Opportunities in the minuteverse

Cryptic ball: release the tiger.

Price-wise not much has happened since the last newsletter went out. Total market cap fell up to 2%, and out of the major alts only Avalanche's AVAX and Decentraland's MANA are still in the green, up ~5% for now. So we need to wait a little bit more until one of yesterday's scenarios plays out, which can potentially be after today's release of the Fed's January meeting minutes, at 7pm UTC.

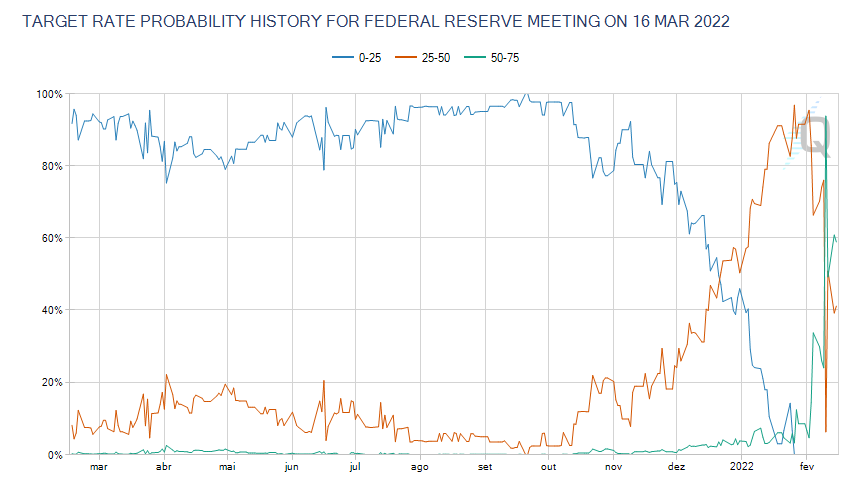

That document will provide more clarity on the extent and the implementation minutiae of the most powerful central bank's balance sheet tightening plans. These are far more important than all the rate hikes (which are also priced in), as the Feds' approach can be more active or passive. An active reduction implies additional selling pressure which, when priced-in, could nuke global markets.

A more passive attitude would just mean reduced demand, as the Fed has been on a buying spree over the past years and would simply stop purchasing corporate and mortgage bonds, as well as treasury bills - but would not sell the ones it currently has, as these would just be held until maturity. Again, the market has not fully incorporated expectations about QT, so more info on this is key.

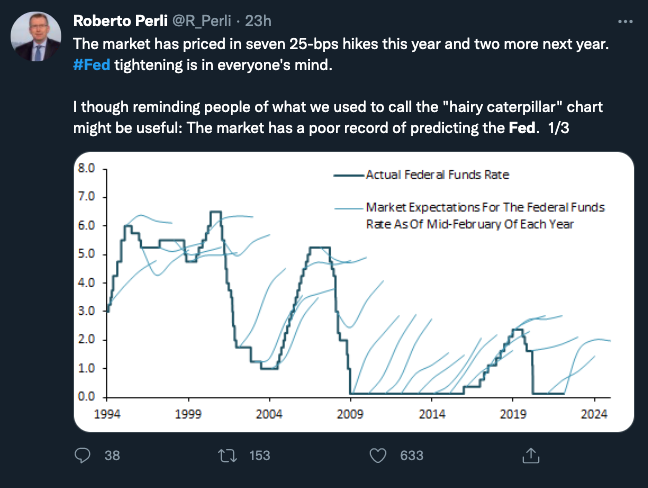

In the past, minutes have often surprised the markets, removing the nuance typically seen in press conferences from the picture. But it's the people, investors, and politicians who are most concerned about inflation, not central bankers. So it's possible that Powell and Co. also want to make sure they don't crash the stock market in their term. To summarise, what does this mean for crypto?

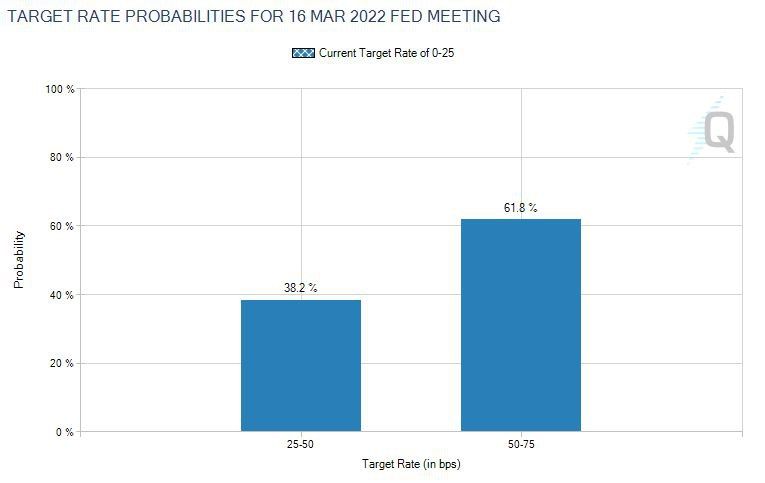

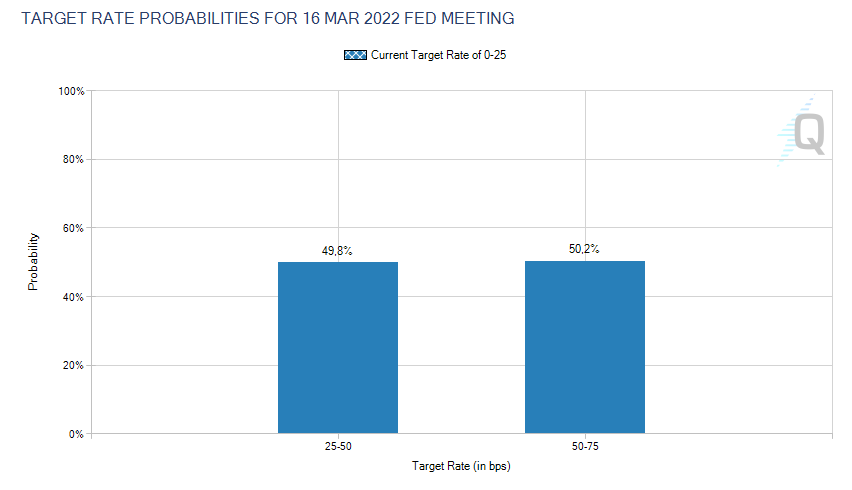

In other words, it's plausible the minutes hint that the 0.5% interest rate hike is out of the cards. As that's pretty much priced-in now, then the markets would react positively to the 0.25% news. The same can happen later in the year, if today's tweet tip proves accurate. Conversely, if that's not the case, then the tightening details would set the tone for the next candles. Until then, embrace the chop!

Chart art: clarify the outcome.

Three things: long-term value.

- You've probably heard about JP Morgan's latest metaverse lounge. But did you read their "Opportunities in the metaverse" report?

- You've probably heard about options. But did you know Deribit has just launched a new crypto options course?

- You've probably heard about FA. But do you know how to do it? If not, check Alpha Please explain their three-pronged fundamental analysis process.

Tweet tip: for the forecasters.

Meme moment: SEC vs. the Fed.

B21 App: research and hodl.

Get started: download the B21 Crypto app!