this December - the highest in 40 years. If we get that or some value below, the data was priced in and uncertainty is out of the door - so those who remain bearish will be punished, at least in the short-term. That would push BTC to test $45.5k and perhaps even higher, whereas alts would likely pump multiples of the orange coin's humble 5% pop.

If we get a higher value, then permanent bears will be proven right and we're back to fear. I'm assigning low probability to this, but remember I'll be looking at short opportunities around $52k unless the fundamentals somehow shift bullish. Meanwhile, it's time to make money. Be sure you hedge or at least manage the risk of your positions in case we get a surprise with CPI, and remember L1s will likely outperform the rest of the market. I'll be looking at ATOM, FTM, and NEAR.

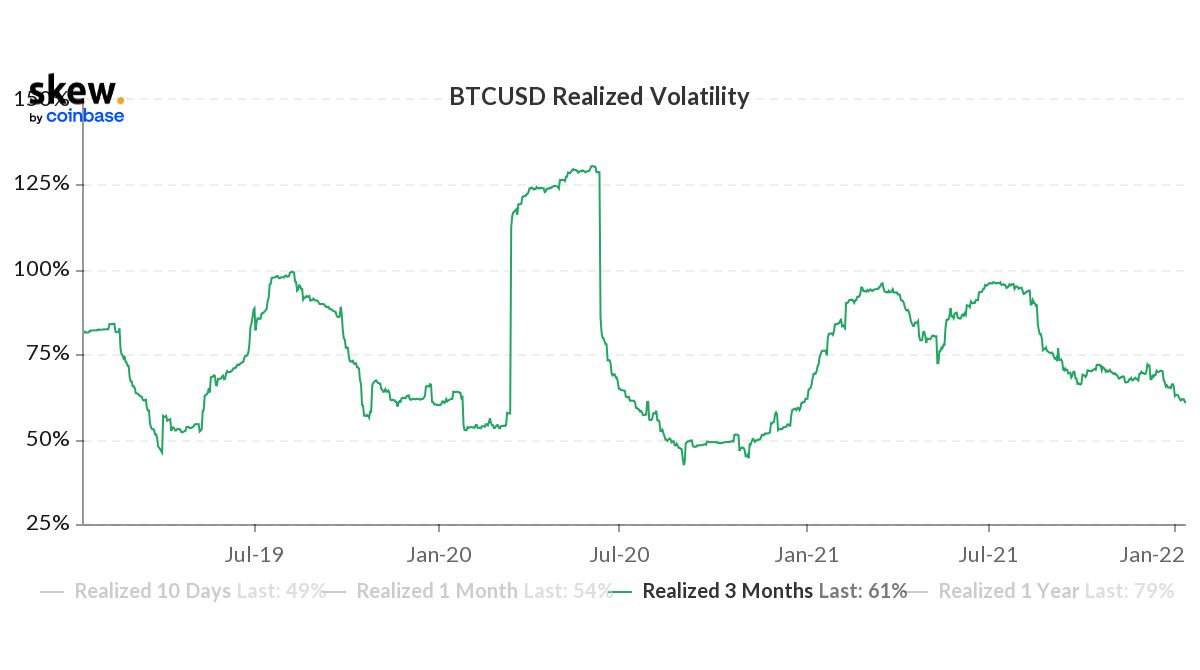

Chart art: squeeze them.

Three things: tighten them.

- Jeff Dorman argues the market is overreacting to the macro bear case. It's a very interesting article which I'll write more about soon; meantime, note he is not considering reflexivity's impact on his rebuttal.

- Kevin Kelly explains why "Bitcoin is behaving like it should" in face of the current macro conditions. TL;DR: less central bank liquidity is bad.

- Mason Nystrom tells you "how to get a job in web3". It's easy!

Tweet tip: trade them.

Meme moment: average them.

B21 App: stake them.

Get started: download the B21 Crypto app!