Digital Assets and the Future of "Open" Finance

Cryptic ball: it's all about Open Finance.

The cryptoasset market's ebb and flows continue, with bitcoin facing a clear rejection after yesterday's test of $52k. The average project is down 2.5% over the past 24 hours, with some alts, like Tezos, pumping up to 25%. Again, this is the bread and butter of this market and note we can expect the current sideways range to hold as long as bitcoin keeps the $42k support. This would allow the alts of the moment to continue offering good trading set-ups if that's what you're looking for.

Moreover, if BTC manages to print a higher low - i.e. a clear local bottom above $47k, the latest local bottom - that may entice bulls to risk a tad bit more than expected under the current conditions. Just remember the current liquidity is thin and even blockchain fees are sitting at a third of what's usual these days, as there's less activity as the holidays season approaches. In other words, don't short a dull market unless you know what you're doing, as sentiment tends to change fast.

But also note a dull market is dull and it may take a while until that green dildo candle shows up and blows everyone's minds. Meanwhile, if you're bored you can tune in to the latest US House Banking Committee hearing, about "digital assets and the future of finance". It starts today at 10am ET, or 20h30 IST, and you will be able to watch the CEOs of Circle, FTX, Coinbase and more key crypto institutions be grilled by North American regulators live on YouTube.

It's going to be a good show, so let's hope these VIPs start shifting DeFi's branding away from decentralisation towards Open Finance, as Andre Cronje suggested on Twitter following a recent trend within the industry to better communicate the benefits of said future of finance to the regulators, who unfortunately have the power to ban the regular consumers away from it. While some of us can always be a step ahead, that's not the case with the majority that needs access to a truly open finance, that is built for the whole community and not for the shareholders.

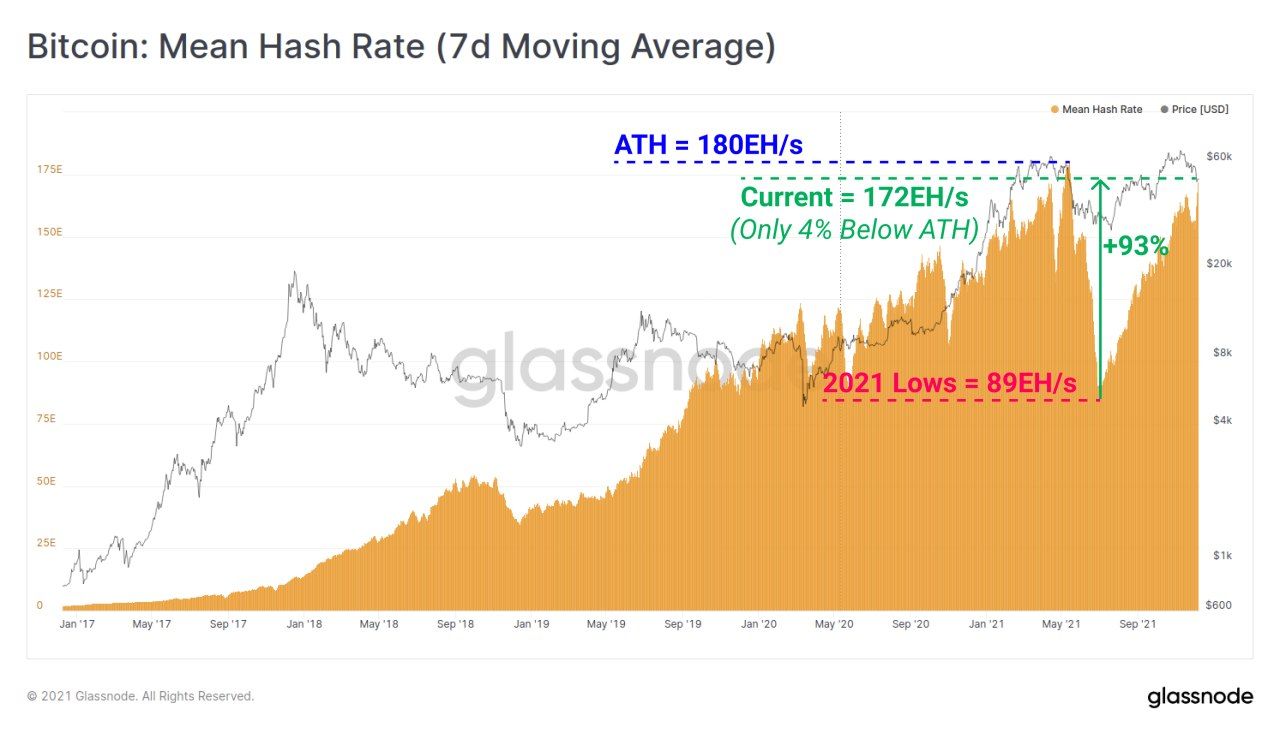

Chart art: it's all about the activity.

Three things: it's all about that outlook.

- Are you trying to figure out the year ahead? Check Arca's outlook for 2022.

- Are you trying to understand Web3? Check David Phelps' Web3 compilation

- Are you a lawyer trying to break into crypto? Check Jake Chervinksy's tips.

Tweet tip: it's all about good memes.

Meme moment: it's all about knowledge.

FV Bank: meet us at CoinAgenda.

Get started: download the B21 Crypto app!