Hold the floor

Cryptic ball: let's hope $46k is lava.

As explained Friday, what's holding bitcoin and the rest of the crypto market together is the support level around $46k - where the important 200-day moving average is currently lying. That key area was tested twice so far: 1) on Saturday, with a bounce to $50k on Sunday which was clearly rejected; 2) and right now, with a possible bounce playing out, albeit on low volume and without confidence. So, as usual, what can you expect for the tough week ahead?

Well, the range bitcoin is trading is still defining sentiment across the board. But this Wednesday we'll have an important event that's affecting the markets: the US Federal Reserve's December two-day meeting, which starts tomorrow, comes to an end with a press conference that will dictate the mood of the markets for the rest of the year. Now, I don't think Jerome Powell wants to ruin Christmas for investors, but inflation is also ruining Christmas for most families.

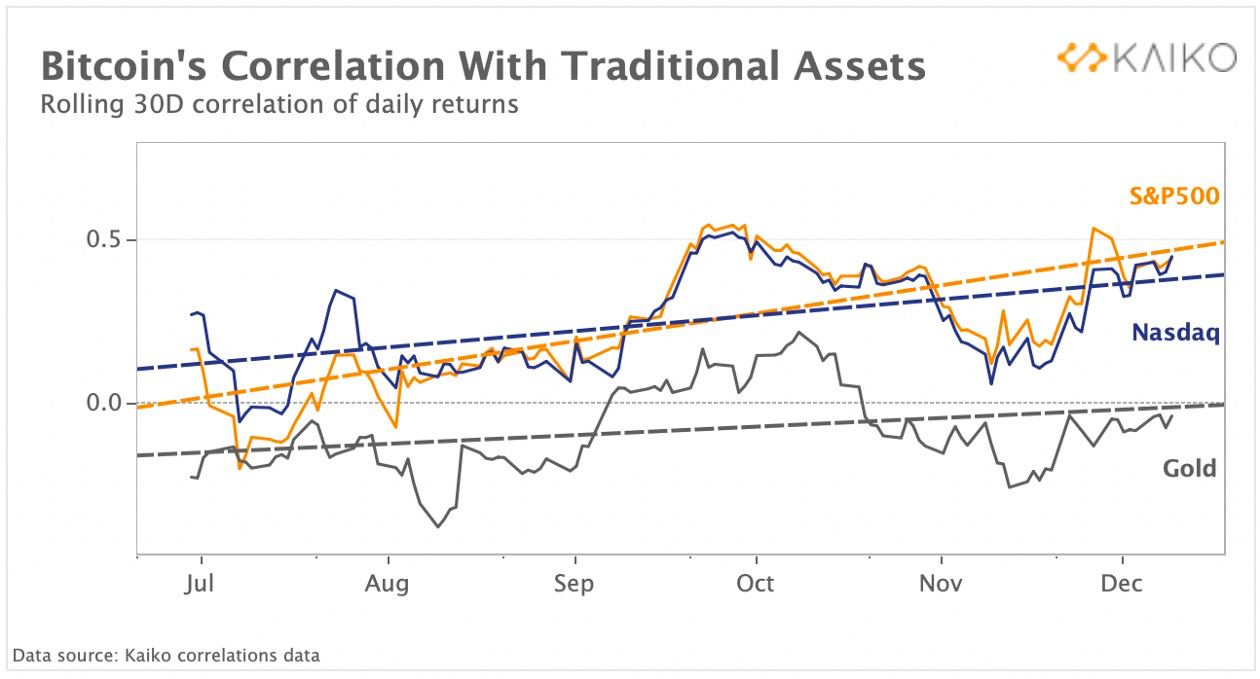

But some reporters are painting a grim picture, hinting that the Fed's chair may announce a faster rate at which it implements monetary tightening policies to mitigate the rise of consumer prices. And that's bad for the rise of risky asset prices, from tech stonks to crypto. However, it's also the case that the stock market's performance heavily influences elections, and Democrats can't lose their mid-terms next November - so Powell has a tough balance to manage.

In other words, there's a lot of uncertainty surrounding all risky assets, right now. Such an environment promotes sideways trading and slow-bleeds, as described in Friday's newsletter regarding bitcoin testing $42k if $46k fails, after which all hell could break loose like last summer. Anyway, I don't expect much action until Wednesday. And it's also true shorts are on the rise, which creates nice liquidation material for bulls to squeeze them. Just stay safe and have a plan.

Chart art: let's hope stonks pump.

Four things: let's hope that extra one is right.

- Hasu and Su Zhu talk about Ethereum and its Layer-1 competitors. Spotify or YouTube?

- Ming Zhao shared "12 Crypto Hedge Fund Trading Strategies".

- Chris Dixon expands on "the seven types of NFTs he is excited about".

- Zaheer explains why the crypto market isn't hot at all.

Tweet tip: let's hope they can please both.

Meme moment: let's hope you don't fall for this.

B21 App: instant ACH transfers.

Get started: download the B21 Crypto app!