February 14th, 2022

Cryptic ball: bittersweet Valentine's?

The weekend is here and bulls want to celebrate their victory, having successfully defended $42k at midnight UTC. Overall, prices have been fairly muted over the past 24 hours - both in crypto and in stocks, even if the latter are experiencing a modest dip after fresh interest rate-related FUD from one of the Fed's member banks. What to do amid such uncertainty? It's all about zooming out.

I've been highlighting some key articles over the past couple of days to ensure you wouldn't miss them and their mutually exclusive topics: 2022's potential storm and the potential of risky, but enticing low-cap alts. The first view argued bears are not over even if there are many opportunities for bounces, while the second guide implied it's time to bet on the most speculative projects you can find.

You need to understand both extremes, but remember virtue is a mean and I can't possibly recommend one over the other. I still believe the outlook I outlined in early January still stands: a bearish Q1 (even if we're bouncing nicely now), a Q2 to recover, and then a new top around the end of the year. But it seems I've now found a great middle-ground I can refer to in the meantime.

In it, Ben Lilly zoomed out further than most and argues the Fed won't be able to hike interest rates for a prolonged period of time, meaning we'll continue to benefit from its historically low values for at least a couple of years. In other words, the party won't end for global markets, and for crypto to crash we would need something more extreme to scare bulls for good.

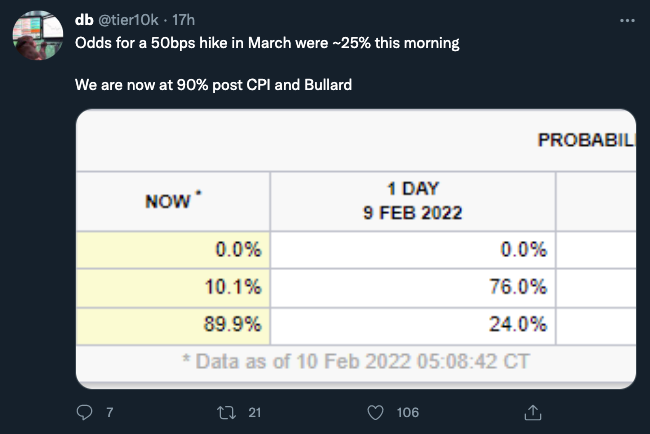

Lastly, and perhaps most importantly, did you know the US Fed is holding an emergency, closed-door meeting Monday? Well, it has been scheduled. And there's some speculation the central bank can surprise the world, either with an earlier-than-expected rate hike or with an announcement that the March interest rate increase will be of 0.5% instead of 0.25%. No one knows what can happen, but remember that bears tend to thrive in such an uncertain environment!

