Bitcoin first

Cryptic ball: as it's taxed so it's not illegal.

After achieving a reasonable higher high yesterday, bitcoin has been falling from $39.3k. That's normal, as prices move up and down even within a trend. We just need to keep an eye to ensure $37k ($36.7k to be specific) holds or else traders will interpret the current trend as broken. So far, it seems bears are pressing their attack across the cryptoasset board, with total market cap also down 4%.

What happened? Well, at least for the first time in a while, this move wasn't caused by the stock market. Both the S&P 500 and Nasdaq are up and almost back to bullish territory, on top of record revenues from Google's Alphabet yesterday and some speculation about Facebook's Meta, which announces its earnings later today. The corporate rebranding could have hurt profit margins, but let's hope Zuck beats the analysts and makes everyone forget how weird its metaverse is.

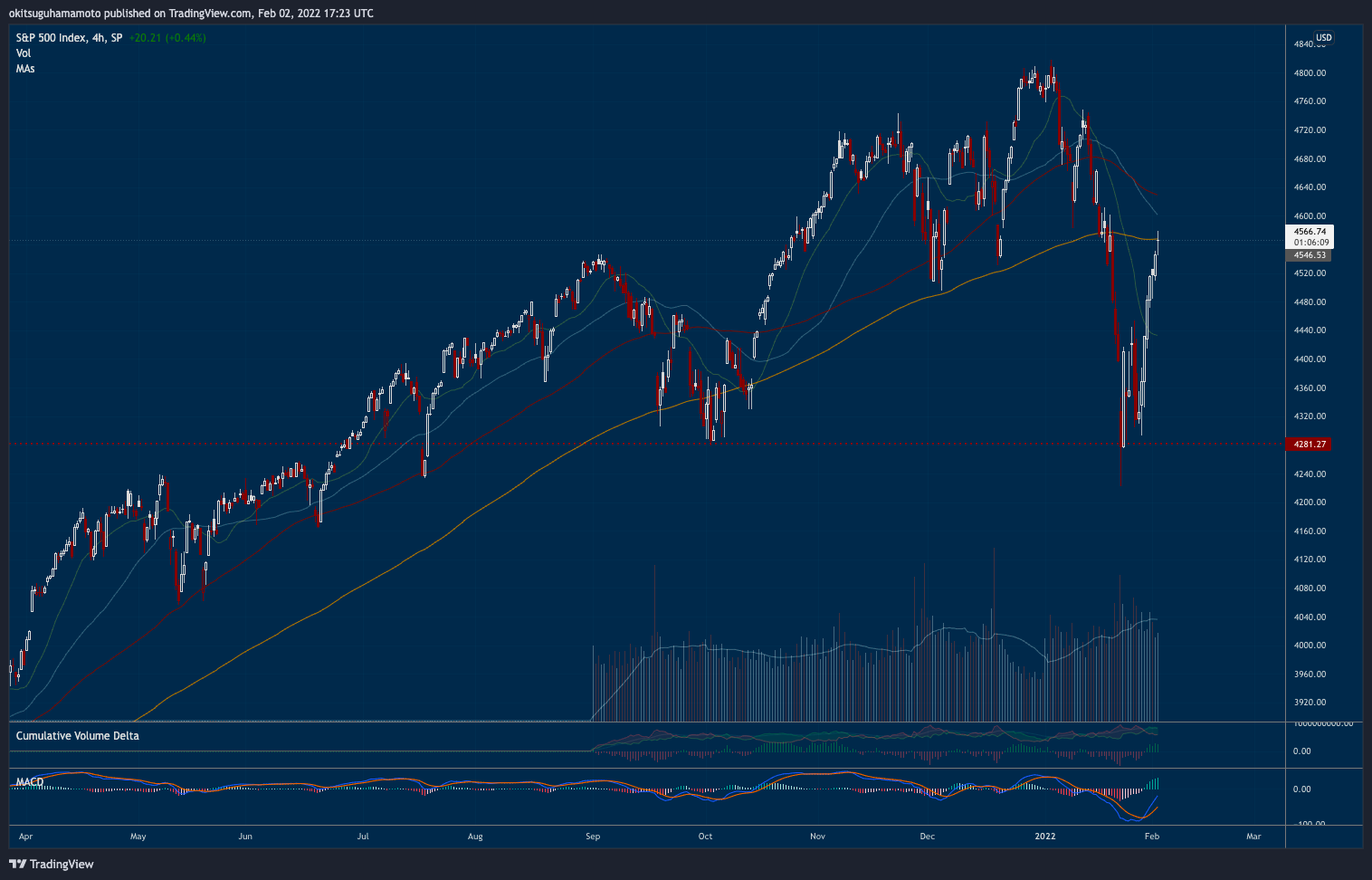

Some analysts were trying to blame the dip on PayPal, which missed its earnings and whose shares dropped 25% yesterday and today. But that's outright ridiculous. In other words, today's dip needs to be short-lived, pushing the orange coin to print a clear higher low, or else we won't see $40k and will continue going down. That could be catalysed if Meta's earnings are bad, ending this relief rally. In any case, things are about to get a bit more interesting - so let's keep an eye out as the S&P 500 is also at a key level that bears will try to reclaim (as you can see below).

Lastly, in other news, India finally provided some clear guidance regarding crypto, with the latest budget imposing a 30% tax on digital asset gains, just like gambling income. As I commented for Blockworks, this is "a very progressive move" and should pave the way for a bright future! The Finance Secretary has also declared "it’s not illegal to buy and sell crypto" even if this emerging asset class still remains in a grey area until more legislation is concluded in the coming months.

Chart art: as it hits resistance so it warrants caution.

Three things: as goes January so goes the year.

- Regan Bozman argues "we should stop talking about Web3 and focus on building it". When adoption decoupling?

- John Street Capital shows how "January was one of the most volatile months in several years for risk assets". When financial decoupling?

- Fidelity Digital Assets explains "why investors need to consider bitcoin separately from other digital assets". When technological decoupling?

Tweet tip: as the past was different so is the future.

Meme moment: as it taxes so it relaxes.

B21 App: easier, faster, safer.

Get started: download the B21 Crypto app!