What rhymes with Ukraine?

Cryptic ball: ah, the pain!

What a day! To begin, please note that due to family circumstances, this newsletter may not be sent over the next few days, but whenever possible I'll try to provide at least a paragraph update and a good article that no other outlet has shared yet. Back to the markets, you probably have noticed that BTC, ETH and the total market cap have dropped +6.5% over the past day, with stonks also crashing.

What happened? Well, the minutes shared by the Fed were quite good, with some even believing Powell wouldn't push for a 0.5% hike in March - although that seems to be wishful thinking. In any case, the world's most powerful central bank confirmed a more passive approach to the reduction of its balance sheet. In other words, a dump wasn't warranted and, as expected, all markets started a minor pump. However, BTC failed to break $46k at the daily close and formed a double top, one of the scenarios I shared Tuesday. Why did the bulls stall?

Well, to compound the poor technical setup, global markets weren't amused at the war theatre currently being played by Russia and the West. Nato had been warning that there were no signs of de-escalation, despite Putin's announcement, but the tension regarding Ukraine keeps growing (curiously, Ukraine's parliament just approved a law legalising cryptoassets and VASPs!). Traders around the world are flocking to bonds and gold as a result, so I'm not expecting any risk-on pump soon.

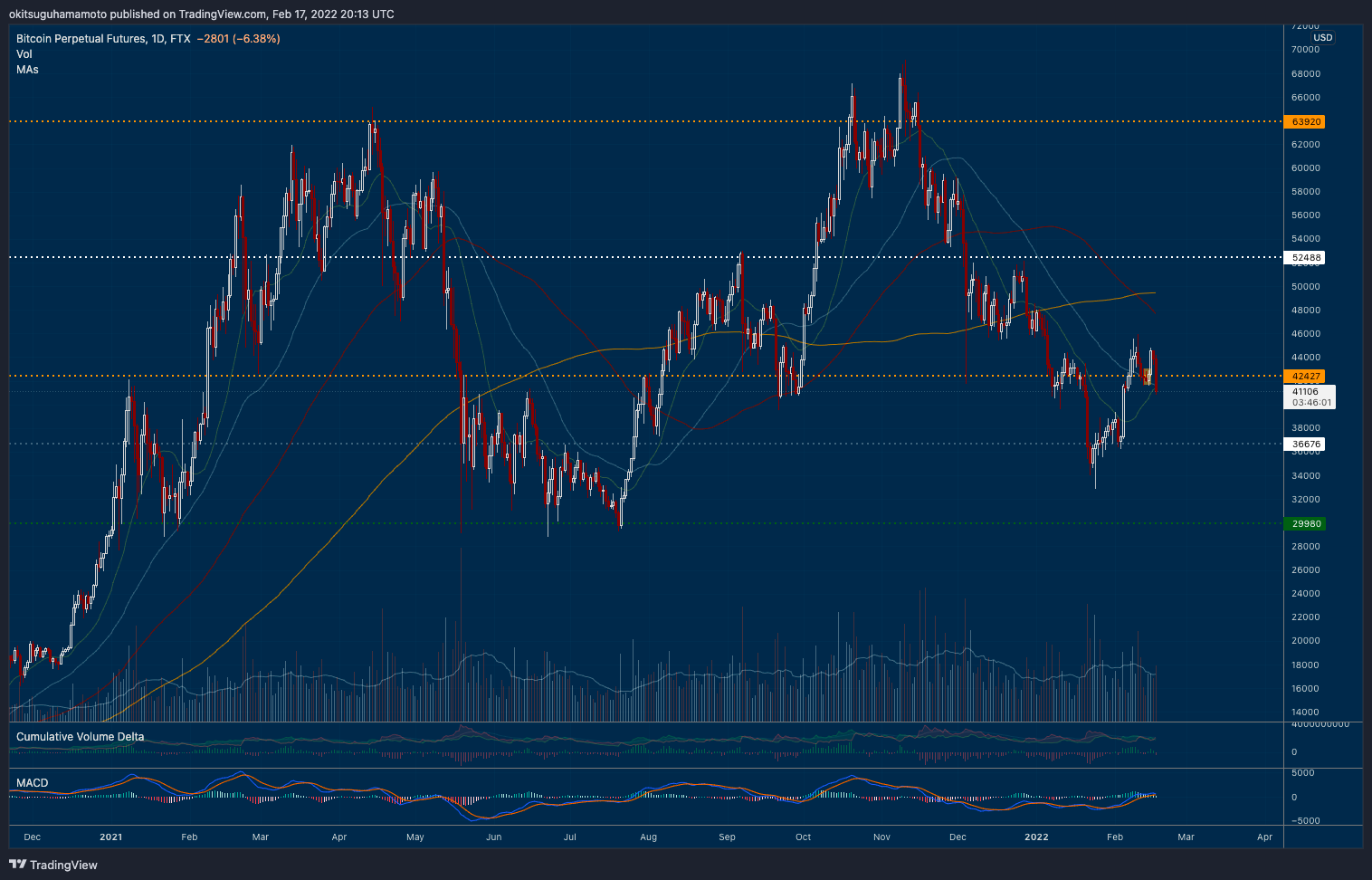

What next? Zoom out and use the below chart as guidance. Currently, there's minor support at $40k, but what matters are the bolder levels. Between $30k and $42k it's bear territory and I would only bet on longs close to the $30k support, knowing that there's a small risk it could break - taking us to $20k and a prolonged bear market. Between $42k and $52k things start to get interesting, but only above that level can alts attempt new ATHs. Be safe out there!

Chart art: ah, the playbook!

Three things: ah, the lack of sleep!

- No Sleep Jon is back with a massive, 22-article NoSleepReading List. If in doubt, no. 8 - the history of DeFi - is a must!

- Macro Alf explains why the Fed's quantitative tightening plan is not the end of the world. I hope he's right because it sure feels like it!

- Packy McCormick asked his audience for the top tokenomics resources around and curated the best answers into this great thread. Another must!

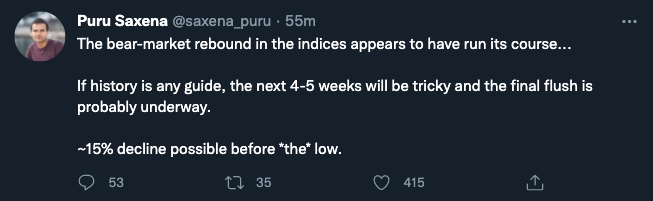

Tweet tip: ah, the dead cat bounce!

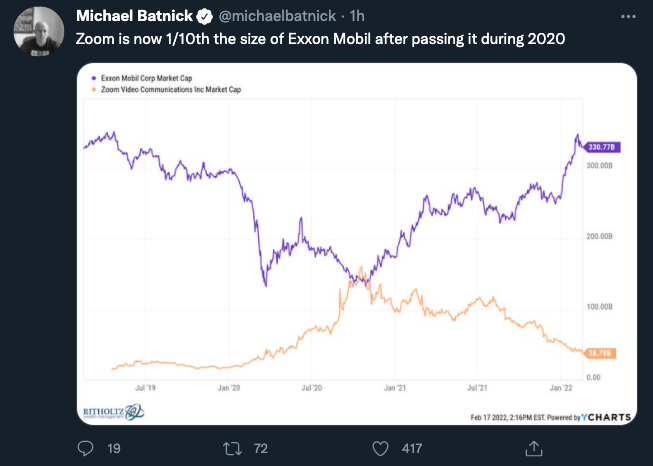

Meme moment: ah, the reality trumping the meme!

B21 App: ah, the simple tap!

Get started: download the B21 Crypto app!