Smooth operator

Cryptic ball: placing high stakes.

This was a very smooth weekend, with bitcoin and the wider cryptoasset market barely moving. If you see today's chart that should become clear. Now, Friday I warned you about an emergency Fed meeting that's taking place as I'm writing this newsletter, and I still believe we're experiencing the calm before a storm.

I hope I'm wrong, but I prefer to be hedged. In any case, and to be clear, I'm aligned with the DeFi Surfer's macro take shared in today's reading list, which also suits up nicely with the outlook shared last week for the year ahead: the next months will be tough, but I'm very bullish for the second half of 2022.

Even if today's Fed meeting doesn't produce any surprise outcome (which is quite likely, as few believe the Fed will want to signal it lacks control of the situation), we're just one month away from March's FOMC meeting, where rates will surely be hiked. While that will likely be a "sell the rumour, buy the announcement" event, that means the next weeks won't see major pumps nor alts mooning.

Chart art: making bulls ache.

Three things: he's loved in seven languages.

- Sino Global Capital explains why they are "bullish on crypto in India".

- DeFi Surfer explains why inflation fears will fade soon and how we're not entering a multi-year bear market.

- Arca's Jeff Dorman explains why the Superbowl ads of crypto exchanges were brilliant and very different from those of the dot-com era.

Tweet tip: diamond nights and ruby lights.

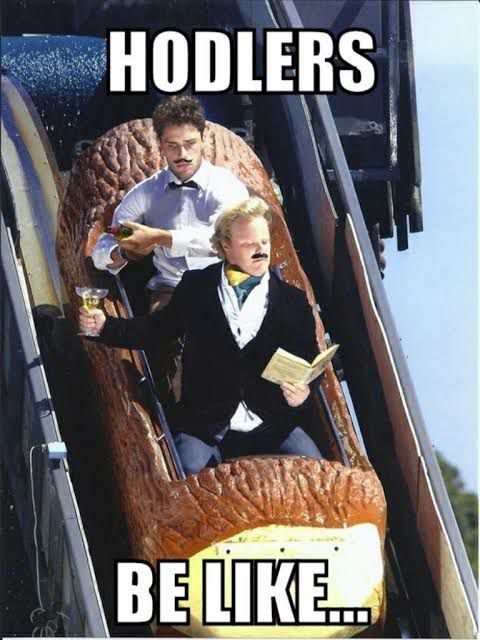

Meme moment: high in the sky.

B21 App: it's better together.

Get started: download the B21 Crypto app!