Some micro-market cycles

Cryptic ball: just some scenarios.

The crypto market's recovery has continued to play out, with total market cap up 4% over the past 24 hours. Bitcoin is now approaching $52k, which is the mid-level in the chart I've been sharing since at least last June. This is has been a key level since last March and also marked this September's local top, so many eyes are on it and its surroundings. If we conquer it immediately, that would cement a V-bounce that would surely bring euphoria back to the sleepiest of the bulls.

Conversely, if we fail to break it and stay above $47k, a zone which would give comfort to alternative cryptoassets to continue pumping until more institutions buy bitcoin, then it's likely that this December we come to experience a slow bleed across the market, at least until BTC tests the $42k support again. Note such a level can't be broken for the bull market to continue, as that would mark a change in sentiment. We also need to conquer $60k asap - as Posty illustrates.

I'll keep referring to these scenarios as Christmas approaches, and review them shall the need arises. But, overall, and as explained Friday and yesterday, I agree with Kyle Davies when he says it's safe to leave the ark (check today's Tweet Tip). And I recommend reading Santiago Santos' post, shared in our Three Things below, about "how to survive crypto winters and other bear markets". As the author says, it's not that we're in a bear market, but these "micro-market cycles" can have the same effect on an investor if they don't have a strong thesis.

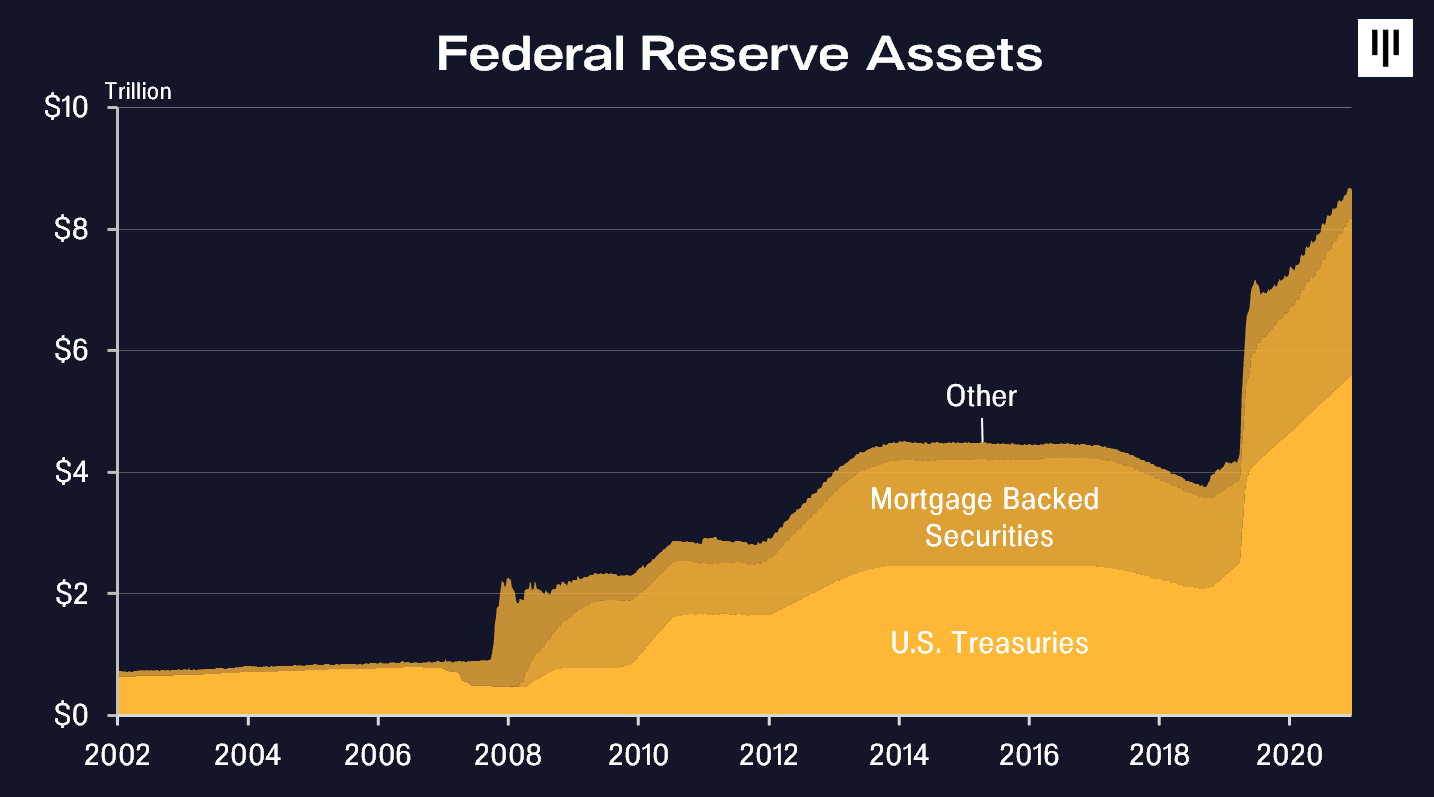

Chart art: just some quantitative easing.

Three things: just three steps to the future.

- Bitwise's CIO Matt Hougan explains the recent crash in a sharp video you can share with your friends who still don't understand crypto.

- Packy McCormick puns the Pareto Frontier away in a sharp post explaining why Web3 makes money fun again and how that attracts talent.

- Benedict Evans shared his annual presentation "exploring macro and strategic trends in the tech industry". This year it's about Web3 and the metaverse.

Tweet tip: just some flushing.

Meme moment: just some old cartoon.

FV Bank: meet us at CoinAgenda.

Get started: download the B21 Crypto app!