Not so powerful hearings

Cryptic ball: it's all about expectations.

The S&P 500 tested its 200-period moving average on the 4h chart, a key level I've highlighted before, and is trying to bounce. Nasdaq fell below that level but if the relief rally continues things will be fine. And bitcoin is still hovering around $41k, where we left it yesterday after the mini short squeeze that trapped late bears. What next? Well, the Fed's chair is right now having his confirmation hearing.

The prepared testimony released yesterday didn't hint at anything new, but the questions from the members of the Senate could force Jerome Powell to go off-script. That's unlikely, though, and I'm not expecting much volatility today - even if the session will be very relevant to understand how the world's most powerful central bank is planning to control inflation without crashing the market.

However, I'm expecting the relief rally to continue. The recent sell-off in equities and crypto suggests markets have priced in the CPI forecasts and any FUD that may come out of the Fed's chair hearing today. Meanwhile, funding rates on BTC and alts are significantly turning negative, indicating there are more shorts than longs pressure right now. What does this mean for your trading?

As explained on December 16th, it means that sophisticated investors have been selling the rumours of high inflation data coming out this Wednesday and they will buy the news once the CPI statistics are released tomorrow. And this has the potential to continue trapping late bears, as prices will rise against their shorts. Still, you must note this doesn't mean I'm changing my stance: Q1 won't be nice.

After all, the Senate is very worried about inflation and they are grilling Jerome Powell about the stock market elite, claiming he was too concerned about the stock market and not as much with the "working people" - even if the Fed's chair just admitted we're in an era of low-interest rates. But it goes to show how markets can still rally in bearish times, and vice versa. Just be on the lookout for the CPI news and let's hope inflation is not worse than the bears expected!