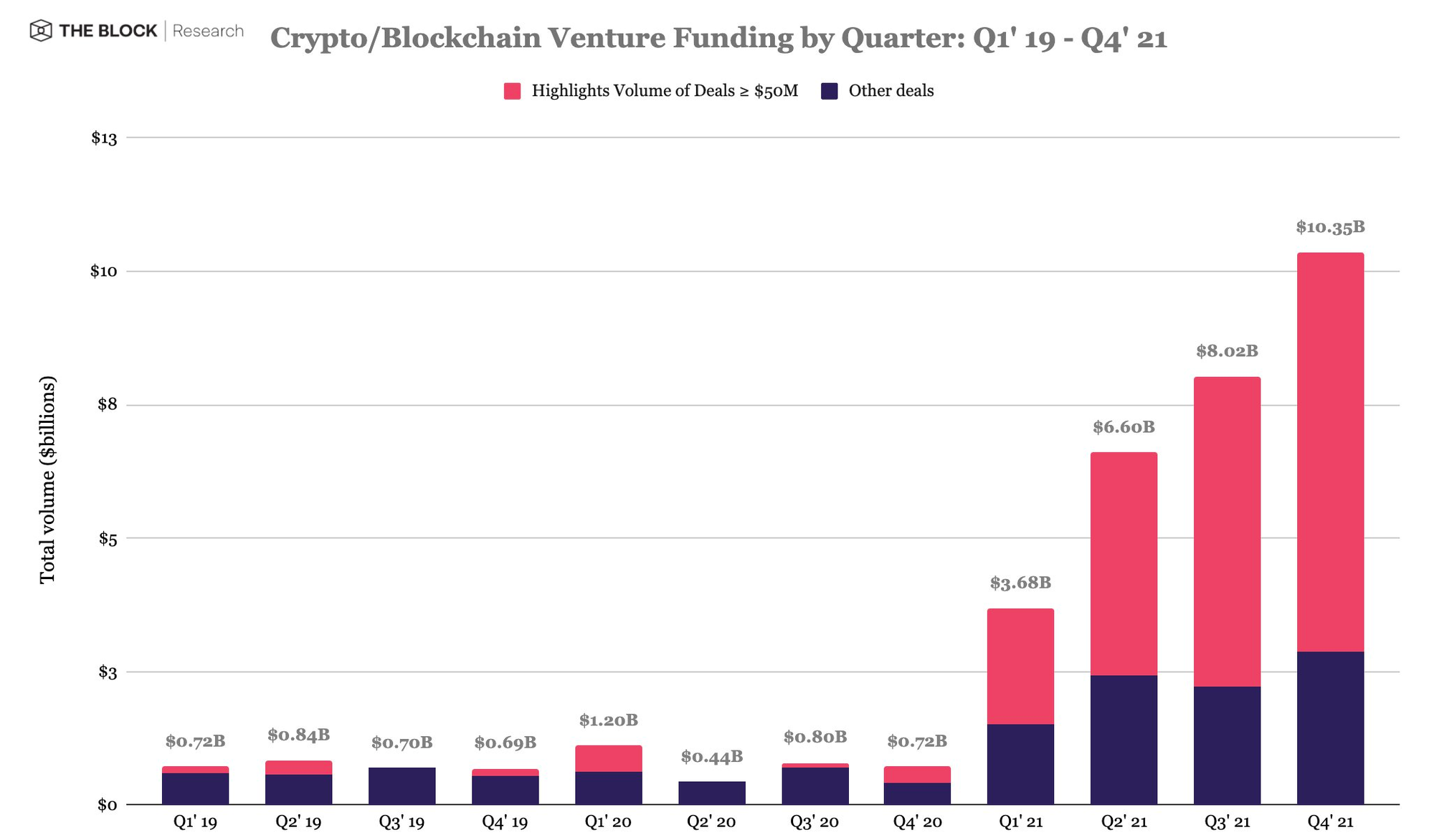

Chart art: poignant ventures?

Three things: heart-breaking singles?

- I'll be back to trios next week, but we need to complete the singles trilogy today with Ben Lily's latest take on macro cycles, about treasury yields.

Tweet tip: disturbing bets?

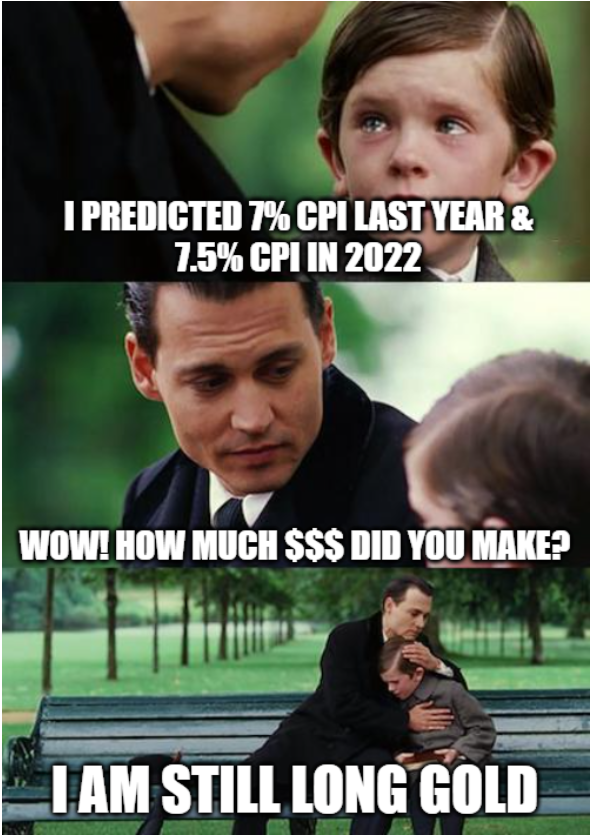

Meme moment: sad forecasts.

B21 Card: get yours today.

Get started: download the B21 Crypto app!