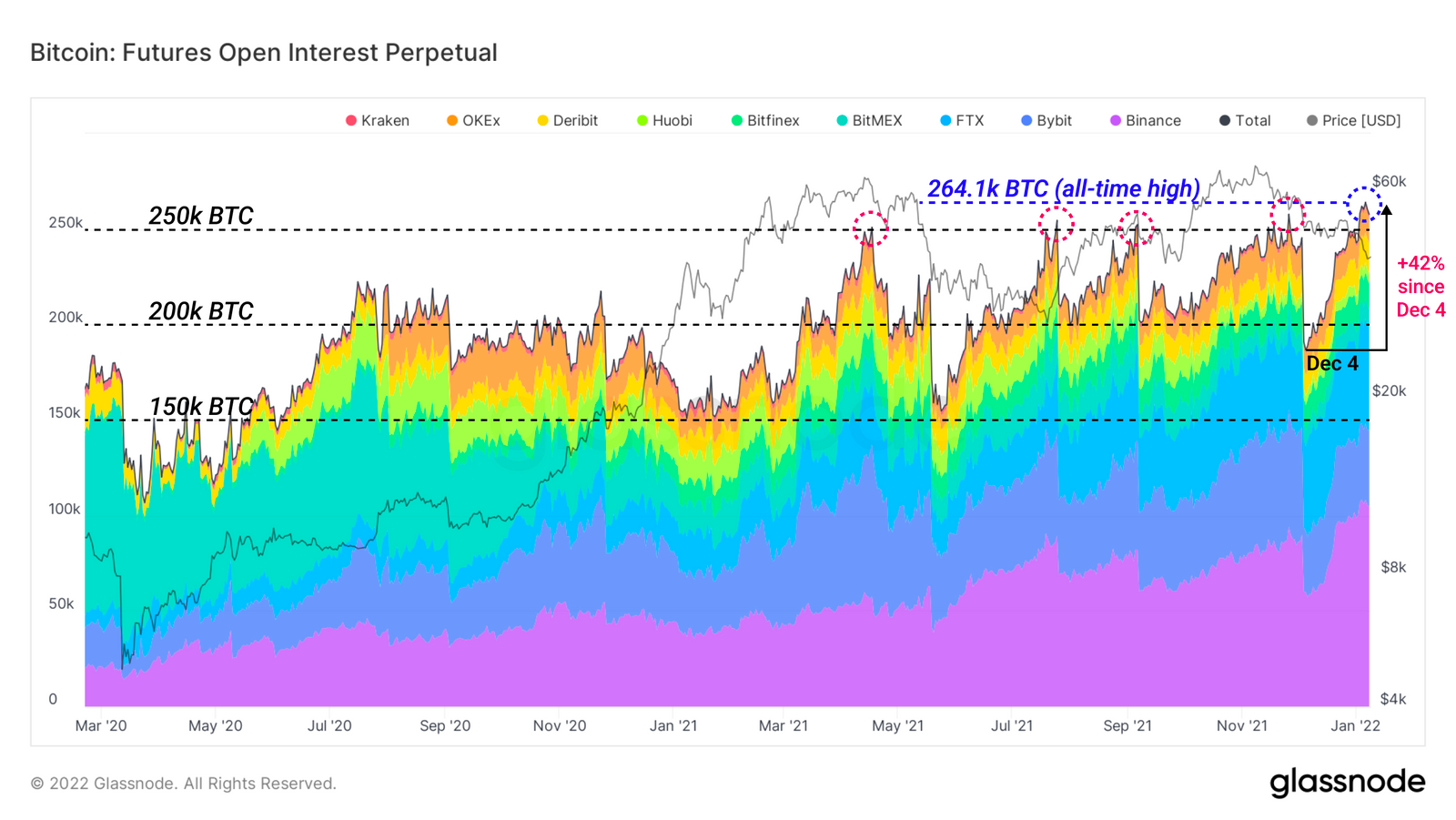

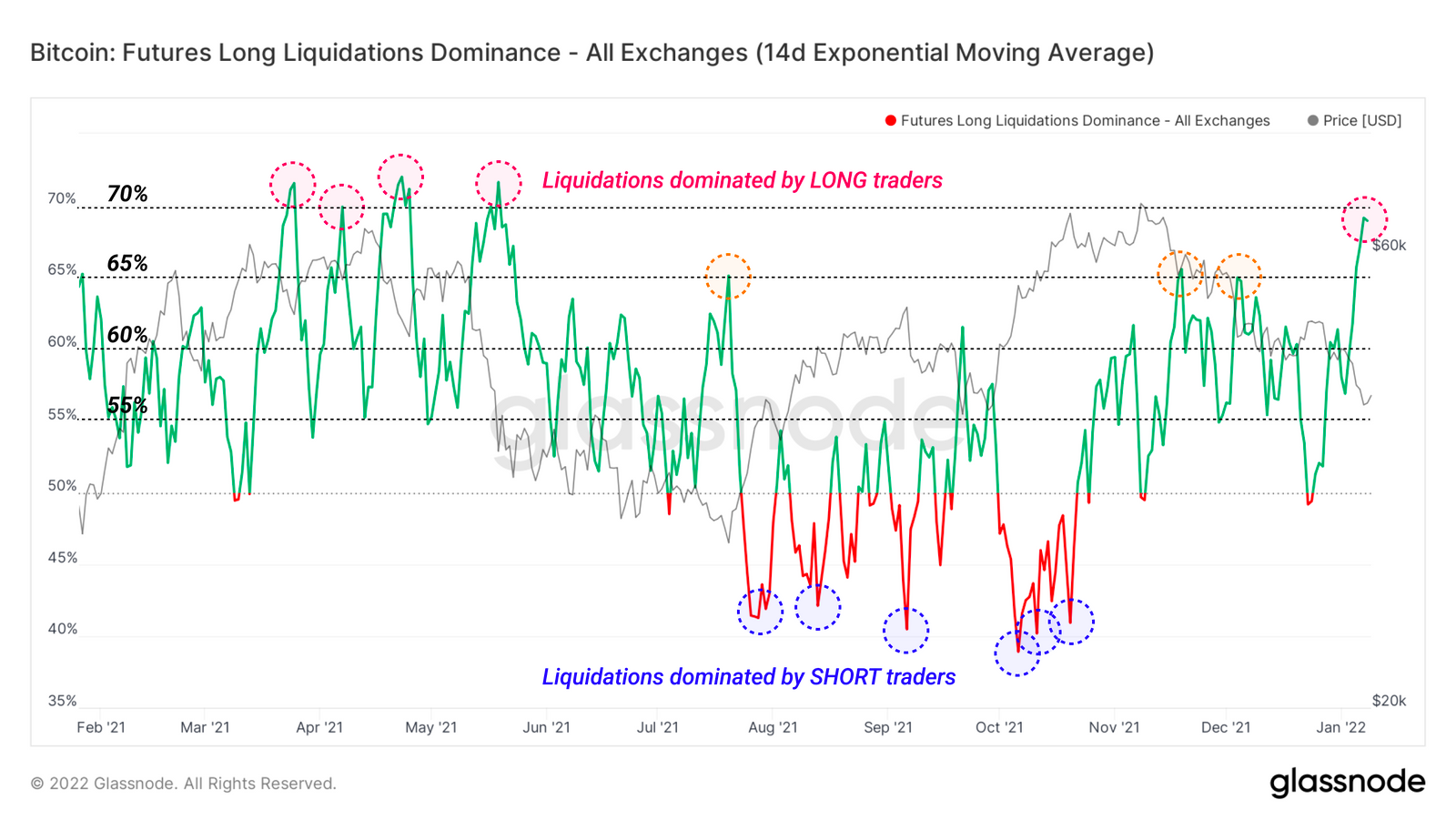

Chart art: it's all about futures.

Three things: it's all about macro.

- Many replied to Moxie's criticism of Web3. But Dror Poleg's answer is particularly good.

- Many believe in the crypto consensus. But Zachary Dash asked 47 crypto leaders "what do they believe that a majority of people disagree".

- Many believe learning about the economy is complicated. But Ted Talks Macro provides an easy to understand outlook aligned with ours.

Tweet tip: it's all about analogies.

Tweet tip 2: it's all about profits.

Meme moment: it's all about memes.

B21 App: it's all about growth.

Get started: download the B21 Crypto app!